The Conference Board Measure of CEO Confidence™ is a barometer of the health of the US economy from the perspective of US chief executives. The measure of CEO confidence is based on CEOs' perceptions of current and expected business and industry conditions. The survey also gauges CEOs' expectations about future actions their companies plan on taking in four key areas: capital spending, employment, recruiting, and wages.

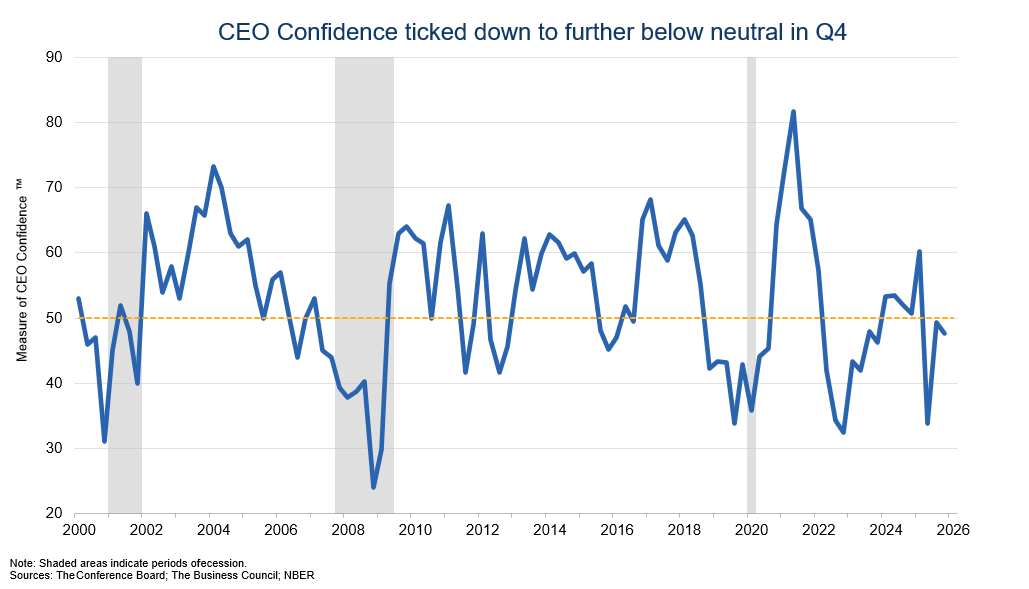

CEO Confidence Ticked Down to Further Below Neutral in Q4

Latest Press Release

Updated: Thursday, October 16, 2025

The Conference Board Measure of CEO Confidence™ in collaboration with The Business Council, fell to 48 in Q4 2025, down 1 point from 49 in Q3. (A reading below 50 reflects more negative than positive responses). A total of 130 CEOs participated in the Q4 survey, which was fielded from September 22 to October 6.

