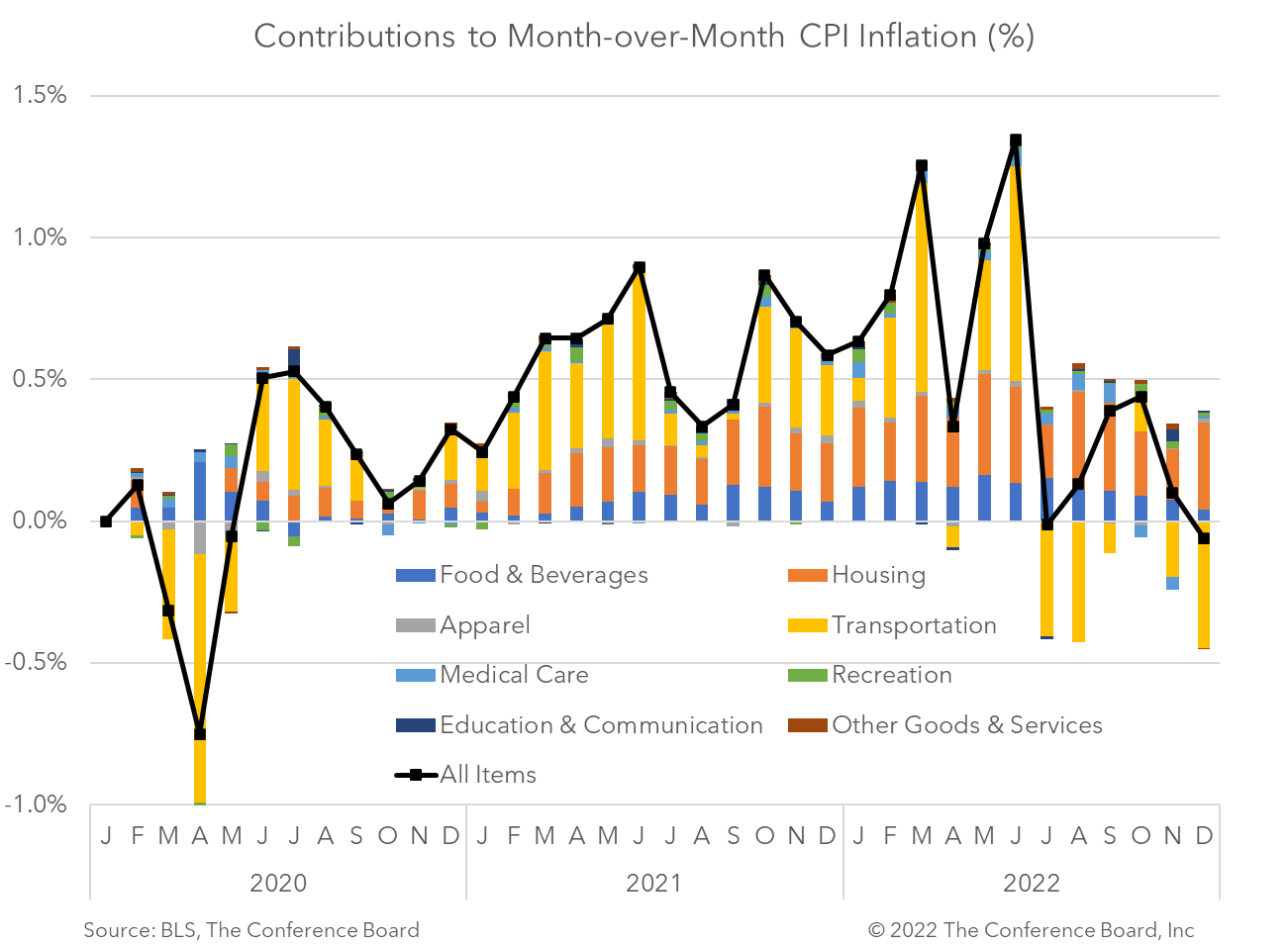

The headline Consumer Price Index (CPI) eased again in December while Core CPI, which excludes food and energy, rose somewhat. Lower energy prices were a large factor in lowering the headline December print. While this is mostly welcome news, much work remains to be done to bring inflation closer to 2 percent. We expect two more 25 bp interest rate hikes in February and March, and a recession to begin early this year. Headline CPI slowed to 6.5 percent year-over-year in December, vs. 7.1 percent in November. In month-over-month terms, this topline inflation metric fell to -0.1 percent, vs. 0.1 percent the month prior. This was the first month-over-month decline recorded since May 2020. Many index components saw price gains moderate for the month, and some (including energy, and both new and used vehicles) saw prices decline. However, shelter price gains remained high. However, Core CPI rose somewhat in December. The core index, which is total CPI less volatile food and energy prices, rose by 0.3 percent month-over-month in December, vs. 0.2 in November, 0.3 in October, and 0.6 percent in September. Despite this uptick, year-over-year core CPI slowed to 5.7 percent from 6.0 percent in October due to base effects.Insights for What’s Ahead

December Inflation Highlights

Lukewarm Holiday Shopping in 2025 Augurs Slower Spending in Q4

February 10, 2026

FOMC Reaction: US Economy In a Good Place, But Staying Vigilant

January 28, 2026

Fed January Decision: Pause or Full Stop?

January 27, 2026

November PCE: Are Consumers Spending Beyond Their Means?

January 22, 2026

Retail Sales Highlight Affordability Issues

January 14, 2026

No, Tamer CPI Does Not Mean Inflation Peaked

January 13, 2026