For Release 9:30 AM ET, November 17, 2025

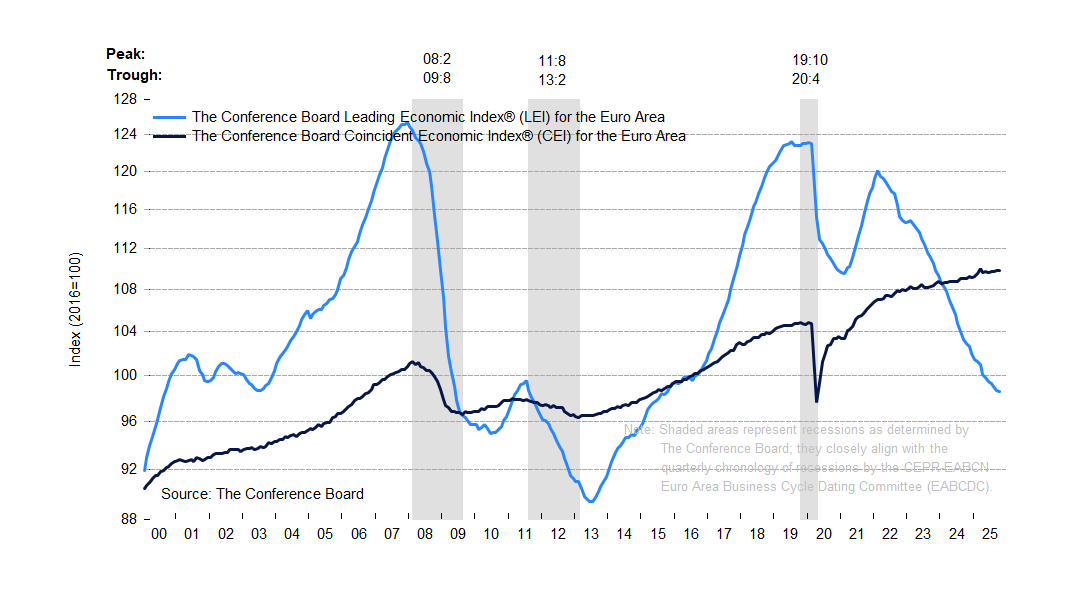

Using the Composite Indexes: The Leading Economic Index (LEI) provides an early indication of significant turning points in the business cycle and where the economy is heading in the near term. The Coincident Economic Index (CEI) provides an indication of the current state of the economy. Additional details are below.