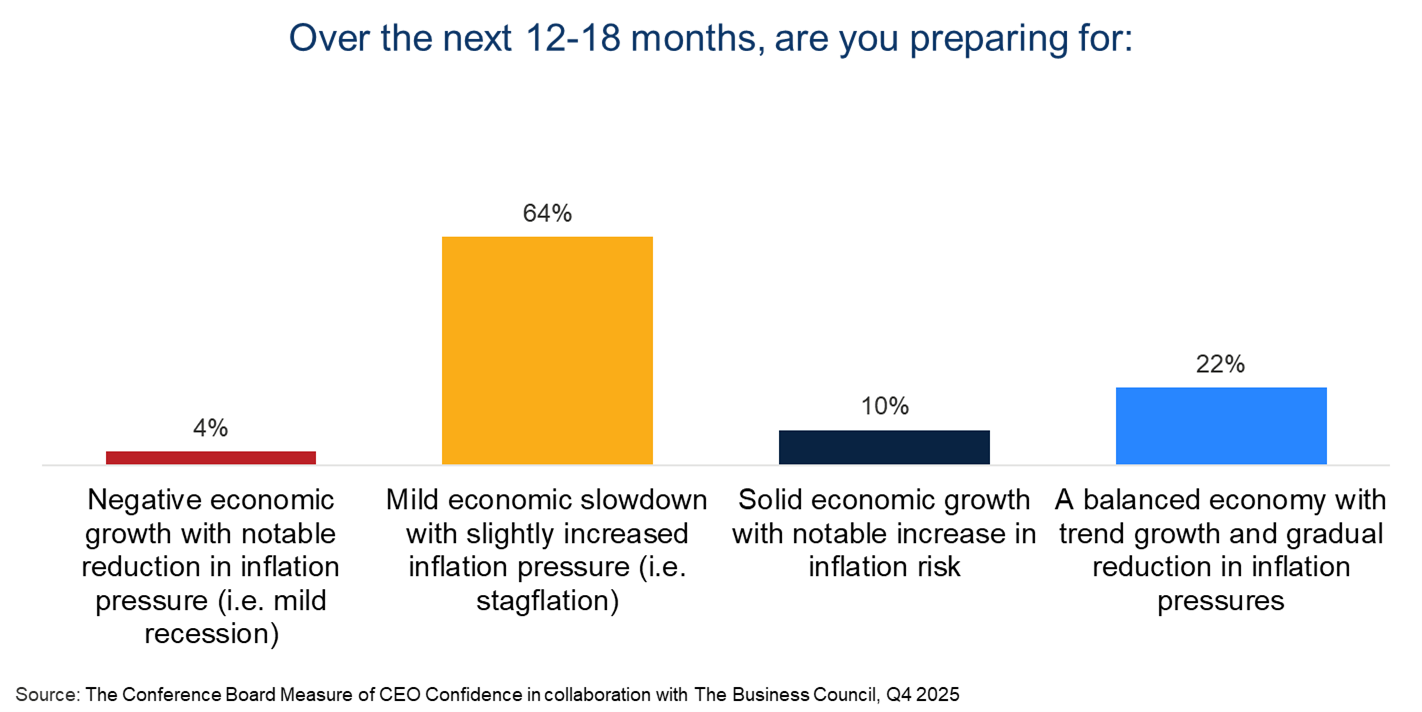

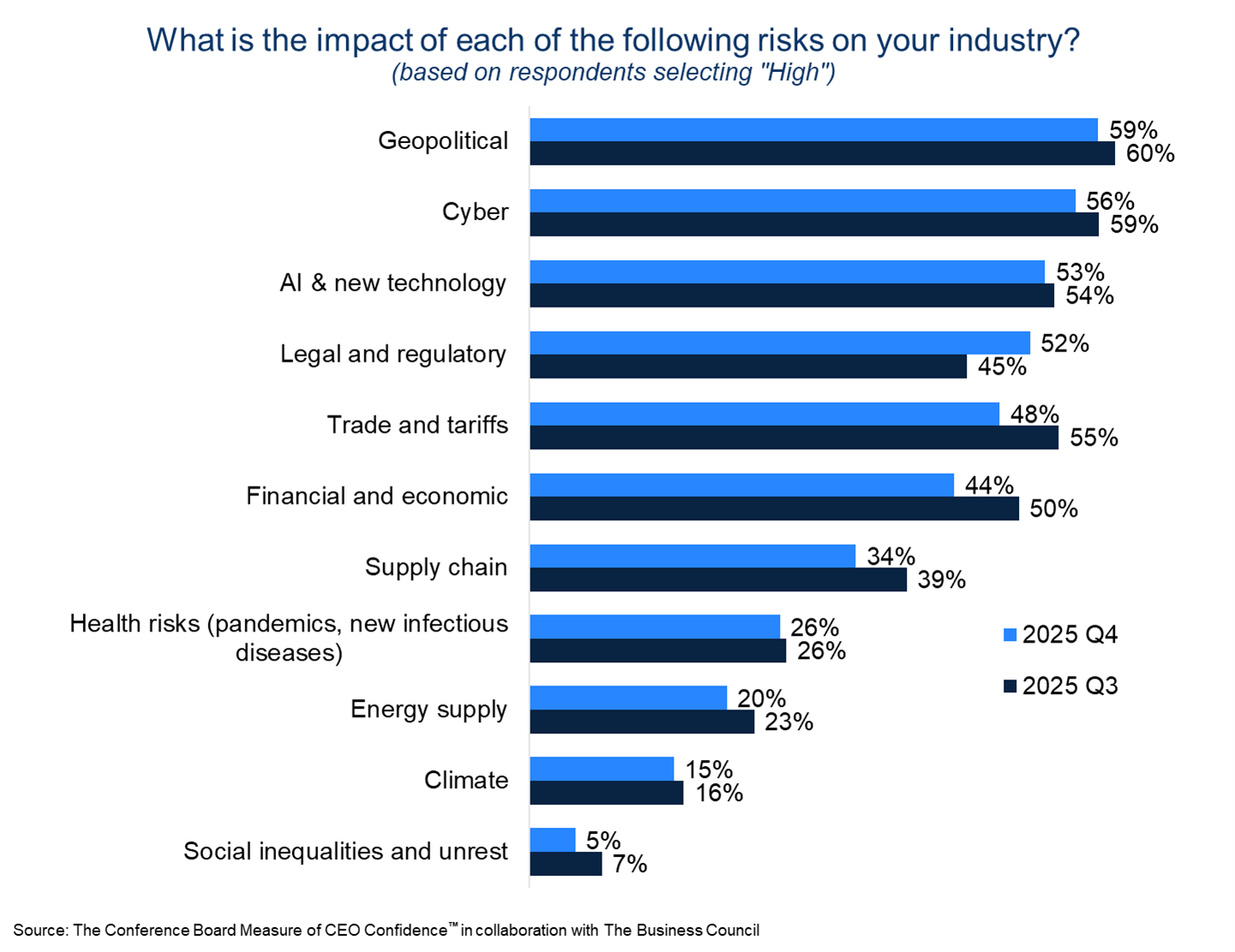

“CEO confidence weakened slightly in the fourth quarter, signaling continued caution among leaders of large firms,” said Stephanie Guichard, Senior Economist, Global Indicators, The Conference Board. “CEOs’ views of general economic conditions now versus six months ago remained slightly negative while CEO’s six-month expectations for the economy turned from neutral to pessimistic. CEOs’ expectations for their own industry were stable, still showing cautious optimism. Meanwhile CEOs’ assessments of current conditions in their own industries—a measure not included in calculating the topline CEO Confidence measure—was slightly less negative. Over the next 12-18 months, most CEOs (64%) expected a mild economic slowdown with slightly increased inflation pressure. Only 4% expected a recession. Geopolitical instability and cyber risks continued to dominate top business risks impacting CEOs’ industries, closely followed by AI and innovation. Meanwhile, trade and tariffs risks were pushed down to fifth place by legal and regulatory risks.”

“Despite slightly weaker confidence, businesses investment and hiring plans strengthened marginally,” said Roger W. Ferguson, Jr., Vice Chairman of The Business Council and Chair Emeritus of The Conference Board. “As in recent quarters, most CEOs indicated no revisions to their capital spending plans over the next 12 months. However, the share of CEOs expecting to cut back investment plans declined slightly while the share of CEOs revising up their investment plans increased notably. Meanwhile, the share of CEOs planning some reduction in the size of their workforce over the next 12 months declined for the first time since Q2 2024 and was below the share planning some expansion. Plans for wage increases moderated slightly. Difficulty finding qualified workers continued to ease.”

