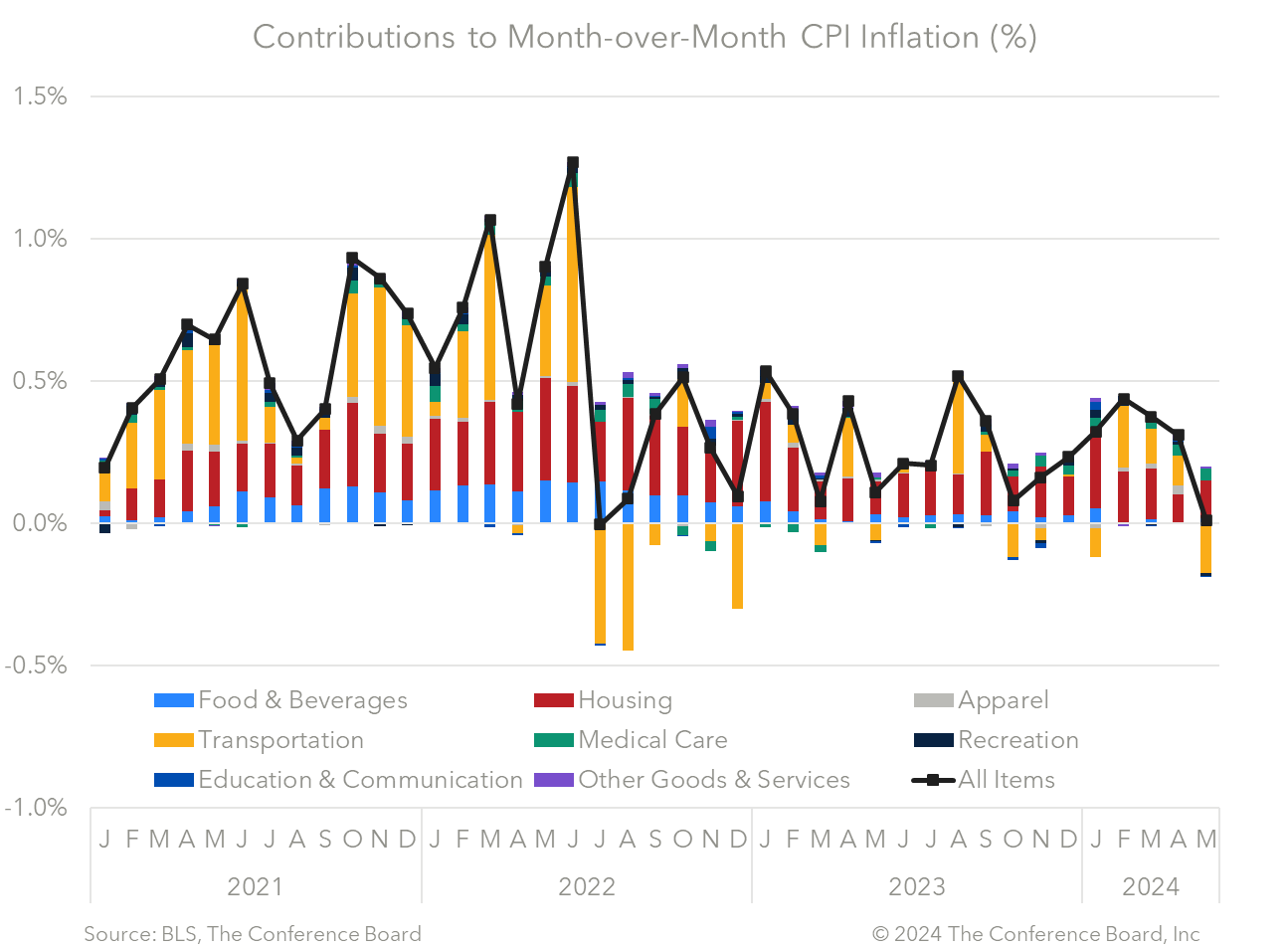

The May Consumer Price Index (CPI) showed that inflation rose by 3.3% from a year earlier, vs. 3.4% in April and 6.4% at the beginning of 2023. Meanwhile, core CPI, which excludes volatile food and energy prices, rose by 3.4% from a year earlier, vs. 3.6% y/y in April and 5.6% y/y at the beginning of 2023. Following hotter-than-expected inflation data in Q1 2024, these May numbers showed welcome relief. Declines in energy prices, and gasoline specifically, helped to offset price increases elsewhere, resulting in a flat m/m headline reading. Goods inflation fell by 0.4% from the month prior, and stubborn services inflation cooled to 0.2%. However, there was no progress on monthly shelter prices, which have risen by 0.4% m/m for four consecutive months. According to the BLS, shelter prices account for over two-thirds of the total 12-month increase in the Core CPI. It is notable that core CPI excluding shelter prices has slowed to 1.9% y/y, while core prices stand at 3.4% y/y. Today’s data will be welcomed by the Fed, which is currently meeting to discuss monetary policy. However, the progress in today’s CPI data isn’t enough to negate the spike in inflation seen at the onset of this year. Optimism about imminent Fed cuts has given way to an expectation that a “higher for longer” interest rate environment is more likely. While we do expect inflation to gradually ebb further we do not think the Fed’s 2% PCE inflation target will be achieved until Q2 2025. However, we forecast that enough progress will be made by the end of 2024 that the Fed will begin to cut interest rates in November. Core CPI rose by 0.2% m/m and 3.4% y/y, vs. April’s 0.3% m/m and 3.6% y/y readings. While shelter price increases have been cooling gradually in %y/y terms, according to the Bureau of Labor Statistics (BLS) it accounted for two-thirds of the 12-month core CPI increase. It is notable that Core CPI excluding shelter prices now stands at just 1.9% year-on-year.

DATA DETAILS

Headline CPI rose by 0.0% m/m and 3.3% y/y, vs. April’s 0.3% m/m and 3.4% y/y readings. Gasoline prices fell by 3.6% from the month prior, but were offset by a rise in shelter prices. According to the BLS, indexes that increased m/m included: shelter (0.4%), medical care (0.3%), used cars and trucks (0.6%), and education (0.4%). Meanwhile, indexes that declined m/m included airline fares (-3.6%), new vehicles (-0.5%), communication (-0.3%), recreation (-0.2%), and apparel (-0.3%). Food prices rose by 0.1% in the month, with food at home remaining flat and food away from home rising slightly.

myTCB® Members get exclusive access to webcasts, publications, data and analysis, plus discounts to events.

November PCE: Are Consumers Spending Beyond Their Means?

January 22, 2026

Retail Sales Highlight Affordability Issues

January 14, 2026

No, Tamer CPI Does Not Mean Inflation Peaked

January 13, 2026

Exiting International Climate Pacts Will Leave The US Isolated

January 08, 2026

Robust Q3 GDP: Finding a Signal in the Noise

December 23, 2025

Fed Doves Get Nice Holiday Gift as CPI Inflation Drops

December 18, 2025