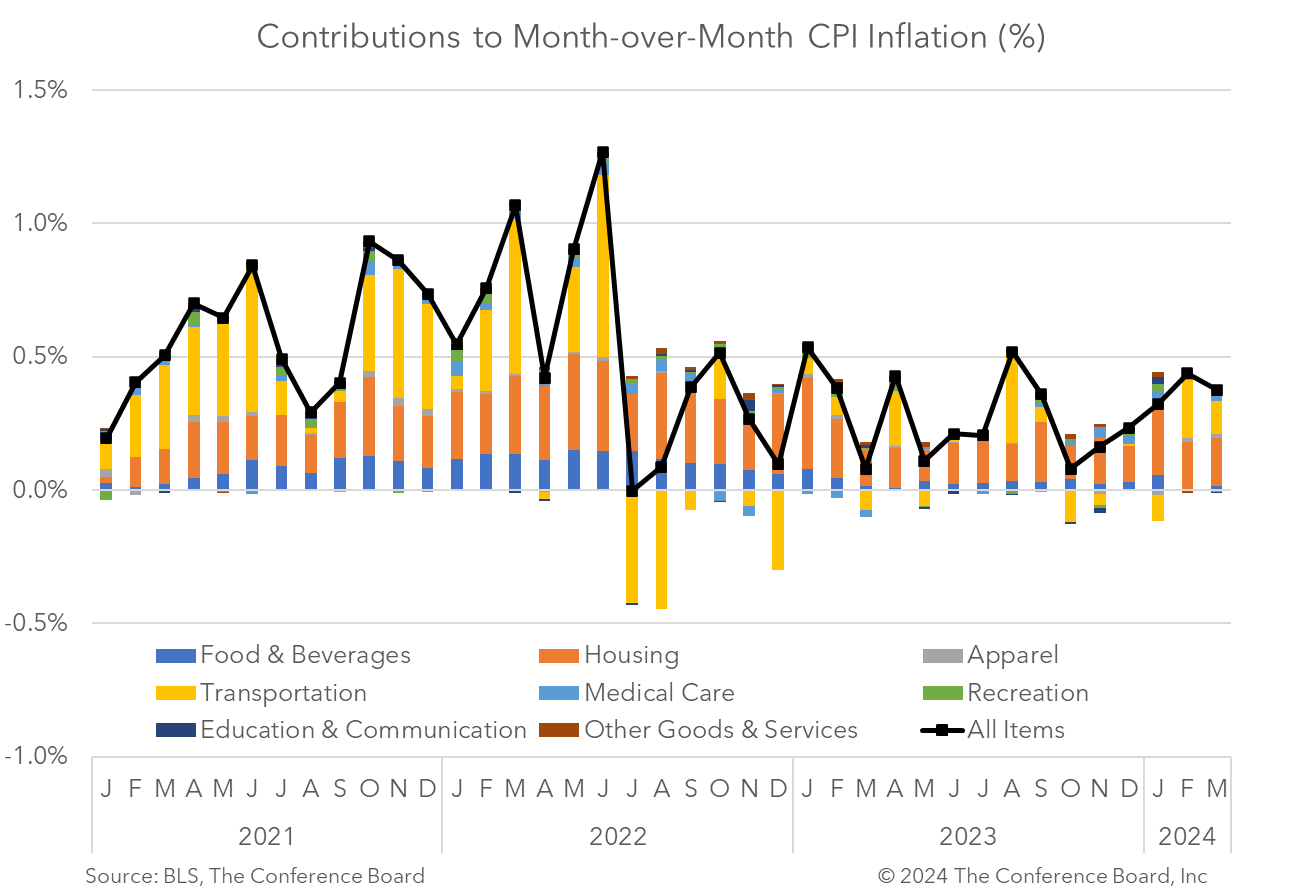

The March Consumer Price Index (CPI) showed that inflation rose by 3.5% in March from a year earlier, vs. 3.2% in February and 6.4% at the beginning of 2023. Meanwhile, core CPI, which excludes volatile food and energy prices, rose by 3.8% in March from a year earlier, vs. 3.8% y/y in February and 5.5% y/y at the beginning of 2023. Following hotter-than-expected January and February CPI data, these March numbers continued to show stubbornness. While the headline CPI did cool slightly in month-on-month terms (from 0.44% to 0.38%) base effects in 2023 drove the year-on-year reading 0.3 percentage points higher. Goods inflation ticked down for the month, but services inflation continues to be problematic. Shelter prices, including both rent and Owners Equivalent Rent (OER) are continuing to cool in year-on-year terms, but month-on-month increases have yet to converge toward their pre-pandemic norms. Meanwhile, prices for insurance continued to rise – especially motor vehicle insurance. Today’s data provide a preview of the PCE deflator—the Fed’s preferred measure for guiding policy—later this month. Given what the CPI signals for the PCE deflator and Fed Chair Powell’s previous statements, the Federal Reserve will likely hold rates steady at the conclusion of the May 1st FOMC meeting. While we continue to expect the Fed to cut rates in June, more progress on inflation will need to occur between now and then. If it doesn’t, the Fed may have to postpone cuts until later this year. Core CPI rose by 0.36% m/m and 3.8% y/y, vs. February’s 0.36% m/m and 3.8% y/y. According to the BLS, the core CPI was driven by shelter, but insurance prices were also a major contributor. Insurance prices continued to rise for the month, with motor vehicle insurance prices rising 2.6% from the month prior. Other indexes that rose for the month were personal care, education, and household furnishings and operations.

DATA DETAILS

Headline CPI rose by 0.38% m/m and 3.5% y/y, vs. February’s 0.44% m/m and 3.3% y/y. Month-on-month shelter and gasoline price increases accounted for more than half of the all items increases, according to the Bureau of Labor Statistics (BLS). Gasoline prices rose 1.7% from the month prior. Within the shelter category, rent prices rose 0.4% m/m, vs. 0.5% in February, but Owner Equivalent Rent (OER) price increases remained steady at 0.4% m/m. However, in year-on-year terms inflation for both of these shelter types continued to cool. Food prices rose 0.1% m/m.

myTCB® Members get exclusive access to webcasts, publications, data and analysis, plus discounts to events.

Shutdown Aside, Growth Moderates Under Inflationary Pressures

February 20, 2026

January CPI Raises More Questions than Provides Answers

February 13, 2026

Lukewarm Holiday Shopping in 2025 Augurs Slower Spending in Q4

February 10, 2026

FOMC Reaction: US Economy In a Good Place, But Staying Vigilant

January 28, 2026

Fed January Decision: Pause or Full Stop?

January 27, 2026

November PCE: Are Consumers Spending Beyond Their Means?

January 22, 2026