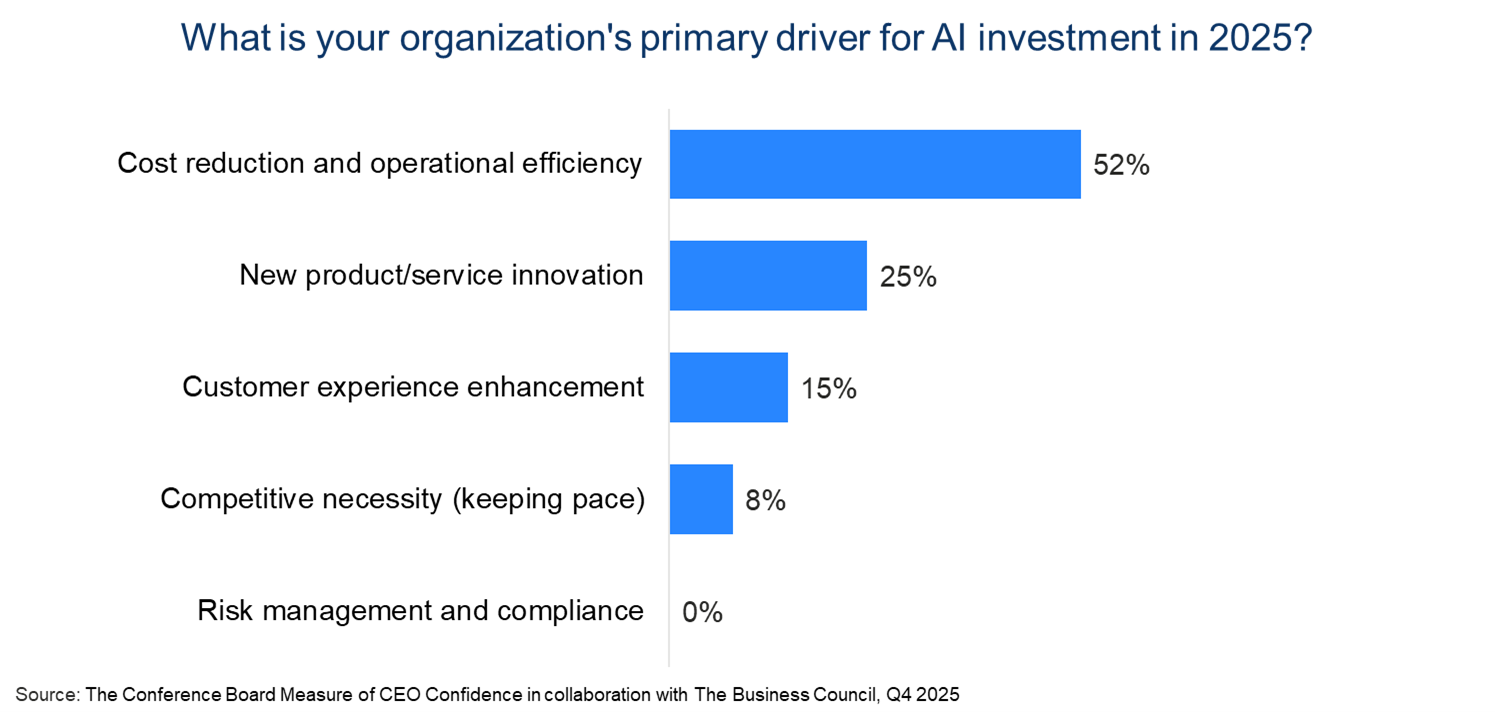

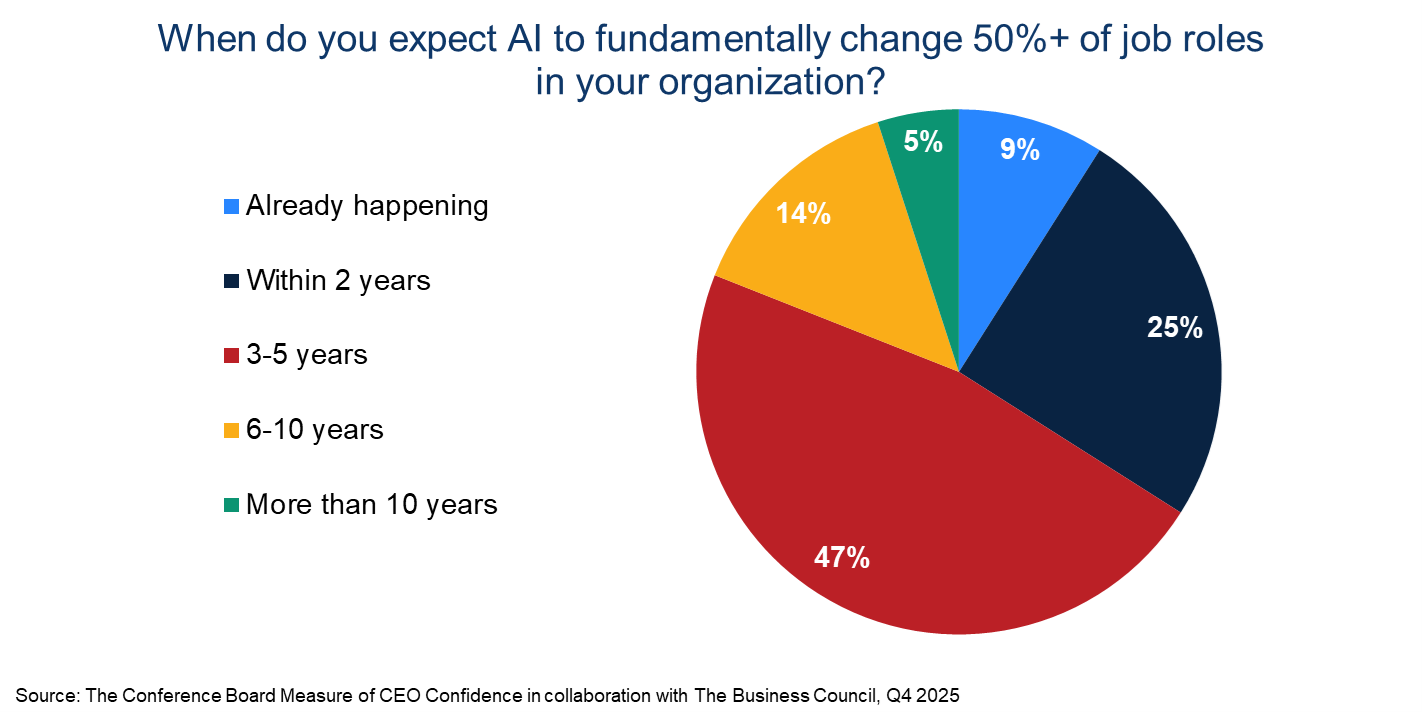

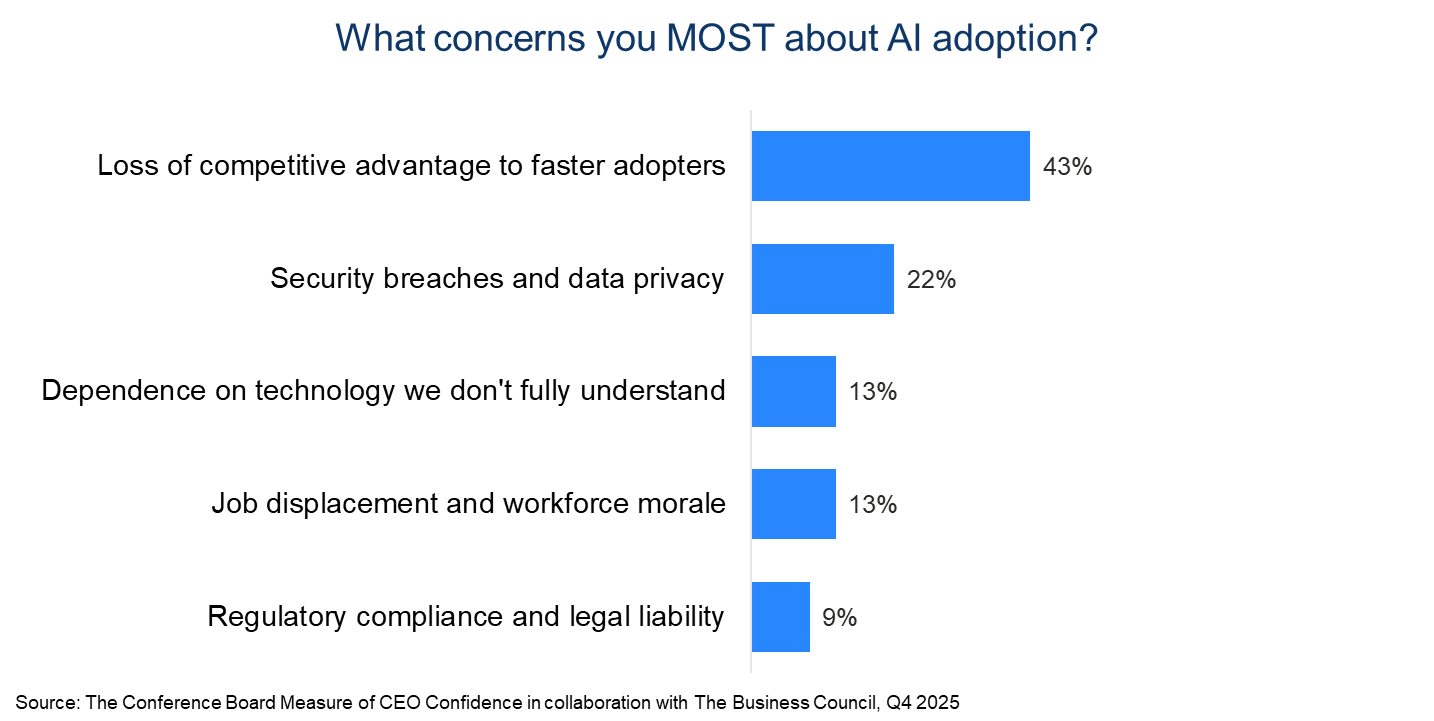

Ferguson continued: “Asked about their primary drivers for AI investment, most CEOs mentioned cost reduction and operational efficiency (52%), followed by new production and services (25%). The top concern regarding AI adoption was losing competitive advantage vis-à-vis early adopters (43%). Most CEOs responding to the survey expected AI to fundamentally transform over 50% of the job roles in their organization in the next 5 years. Notably, 9% thought it was already happening, 25% expected this transformation to happen within the next 2 years, and about half predicted 3 to 5 years from now.”

Current Conditions

CEOs’ assessment of general economic conditions weakened slightly in Q4 2025:

- 37% of CEOs said economic conditions were worse than six months ago, up from 34% in Q3.

- 20% said economic conditions were better, down from 22%.

CEOs’ assessments of conditions in their own industries improved in Q4:

- 38% of CEOs said conditions in their own industries were worse than six months ago, unchanged from Q3.

- 29% said conditions in their own industries were better, up from 18%.

Future Conditions

CEOs’ expectations about the short-term economic outlook turned negative in Q4.

- 38% of CEOs expected economic conditions to worsen over the next six months, up from 30% in Q3.

