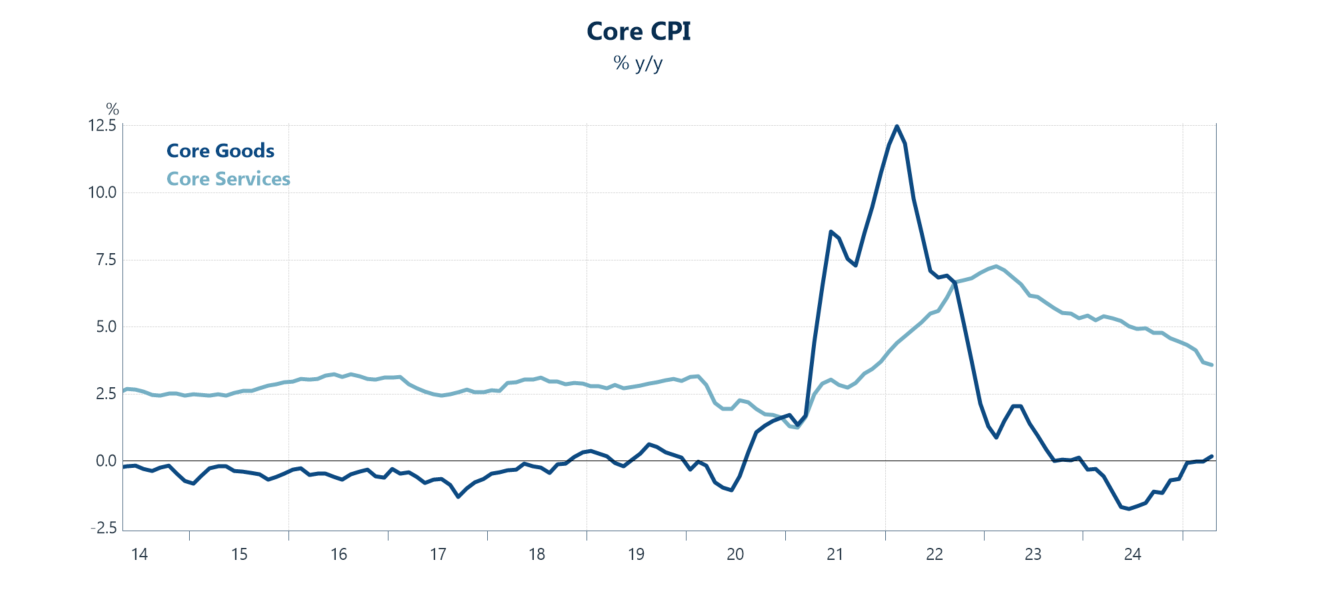

No major signs of the inflationary impact of the “Liberation Day” tariffs were evident in the April CPI report, suggesting that the pass-through of tariffs on imports is yet to be seen in the coming months. Meanwhile, declines in discretionary travel-related services prices continued to indicate consumers’ caution about their financial situation, reflected in recent consumer confidence data.

Figure 1. Goods Inflation Edges Higher, while Service Price Growth Slows

Sources: Bureau of Labor Statistics, Haver Analytics, The Conference Board.

myTCB® Members get exclusive access to webcasts, publications, data and analysis, plus discounts to events.

Shutdown Aside, Growth Moderates Under Inflationary Pressures

February 20, 2026

January CPI Raises More Questions than Provides Answers

February 13, 2026

Lukewarm Holiday Shopping in 2025 Augurs Slower Spending in Q4

February 10, 2026

FOMC Reaction: US Economy In a Good Place, But Staying Vigilant

January 28, 2026

Fed January Decision: Pause or Full Stop?

January 27, 2026

November PCE: Are Consumers Spending Beyond Their Means?

January 22, 2026