These are interesting times for the American consumer—and the US economic forecaster. On one hand, the key indicators continue trending at impressive heights: Yet consumer-facing businesses still need to ask some important questions: How is this sunny picture reflected in the actual near-term spending decisions of US consumers? And looking ahead, is consumer spending more likely to be the fuel that keeps a soaring US economy aloft—or the drag that is going to bring it back down? Here are four early signals we’re seeing in the data.

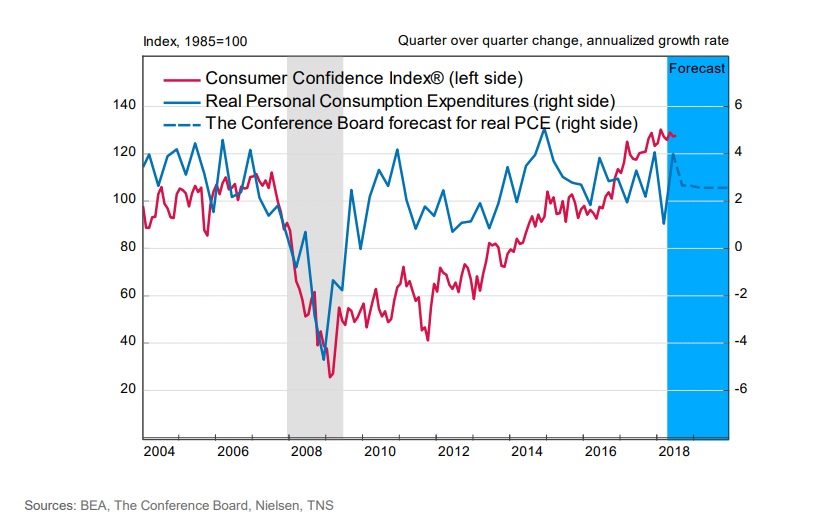

1. Consumer spending can't sustain its Q2 altitude but is likely to remain strong for some time ahead:

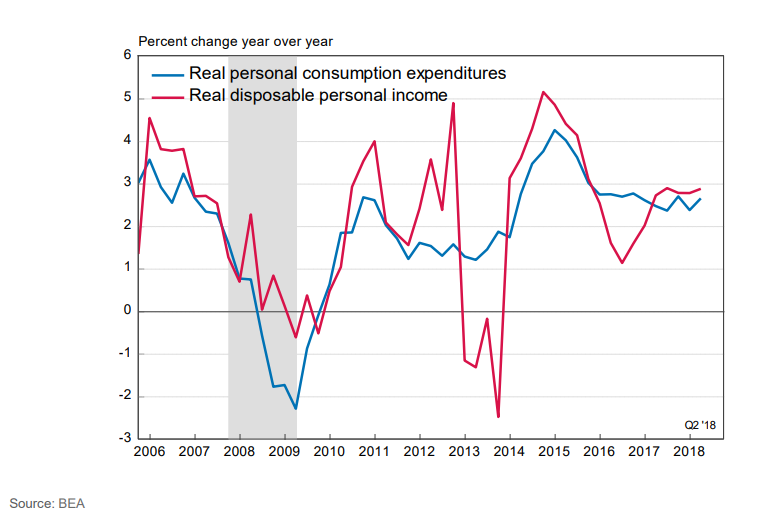

2. A strong job market and tax cuts have provided spending power to sustain strong consumption growth:

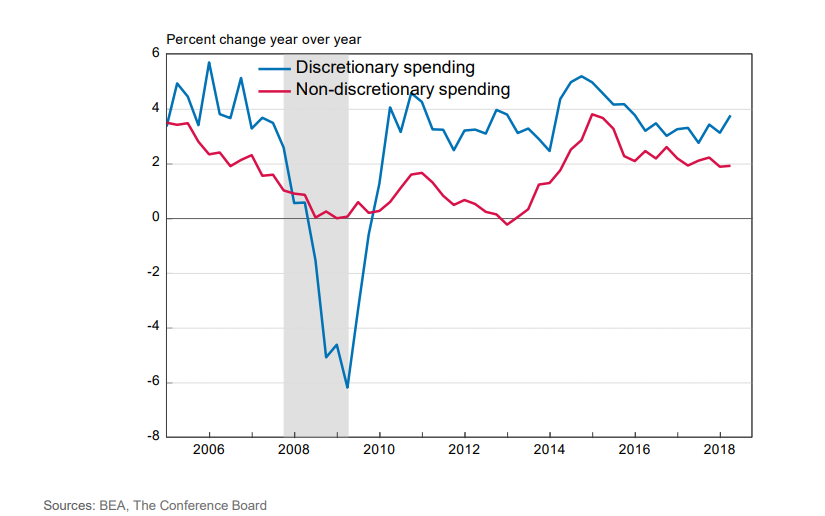

3. During times of strong spending growth, discretionary categories benefit most:

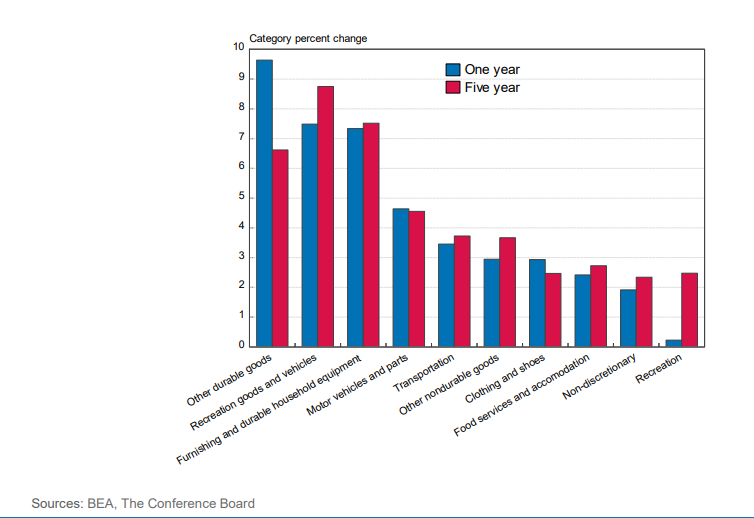

4. Durable goods and transportation services have been the key categories fueling recent consumption growth:

myTCB® Members get exclusive access to webcasts, publications, data and analysis, plus discounts to events.

Trust is the Tie that Binds Intangibles to Tangible Value

February 12, 2020

Making Intangibles Tangible: Who is to Blame When Brands are Written Down?

September 11, 2019