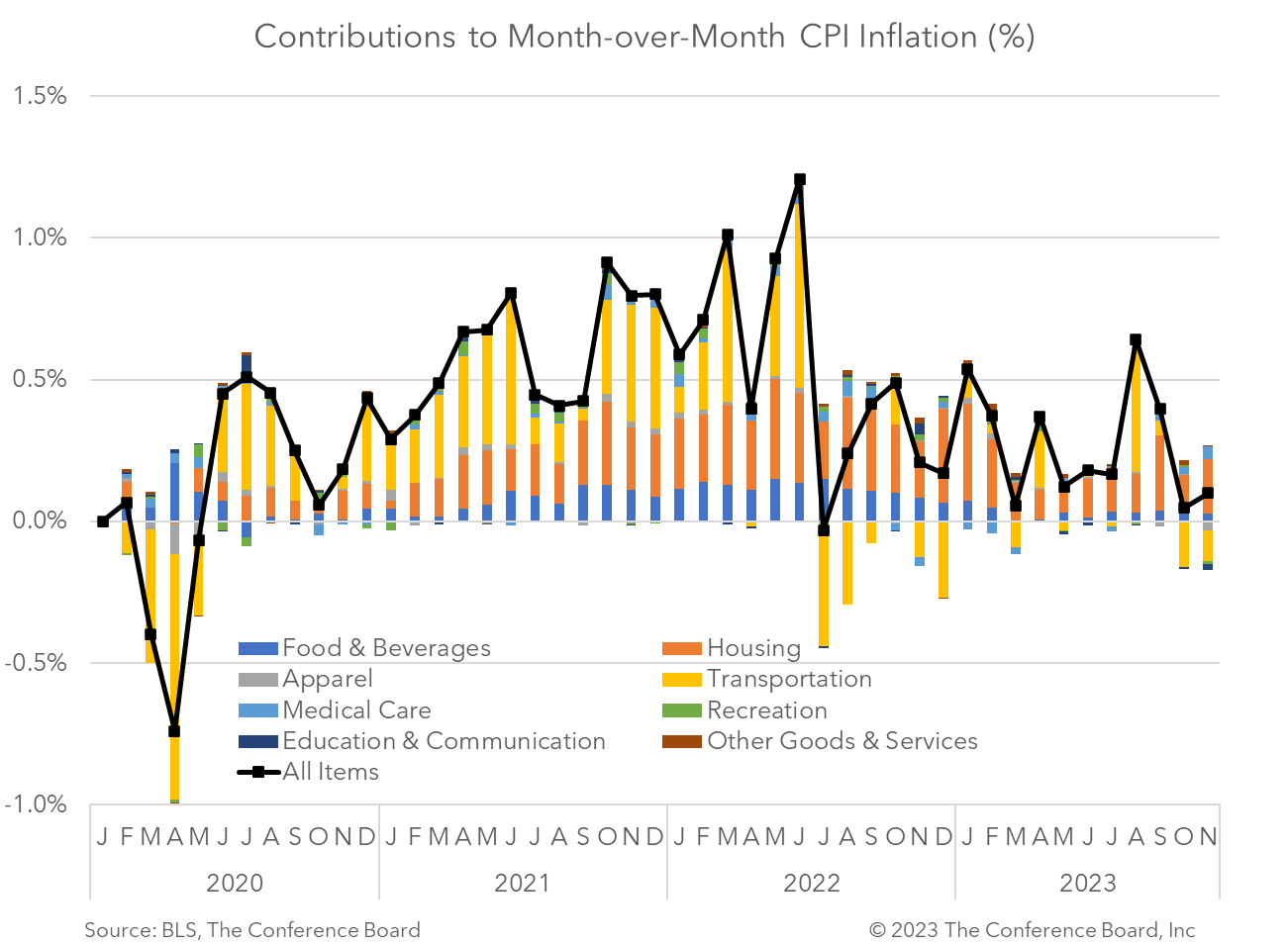

The November Consumer Price Index (CPI) showed that inflation rose 3.1% from a year earlier, vs. 3.2% y/y in September and 6.4% y/y at the beginning of the year. Meanwhile, core CPI, which excludes volatile food and energy prices, rose 4.0% in November from a year earlier, vs. 4.0% y/y in October and 5.6% y/y at the beginning of the year. The Fed will be pleased with this print and will hold rates steady at the conclusion of the December FOMC meeting tomorrow. However, as Chair Powell said last month - future progress on inflation will be “lumpy” and “bumpy.” We expect the Fed to close in on its 2% y/y inflation target by the end of next year. We also expect the US economy to cool significantly in early 2024 under the weight of elevated interest rates. As such, the Fed is likely to start lowering rates in mid-2024 as a pace of 25 basis points per meeting. Headline CPI rose by 0.1% month-on-month and 3.1% y/y, vs. October’s 0.0% m/m and 3.2% y/y. Shelter prices continued to rise in November, but a decline in gasoline prices kept the headline index from rising much. Energy commodity prices fell 5.8% m/m while used vehicle prices rose 1.6% m/m and transportation services rose 1.1% m/m. Meanwhile, food prices rose 0.2% m/m. Core CPI rose 0.3% m/m and 4.0% y/y, vs. October’s 0.2% m/m and 4.0% y/y. While shelter prices rose 0.4% m/m, this is down significantly from the rates recorded at the onset of 2023.

Data Details

myTCB® Members get exclusive access to webcasts, publications, data and analysis, plus discounts to events.

Shutdown Aside, Growth Moderates Under Inflationary Pressures

February 20, 2026

January CPI Raises More Questions than Provides Answers

February 13, 2026

Lukewarm Holiday Shopping in 2025 Augurs Slower Spending in Q4

February 10, 2026

FOMC Reaction: US Economy In a Good Place, But Staying Vigilant

January 28, 2026

Fed January Decision: Pause or Full Stop?

January 27, 2026

November PCE: Are Consumers Spending Beyond Their Means?

January 22, 2026