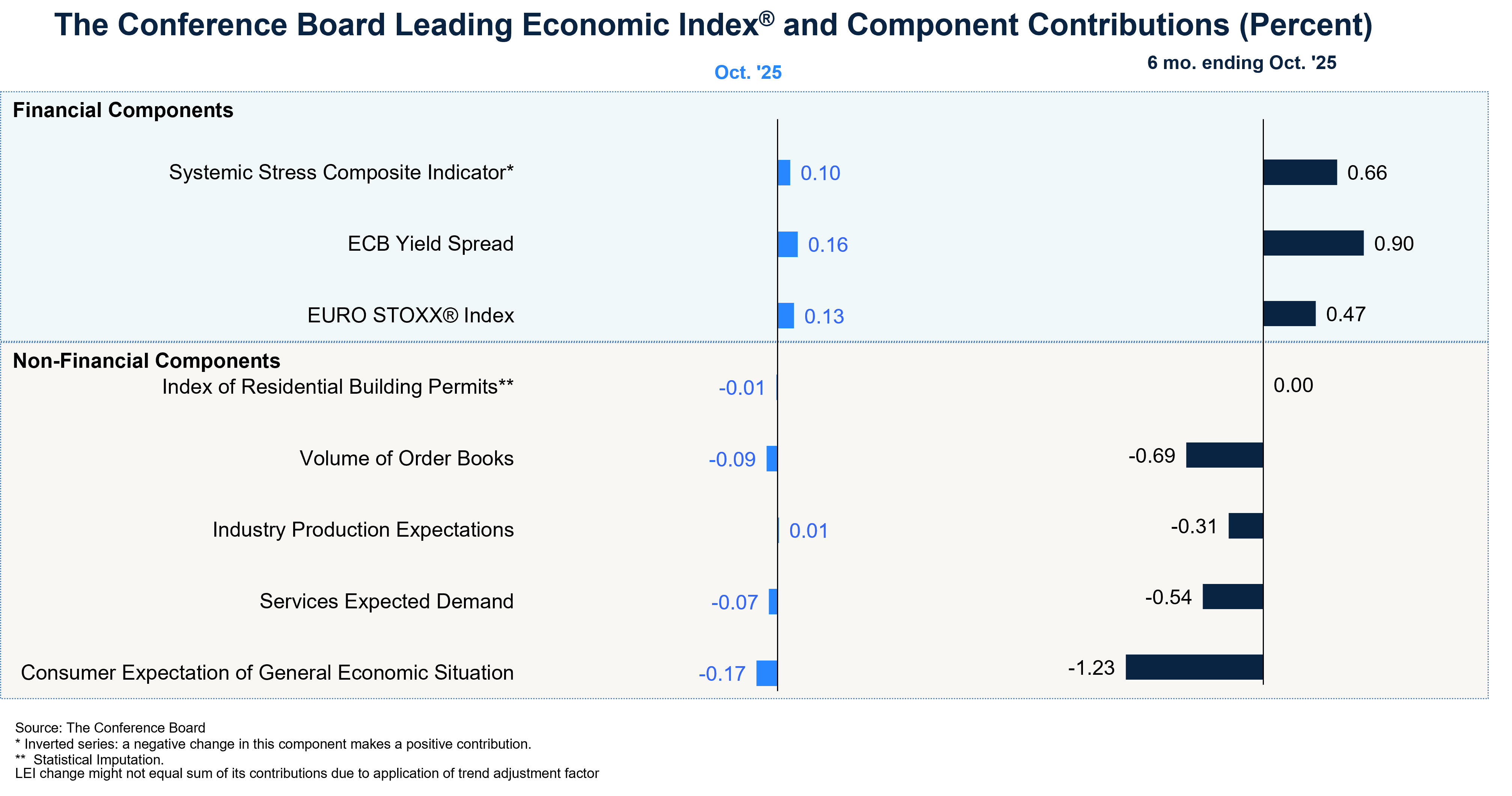

The Conference Board Leading Economic Index®(LEI) for the Euro Area ticked down by 0.1% in October 2025 to 98.6 (2016=100), after declining by 0.3% in September. As a result, over the six-month period from April to October 2025, the LEI contracted 1.5%, a smaller rate of decline than the -2.7% experienced over the previous six-month period, from October 2024 to April 2025.

The Conference Board Coincident Economic Index® (CEI) for the Euro Area remained unchanged in October 2025 at 109.8 (2016=100), after increasing by 0.1% in September. Overall, the CEI increased by 0.2% from April to October 2025, a continuation of the 0.5% growth from October 2024 through April 2025.

