For Release 9:30 AM ET, August 20, 2025

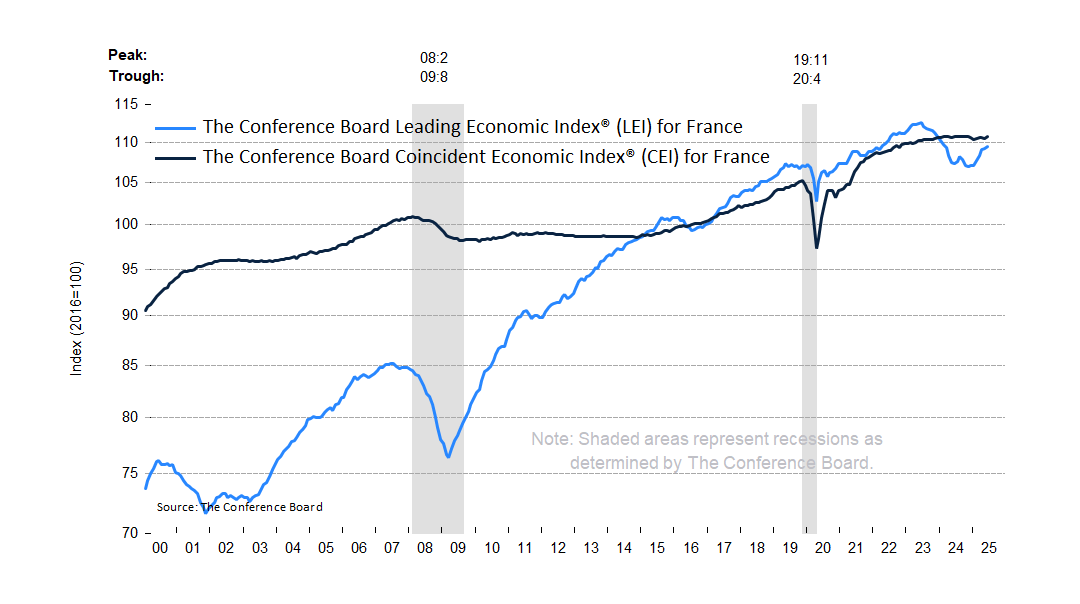

Using the Composite Indexes: The Leading Economic Index (LEI) provides an early indication of significant turning points in the business cycle and where the economy is heading in the near term. The Coincident Economic Index (CEI) provides an indication of the current state of the economy. Additional details are below.

