The Consumer Confidence Survey® reflects prevailing business conditions and likely developments for the months ahead. This monthly report details consumer attitudes, buying intentions, vacation plans, and consumer expectations for inflation, stock prices, and interest rates. Data are available by age, income, 9 regions, and top 8 states.

US Consumer Confidence Declines Again in September

Latest Press Release

Updated: Tuesday, September 30, 2025

A sharp deterioration in consumers’ views of the current economic situation weighed on confidence

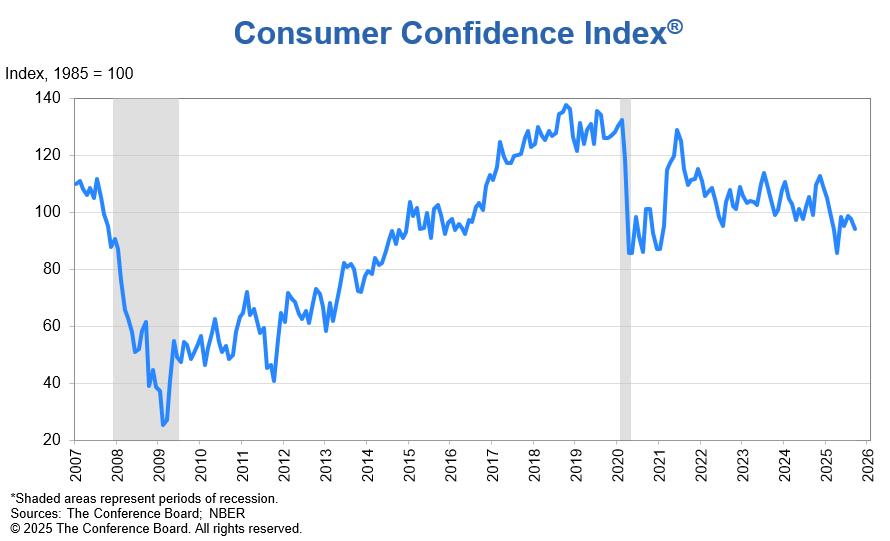

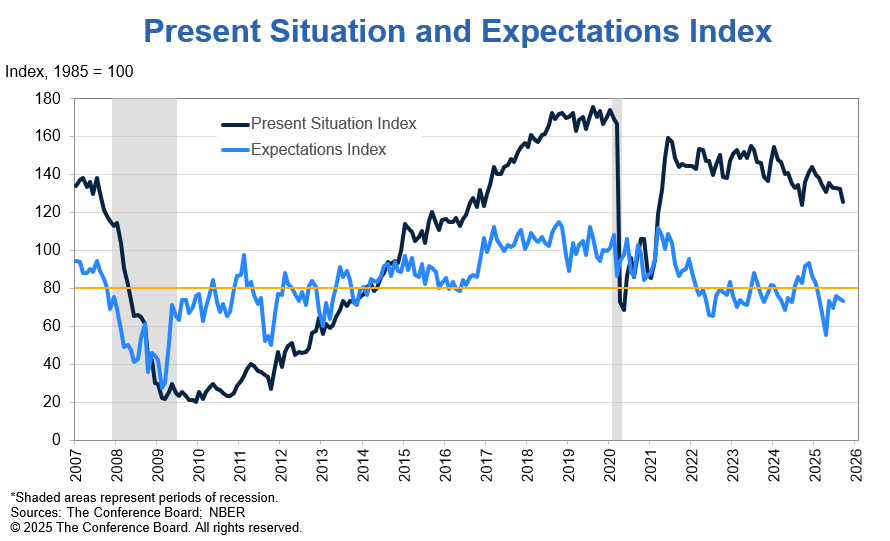

The Conference Board Consumer Confidence Index® declined by 3.6 points in September to 94.2 (1985=100), down from 97.8 in August. The Present Situation Index—based on consumers’ assessment of current business and labor market conditions—fell by 7.0 points to 125.4. The Expectations Index—based on consumers’ short-term outlook for income, business, and labor market conditions—decreased by 1.3 points to 73.4. Expectations have been below the threshold of 80 that typically signals a recession ahead since February 2025. The cutoff date for preliminary results was September 21, 2025.

“Consumer confidence weakened in September, declining to the lowest level since April 2025,” said Stephanie Guichard, Senior Economist, Global Indicators at The Conference Board. “The present situation component registered its largest drop in a year. Consumers’ assessment of business conditions was much less positive than in recent months, while their appraisal of current job availability fell for the ninth straight month to reach a new multiyear low. This is consistent with the decline in job openings. Expectations also weakened in September, but to a lesser extent. Consumers were a bit more pessimistic about future job availability and future business conditions but optimism about future income increased, mitigating the overall decline in the Expectations Index.”

