Access Current & Historical Data

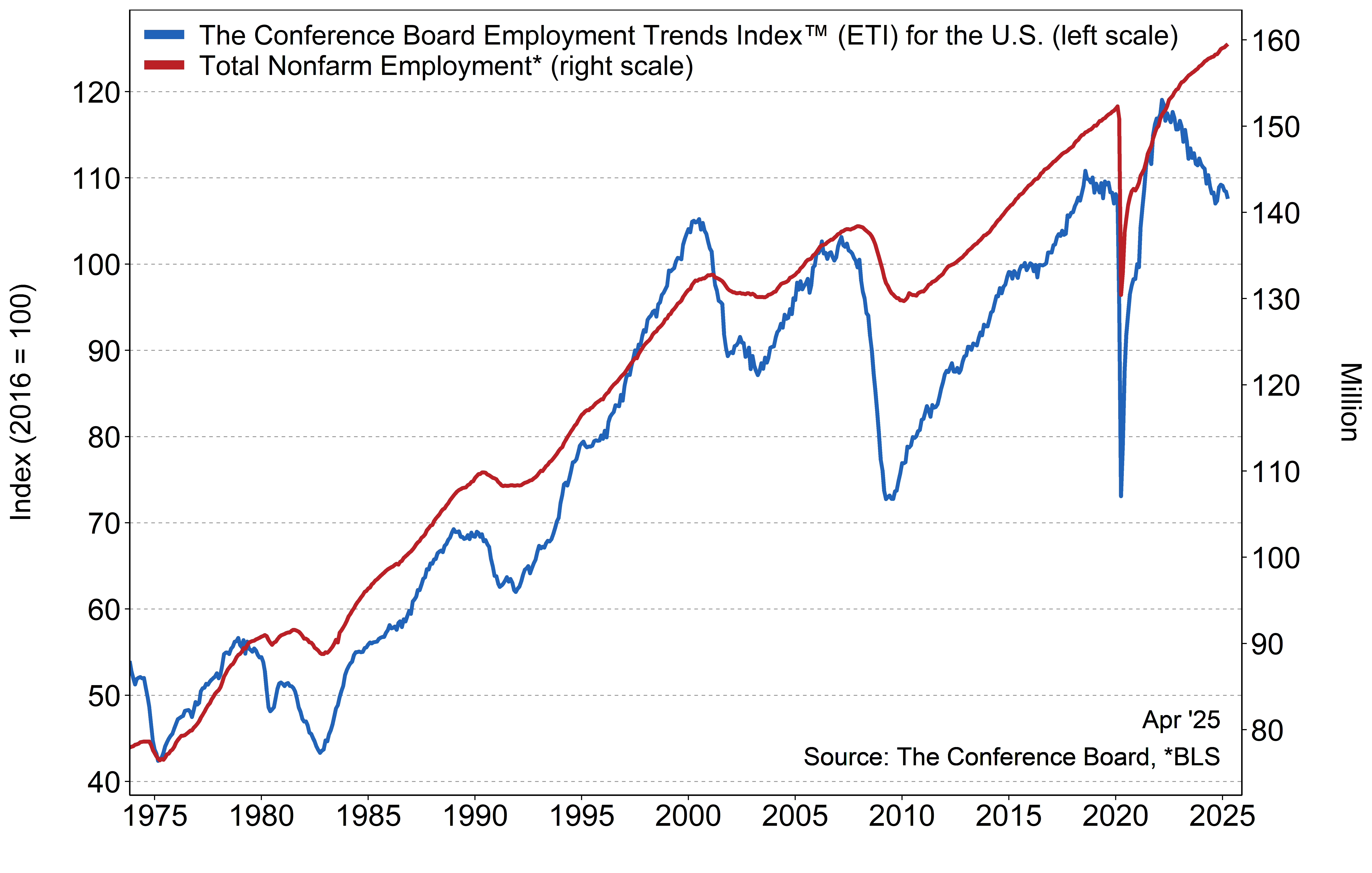

The Conference Board Employment Trends Index™ (ETI) decreased in April to 107.57, from a downwardly revised 108.41 in March. The Employment Trends Index is a leading composite index for payroll employment. When the Index increases, employment is likely to grow as well, and vice versa. Turning points in the Index indicate that a change in the trend of job gains or losses is about to occur in the coming months.