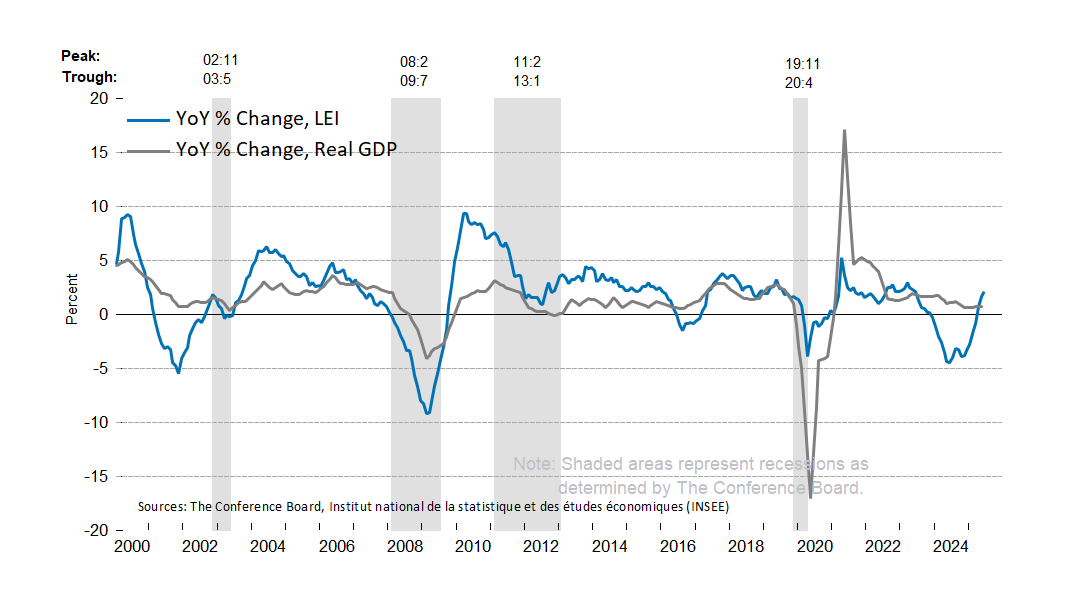

The Conference Board Leading Economic Index® (LEI) for France rose by 0.3% in June 2025 to 109.5 (2016=100), after a marginal increase of 0.1% in May. Overall, the France LEI grew by 2.2% over the first half of 2025, a turnaround from the decline of 0.3% over the second half of 2024.

The Conference Board Coincident Economic Index® (CEI) for France also rose by 0.3% to 110.8 (2016=100) in June 2025, after inching down by 0.1% in May. Over the first half of this year, the CEI for France increased by 0.2%, a reversal of the 0.1% contraction over the previous six-month period, from June to December 2024.