Among demographic groups, confidence rose for consumers under 35 years old but declinedfor consumers over 35. The evolution of confidence by income group was mixed, with no clear pattern emerging. By income, confidence remained above its April low for all consumer cohorts besides households making between $25K and $35K and those making above $200K. By partisan affiliation, confidence improved slightly among both Republicans and Democrats but dropped substantially among Independents.

Guichard added: “Consumers’ write-in responses showed that references to prices and inflation rose in September, regaining its top position as the main topic influencing consumers’ views of the economy. References to tariffs declined this month, but remained elevated and continued to be associated with concerns about higher prices. Nonetheless, consumers’ average 12-month inflation expectations inched down, to 5.8% in September from 6.1% in August. This is still notably above 5.0%, the level at the end of 2024.”

Among consumers’ write-in responses, there was a rise in mentions of jobs and employment to a level unseen since August 2024. The comments were mostly negative, especially when referring to the current situation; there were a few positive comments which mostly conveyed hopes that things would get better.

In September, consumers’ outlook on stock prices improved slightly. The share of consumers expecting stock prices to increase over the next 12 months has been unchanged at 48.9% since August and July. Meanwhile, 27.6% of consumers expected stock prices to decrease over the next 12 months, down from 30.2% in August. The share of consumers expecting interest rates to riseticked down to 51.9% from 52.1% in August; meanwhile, 25.6% consumers expected interest rates to decline, up from 23.6% in August.

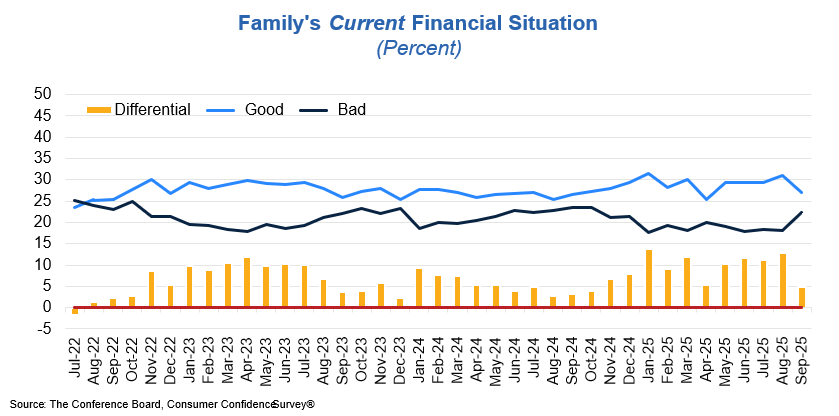

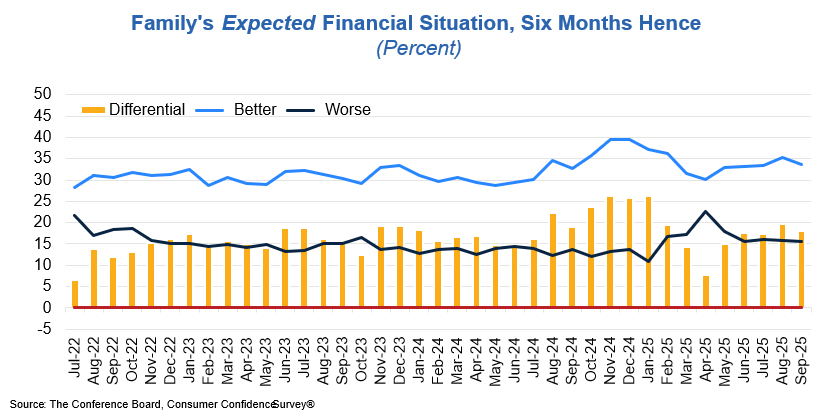

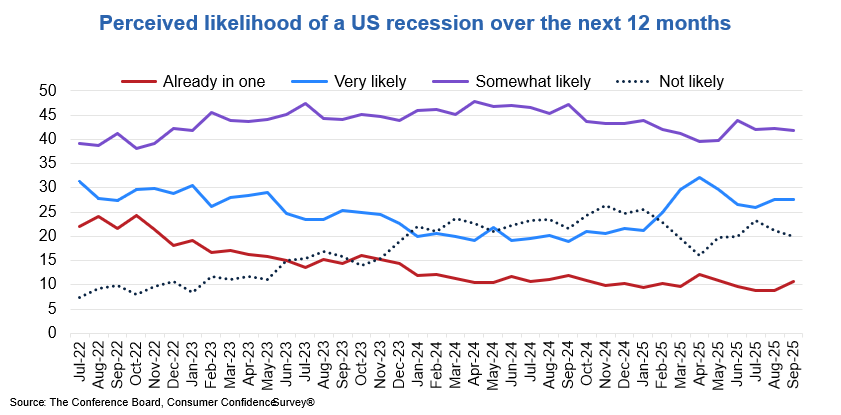

Consumers’ views of their Family’s Current and Future Financial Situation both weakened in September. Notably, consumers’ views of their current financial situation recorded the largest one-month drop since we started to collect this data in July 2022. The share of consumers thinking that a recession is very likely over the next 12 months rose slightly in September, to the highest level since May. In addition, more consumers thought that the economy was already in recession. (These measures are not included in calculating the Consumer Confidence Index®).