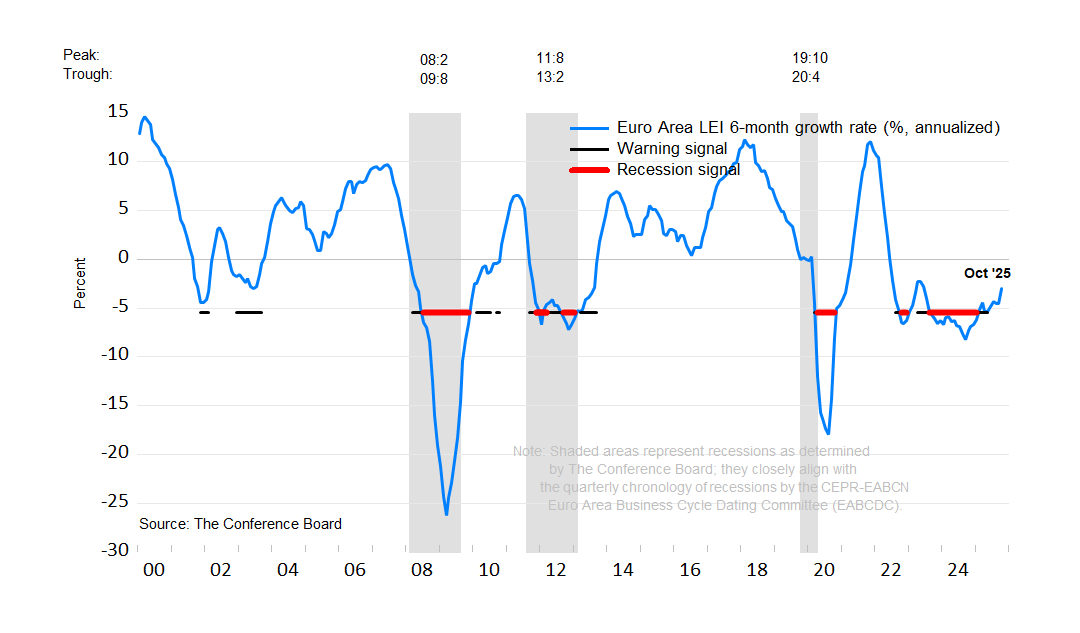

“The Euro Area LEI declined again in October,” said Timothy Brennan, Economic Research Associate, at The Conference Board. “As in previous months, consumer expectations remained the primary driver of weakness in the LEI. Furthermore, volume of order books and expected demand in the service sector remained subdued, more than offsetting gains from financial components, which continued to show resilience. The 6-month growth rate of the Euro Area LEI, while still negative, has been improving, signaling dissipating pressure on growth. Continued tension from US tariffs has weighed on export oriented European economies, with both Germany and Italy reporting zero growth in Q3 following modest contractions in Q2, highlighting headwinds to the region’s near-term expansion. Nonetheless, after modest expansion in Q3, The Conference Board still expects GDP growth to accelerate in Q4 of 2025 and into 2026, with annual growth forecasted at 1% in 2025 and 1.2% in 2026.

The next release is scheduled for Tuesday, December 16, 2025, at 9:30 A.M. ET.

NOTE: The chart illustrates the so-called 3Ds—duration, depth, and diffusion—for interpreting a downward movement in the LEI. Duration refers to how long the decline has lasted. Depth denotes the size of decline. Duration and depth are measured by the rate of change of the index over the most recent six months at an annualized rate. Diffusion is a measure of how widespread the decline is among the LEI’s component indicators—on a scale of 0 to 100, a diffusion index reading below 50 indicates most components are weakening.

The 3Ds rule signals an impending recession when: 1) the six-month diffusion index lies at or below 50, shown by the black warning signal lines in the chart; and 2) the LEI’s six-month growth rate (annualized) falls below the threshold of −5.6%. The red recession signal lines indicate months when both criteria are met simultaneously—and thus that a recession is likely imminent or underway.

The composite economic indexes are key elements in an analytic system designed to signal peaks and troughs in the business cycle. Comprised of multiple independent indicators, the indexes are constructed to summarize and reveal common turning points in the economy in a clearer and more convincing manner than any individual component.

The CEI reflects current economic conditions and is highly correlated with real GDP. The LEI is a predictive tool that anticipates—or “leads”—turning points in the business cycle by around seven months.

The eight components of Leading Economic Index® for the Euro Area are:

The four components of the Coincident Economic Index® for the Euro Area are:

To access data, please visit: https://data-central.conference-board.org

About The Conference Board

The Conference Board is the member-driven think tank that delivers Trusted Insights for What’s Ahead®. Founded in 1916, we are a non-partisan, not-for-profit entity holding 501 (c) (3) tax-exempt status in the United States. TCB.org

PRESS RELEASE

The LEI for Germany Decreased in September

November 14, 2025

PRESS RELEASE

LEI for Brazil Increased in October

November 13, 2025

PRESS RELEASE

The LEI for France Increased in September

November 13, 2025

PRESS RELEASE

LEI for Australia Unchanged in September

November 12, 2025

PRESS RELEASE

LEI for the UK declined in September

November 11, 2025

PRESS RELEASE

LEI for Japan Declined in September

November 11, 2025

All release times displayed are Eastern Time

Note: Due to the US federal government shutdown, all further releases for The Conference Board Employment Trends Index™ (ETI), The Conference Board-Lightcast Help Wanted OnLine® Index (HWOL Index), The Conference Board Leading Economic Index® of the US (US LEI) and The Conference Board Global Leading Economic Index® (Global LEI) data may be delayed. TCB will resume publication once updated US federal government data are released.

Business & Economics Portfolio

October 08, 2025 | Database

The Economy Stabilized in August but Outlook Remains Weak

September 27, 2023 | Report

China's Economic Recovery Continues to Stutter (Economy Watch: China View, June 2023)

June 30, 2023 | Report

Leading Economic Indicators and the Oncoming Recession

December 07, 2022 | Article

The Evolving Economic Outlook for Europe

July 10, 2024

Is a Global Recession on the Horizon?

July 13, 2022