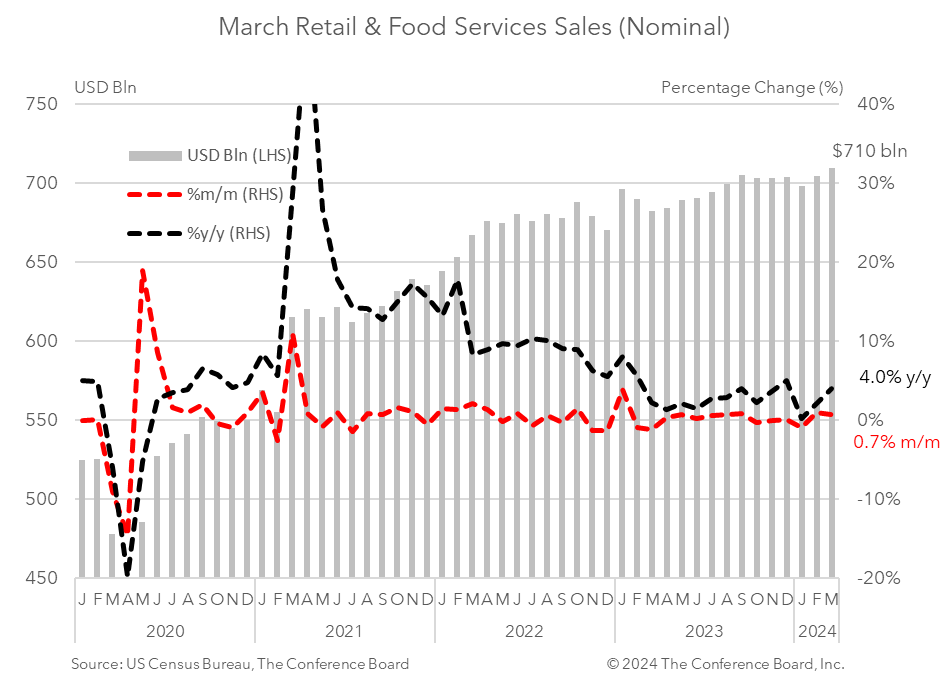

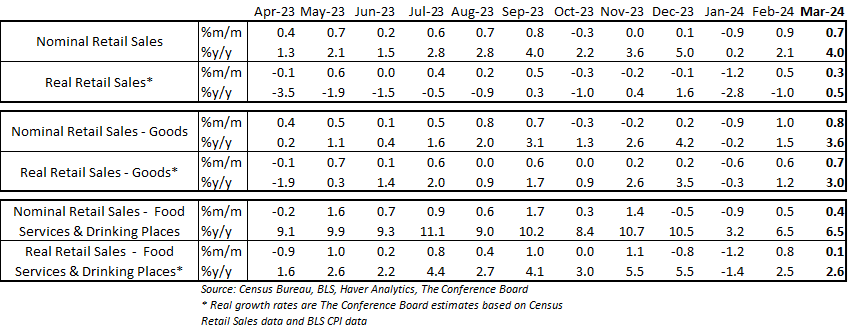

Following a weak retail sales report at the onset of the year, March spending data saw an unexpected improvement and January & February figures were both revised higher. Nominal retail spending rose by 0.7% in March, following a 0.9% m/m (revised) gain in February and a decline of 0.9% (revised) in January. However, after adjusting for inflation using CPI data real March spending growth was up just 0.3% from February. Notably, the real Jan-Mar average was down 3.5% annualized from the Q4 2023 average.* While this was a strong report some spending categories continued to struggle. Motor vehicle spending dropped by 0.9% from the month prior, and clothing, sporting equipment, appliances, and furnishings all saw declines in spending. Rising oil prices helped to boost sales at gasoline stations and nonstore retailers also saw a large increase. These patterns suggest that some consumers are spending more cautiously. Finally, inflation has played a large role in augmenting these Q1 2024 nominal retail sales data. As mentioned above, after factoring CPI into these Q1 2024 figures the annualized growth rate from Q4 2023 remains negative. Consumer demand for goods rose by 0.8% from the month prior in nominal terms. Spending on motor vehicles and parts fell by 0.7% in March from February (driven by weak motor vehicle sales, parts sales were strong), while retail sales excluding these categories rose by 1.2%. Spending at gasoline stations rose by 2.1% from the month prior due to an uptick in gasoline prices. Retail sales, less motor vehicles, gasoline, and building supplies (known as “Retail Control”) rose by 1.1% from the previous month. Other categories that saw strength included general merchandise stories, miscellaneous stores, and nonstore retailers. Spending on clothing and accessories, sporting goods, and electronics & appliances contracted from the month prior. When adjusting goods spending for CPI inflation, the real growth rate was about 0.7%.* Meanwhile, spending at food services and drinking places rose by 0.4% month-over-month in March. After adjusting for CPI inflation the real growth rate was about 0.1%.* * Real growth rates are The Conference Board estimates based on Census Retail Sales data and BLS CPI data.

Key drivers of retail sales in March:

Shutdown Aside, Growth Moderates Under Inflationary Pressures

February 20, 2026

January CPI Raises More Questions than Provides Answers

February 13, 2026

Lukewarm Holiday Shopping in 2025 Augurs Slower Spending in Q4

February 10, 2026

FOMC Reaction: US Economy In a Good Place, But Staying Vigilant

January 28, 2026

Fed January Decision: Pause or Full Stop?

January 27, 2026

November PCE: Are Consumers Spending Beyond Their Means?

January 22, 2026