- 24% expected economic conditions to improve, down from 30%.

CEOs’ expectations for short-term prospects in their own industries were unchanged in Q4:

- 28% of CEOs expected conditions in their own industry to worsen over the next six months, up from 25%.

- However, 33% expected conditions in their own industry to improve, up from 30% in Q3.

Employment, Recruiting, Wages, and Capital Spending

- Employment: The share of CEOs planning to expand their workforce rose to 32% from 27%, while 39% of CEOs planned to maintain the size of their workforce, the same share as Q3. Meanwhile, 29% of CEOs expected a net reduction in their workforce over the next 12 months, down from 34% in Q3.

- Hiring Qualified People: Most CEOs continued to report no problemsinhiring overall, and the share of CEOs reporting trouble hiring in key areas eased.

- Wages: 50% of CEOs planned to increase salaries by 3.0–3.9% over the next 12 months and overall pay plans slightly moderated.

- Capital Spending: The share of CEOs expecting to increase capital spending increased strongly —to 22% in Q4 from 15% in Q3. Meanwhile, 20% of CEOs expected to revise spending plans downward. Most CEOs (57%) indicated no plans to revise capital spending.

US Recession:

Most CEOs expected a mild economic slowdown with slightly increased inflation pressure

Industry Risks:

CEOs ranked geopolitical, cyber, and AI & new technology risks as top concerns for their industry

AI Adoption: Drivers:

Cost reduction and operational efficiency was the primary driver for AI investment for most CEOs

AI Adoption: Speed of Influence on Job Roles:

81% of CEOs expected AI to fundamentally change most job roles in their organization within 5 years

AI Adoption: Concerns:

The top concern regarding AI adoption was losing competitive advantage vis-à-vis early adopters

About The Conference Board

The Conference Board is the member-driven think tank that delivers Trusted Insights for What's Ahead®. Founded in 1916, we are a non-partisan, not-for-profit entity holding 501 (c) (3) tax-exempt status in the United States. TCB.org

About The Business Council

The Business Council is a forum for the CEOs of the world’s largest multinational corporations across all industry sectors. Members gather several times each year to share best practices, network and engage in intellectually provocative, enlightening discussions with peers and thought-leaders in business, government, academia, science, technology and other disciplines. Through the medium of discussion, the Council seeks to foster greater understanding of the major opportunities and challenges facing business, and to create consensus for solutions. The Business Council is a non-partisan, not-for-profit entity holding 501 (c) (6) tax-exempt status. The Business Council does not lobby. Visit The Business Council’s website at www.thebusinesscouncil.org