Personal income, spending and inflation all hit a sweet spot in June. Personal consumption expenditures continued to grow, though not by too much; personal incomes continued to cool, but did not contract; and inflation continued to cool. The Federal Reserve’s goal of bringing the US economy in for a soft landing is on track for now, but we expect growth to veer off-course later this year. We forecast a short and shallow recession to commence in Q4 2023. Highlights The Fed has reason to be optimistic that it may defeat inflation without triggering a recession, but we believe this goldilocks scenario will eventually give way to a period of contraction. The Fed will probably not lower rates until its approaches its 2 percent inflation target, which we believe will be around mid-2024. High interest rates, paired with a cooling labor market, dwindling pandemic excess savings, rising personal debt, student loan repayment resumption, and other factors will likely push consumer spending into negative territory and the broader economy into recession. We expect this to happen in late 2023 and early 2024. Inflation Incomes Spending

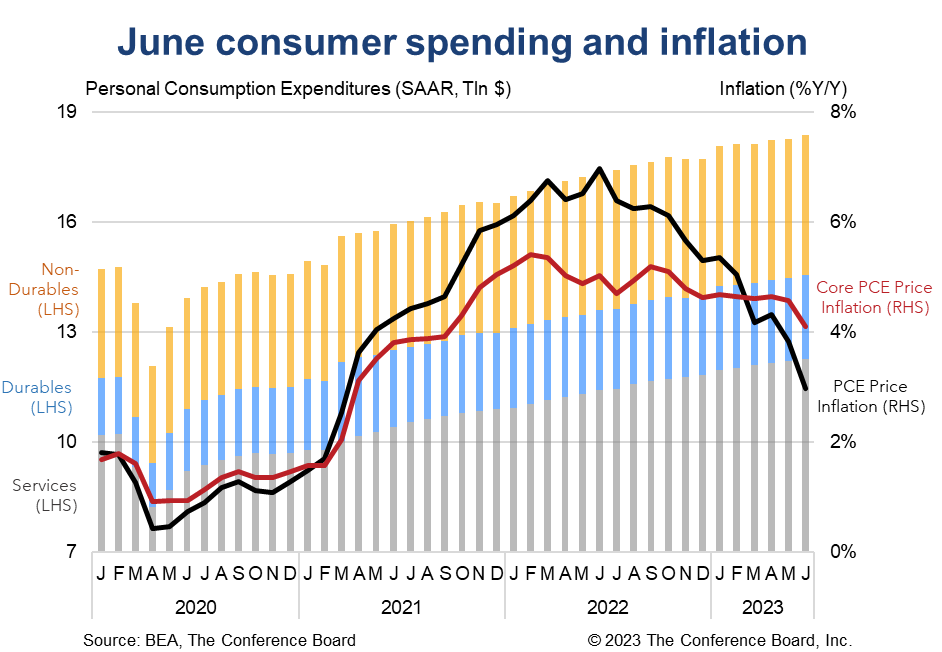

Collectively, this report shows that the US economy is continuing to grow, but that the right parts are cooling. PCE inflation has dropped from 7.0 percent year-over-year in June 2022 to 3.0 percent y/y today. Core inflation, which is more important, is down from 5.4 percent y/y in Feb 2022 to 4.1 percent y/y today. This progress has come under the weight of 525 basis points in Fed hikes since early 2022. Despite the duel headwinds of high inflation and rapidly rising interest rates, the US consumer has not buckled. Real spending has slowed, but not fallen apart, and business investment has largely held together. The real estate market has been hit, but even that is showing evidence of stabilization and recovery.

Headline PCE price inflation fell from 3.8 to 3.0 percent year-over-year (y/y) in June and core PCE price inflation (which excludes food and energy) fell from 4.6 to 4.1 percent y/y. On a month-over-month basis (m/m), headline PCE inflation rose from 0.1 percent to 0.2 percent while core PCE inflation fell from 0.3 percent to 0.2 percent. Prices for goods fell for the quarter, but services prices continued to rise.

Overall personal income rose 0.3 percent m/m (in nominal terms) in June, vs. 0.5 percent m/m in May. However, when factoring in inflation, the real month-over-month growth rate dropped to 0.1 percent m/m, vs. 0.3 percent m/m in May. In year-over-year terms, real personal income rose 2.3 percent in June, vs. 1.6 percent in May. Meanwhile the savings rates fell from 4.6 percent to 4.3 percent of disposable personal income.

Personal consumption expenditures jumped by 0.5 percent m/m (in nominal terms) in June, vs. 0.2 percent m/m percent in May. Spending on services rose by 0.4 percent m/m while spending on goods rose to 0.8 percent m/m. However, after accounting for inflation, real consumer spending was up 0.4 percent m/m in June with spending on goods rising to 0.9 percent m/m and spending of services rising 0.1 percent m/m.

January CPI Raises More Questions than Provides Answers

February 13, 2026

Lukewarm Holiday Shopping in 2025 Augurs Slower Spending in Q4

February 10, 2026

FOMC Reaction: US Economy In a Good Place, But Staying Vigilant

January 28, 2026

Fed January Decision: Pause or Full Stop?

January 27, 2026

November PCE: Are Consumers Spending Beyond Their Means?

January 22, 2026

Retail Sales Highlight Affordability Issues

January 14, 2026