“The ETI fell in April to its lowest level since October, reflecting growing economic uncertainty,” said Mitchell Barnes, Economist at The Conference Board. “While labor market indicators for the private sector largely remained stable in April, consumers and businesses are beginning to anticipate the impact of tariffs and import declines that could materialize over the next month.”

The share of consumers who report ‘jobs are hard to get’—an ETI component from the Consumer Confidence Survey®—rose for the third consecutive month in April to 16.6%, the highest share since October. The shift in consumers’ labor market outlook is part of a broader decline in confidence, that saw the Consumer Expectations Index fall in April to its lowest level since October 2011. The share of small firms that report jobs are ‘not able to be filled right now’ (an ETI component) fell by 6 percentage points to 34%, the lowest mark since September.

“April’s ETI is likely the last result we see before tariff disruptions begin to hit supply chains. Ahead of that, measures of business activity and labor demand largely held firm in data through April,” said Barnes. “And we’re likely to see the continuation of tight labor supply in the US given the aging workforce and limits on immigration.”

Real Manufacturing and Trade Sales continued to show post-election strength in the most recently released February data, showing annual growth of 3.2%. The share of involuntary part-time workers declined for the second consecutive month to 17.1% in April after reaching 18% in February, a high since mid-2021. Employment in the temporary-help industry grew by 3,600 in April, its first monthly gain in 2025 partially offsetting 12,900 net losses over January to March. Initial claims for unemployment insurance rose slightly over the course of April but the current level of 226,000 remains exactly equal to the series’ 12-month average, indicating no increasing trend. However, job openings continued to fall through March and may indicate that uncertainty is creating greater hesitation in hiring for businesses. Revisions to job openings in recent months now show a total decline of nearly 840,000 since November.

Barnes added, “While confidence in the labor market has slipped, it’s still unclear how much of a pullback in hiring or a rise in layoffs we’ll see from these anticipated tariff impacts. But it is almost certain that the labor market’s streak of resiliency will be tested in the months ahead.”

April’s decrease in the Employment Trends Index was driven by negative contributions from 4 of its eight components: Percentage of Firms with Jobs Not Able to Fill Right Now, Real Manufacturing and Trade Sales, Percentage of Respondents Who Say They Find ‘Jobs Hard to Get,’ and Initial Claims for Unemployment Insurance.

The Employment Trends Index aggregates eight leading indicators of employment, each of which has proven accurate in its own area. Aggregating individual indicators into a composite index filters out “noise” to show underlying trends more clearly.

The Conference Board Employment Trends Index ™, November 1973 to Present

The eight leading indicators of employment aggregated into the Employment Trends Index include:

*Statistical imputation for the recent month

**Statistical imputation for two most recent months

The Conference Board publishes the Employment Trends Index monthly, at 10 a.m. ET, on the Monday that follows each Friday release of the Bureau of Labor Statistics Employment Situation report. The technical notes to this series are available on The Conference Board website: http://www.conference-board.org/data/eti.cfm.

About The Conference Board

The Conference Board is the member-driven think tank that delivers Trusted Insights for What’s Ahead®. Founded in 1916, we are a non-partisan, not-for-profit entity holding 501 (c) (3) tax-exempt status in the United States. www.conference-board.org.

Employment Trends Index (ETI)™ 2025 Publication Schedule

For further information contact:

Joseph DiBlasi

781.308.7935

jdiBlasi@tcb.org

Jonathan Liu

jliu@tcb.org

Methodology

May 05, 2025

PRESS RELEASE

Employment Trends Index™ (ETI) Decreased in April

May 05, 2025

PRESS RELEASE

Employment Trends Index™ (ETI) Increased in March

April 07, 2025

All release times displayed are Eastern Time

Connect and be informed about this topic through webcasts, virtual events and conferences

Jobs Report: April Showers, Tariff Storm Looms

May 02, 2025 | Brief

March Payrolls: The Calm Before the Tariff Storm

April 04, 2025 | Brief

February Jobs Report Hints at Growing Uncertainty

March 07, 2025 | Brief

Q4 ECI Wage Deceleration Slows

February 07, 2025 | Brief

Stability Underneath January’s Noisy Jobs Report

February 07, 2025 | Brief