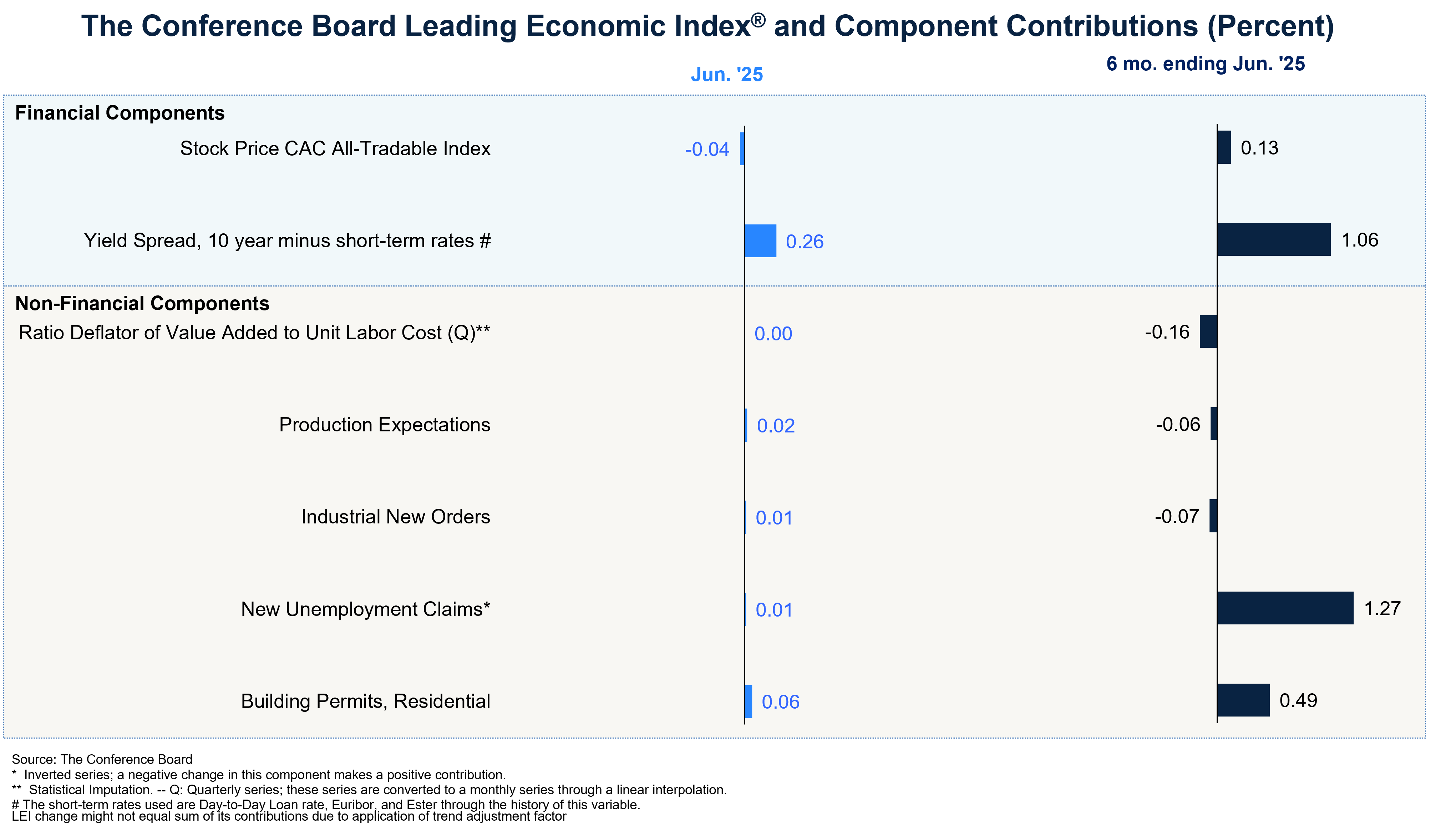

“The France LEI continued to increase in June,” said Allen Li, Associate Economist at The Conference Board. “The positive yield spread led the LEI improvement. Most other components of the Index made a small positive contribution in June, except for the stock market which pulled back slightly. The 6-month and annual growth rates of the France LEI turned positive in recent months and have continued to improve, signaling a more supportive economic environment . Still, political instability, fiscal pressures, and US tariffs on imports from the EU will continue to weigh on the economic outlook. Following the stronger than expected Q2, the Conference Board has upgraded its forecast for France’s GDP growth in 2025 to 0.6%, from 0.4%, which is still a slowdown from the 1.1% growth in 2024.”

The next release is scheduled for Wednesday, September 17, 2025, at 9:30 A.M. ET.

NOTE: The chart illustrates the so-called 3Ds—duration, depth, and diffusion—for interpreting a downward movement in the LEI. Duration refers to how long the decline has lasted. Depth denotes the size of decline. Duration and depth are measured by the rate of change of the index over the most recent six months at an annualized rate. Diffusion is a measure of how widespread the decline is among the LEI’s component indicators—on a scale of 0 to 100, a diffusion index reading below 50 indicates most components are weakening.

The 3Ds rule signals an impending recession when: 1) the six-month diffusion index lies at or below 50, shown by the black warning signal lines in the chart; and 2) the LEI’s six-month growth rate (annualized) falls below the threshold of −2.4%. The red recession signal lines indicate months when both criteria are met simultaneously—and thus that a recession is likely imminent or underway.

About The Conference Board Leading Economic Index® (LEI) and Coincident Economic Index® (CEI) for France

The composite economic indexes are key elements in an analytic system designed to signal peaks and troughs in the business cycle. Comprised of multiple independent indicators, the indexes are constructed to summarize and reveal common turning points in the economy in a clearer and more convincing manner than any individual component.

The CEI reflects current economic conditions and is highly correlated with real GDP. The LEI is a predictive tool that anticipates—or “leads”—turning points in the business cycle by around seven months.

The seven components of Leading Economic Index® for France are:

The four components of the Coincident Economic Index® for France are:

To access data, please visit: https://data-central.conference-board.org

About The Conference Board

The Conference Board is the member-driven think tank that delivers Trusted Insights for What’s Ahead®. Founded in 1916, we are a non-partisan, not-for-profit entity holding 501 (c) (3) tax-exempt status in the United States. ConferenceBoard.org

PRESS RELEASE

LEI for Mexico Increased Again in July

August 20, 2025

PRESS RELEASE

LEI for the Euro Area Decreased in July

August 19, 2025

PRESS RELEASE

LEI for Brazil Decreased Again in July

August 15, 2025

PRESS RELEASE

LEI for the UK Continued to Fall in June

August 14, 2025

PRESS RELEASE

LEI for Australia Increased Again in June

August 14, 2025

PRESS RELEASE

The LEI for Germany Flat in June

August 13, 2025

All release times displayed are Eastern Time

Business & Economics Portfolio

July 03, 2025 | Database

The Economy Stabilized in August but Outlook Remains Weak

September 27, 2023 | Report

China's Economic Recovery Continues to Stutter (Economy Watch: China View, June 2023)

June 30, 2023 | Report

Leading Economic Indicators and the Oncoming Recession

December 07, 2022 | Report

The Evolving Economic Outlook for Europe

July 10, 2024

Is a Global Recession on the Horizon?

July 13, 2022