Purchasing plans for cars weakened in September, with buying intentions for both used and new cars declining.Meanwhile, purchasing plans for homes jumped to a 4-month high.Consumers’ plans to buy big-ticket items were little changed overall. However, there was a lot of variation across different types of appliances: intentions to purchase TVs and dryers saw the largest increase in September, refrigerators saw the largest declines. Electronics purchase intentions were mostly up, with smartphones leading the rise. Consumers’ intentions to purchase more services ahead deteriorated. Almost all types of services registered a decline in buying intentions, especially travel-related services. Vacation intentions fell again to the lowest level since April, with intentions to travel abroad driving the decline.

Present Situation

Consumers’ assessments of current business conditions deteriorated in September.

- 19.5% of consumers said business conditions were “good,” down from 21.8% in August.

- 15.4% said business conditions were “bad,” up from 14.6%.

Consumers’ views of the labor market cooled further in September.

- 26.9% of consumers said jobs were “plentiful,” down from 30.2% in August.

- 19.1% of consumers said jobs were “hard to get,” unchanged from last month.

Expectations Six Months Hence

Consumers were a bit more pessimistic about future business conditions in September.

- 18.7% of consumers expected business conditions to improve, down from 20.2% in August.

- 22.3% expected business conditions to worsen, also down from 23.5%.

Consumers were more worried about the labor market outlook in September.

- 16.1% of consumers expected more jobs to be available, down from 17.9% in August.

- 25.6% anticipated fewer jobs, down slightly from 25.9%.

Consumers’ outlook for their income prospects was slightly more positive in September.

- 17.6% of consumers expected their incomes to increase, down from 18.8% in August.

- 11.7% expected their income to decrease, down from 13.3%.

Assessment ofFamily Finances and Recession Risk

- Consumer assessments of their Family’s Current Financial Situation weakened notably in September.

- Consumer assessments of their Family’s Expected Financial Situation cooled slightly.

- Consumers’ Perceived Likelihood of a US Recession over the Next 12 Months was stable in September, but more consumers thought a recession had already started.

The monthly Consumer Confidence Survey®, based on an online sample, is conducted for The Conference Board by Toluna, a technology company that delivers real-time consumer insights and market research through its innovative technology, expertise, and panel of over 36 million consumers. The cutoff date for the preliminary results was September 21.

Source: September 2025 Consumer Confidence Survey®

The Conference Board

The Conference Board publishes the Consumer Confidence Index® at 10 a.m. ET on the last Tuesday of every month. Subscription information and the technical notes to this series are available on The Conference Board website: https://www.conference-board.org/data/consumerdata.cfm.

About The Conference Board

The Conference Board is the member-driven think tank that delivers Trusted Insights for What’s Ahead®. Founded in 1916, we are a non-partisan, not-for-profit entity holding 501 (c) (3) tax-exempt status in the United States. ConferenceBoard.org.

The next release is Tuesday, October 28th at 10 AM ET.

© The Conference Board 2025. All data contained in this table are protected by United States and international copyright laws. The data displayed are provided for informational purposes only and may only be accessed, reviewed, and/or used in accordance with, and the permission of, The Conference Board consistent with a subscriber or license agreement and the Terms of Use displayed on our website at www.conference-board.org. The data and analysis contained herein may not be used, redistributed, published, or posted by any means without express written permission from The Conference Board.

COPYRIGHT TERMS OF USE All material on Our Sites are protected by United States and international copyright laws. You must abide by all copyright notices and restrictions contained in Our Sites. You may not reproduce, distribute (in any form including over any local area or other network or service), display, perform, create derivative works of, sell, license, extract for use in a database, or otherwise use any materials (including computer programs and other code) on Our Sites ("Site Material"), except that you may download Site Material in the form of one machine readable copy that you will use only for personal, noncommercial purposes, and only if you do not alter Site Material or remove any trademark, copyright or other notice displayed on the Site Material. If you are a subscriber to any of the services offered on Our Sites, you may be permitted to use Site Material, according to the terms of your subscription agreement.

Trademarks "THE CONFERENCE BOARD," the TORCH LOGO, "CONSUMER CONFIDENCE SURVEY", "CONSUMER CONFIDENCE INDEX", and other logos, indicia and trademarks featured on Our Sites are trademarks owned by The Conference Board, Inc. in the United States and other countries ("Our Trademarks").

You may not use Our Trademarks in connection with any product or service that does not belong to us nor in any manner that is likely to cause confusion among users about whether The Conference Board is the source, sponsor, or endorser of the product or service, nor in any manner that disparages or discredits us.