Boards in industries beyond oil and gas, industrial, and utilities are increasingly asking about climate at their companies. They’re right to ask. Even as the COVID-19 pandemic and other crises have increased the focus on social issues, climate has remained front and center for many investors, regulators, customers, and employees.[1] Indeed, the number of environmental proposals filed and voted on at US companies increased from 2020 to 2021, and fully 70 percent of all filed proposals concerned climate—an increase from 61 percent in 2020. Moreover, average support for climate-related proposals rose from 33 percent in 2020 to 49 percent in 2021.[2] “Say-on-climate” proposals—which call for companies to conduct an advisory shareholder vote on the firm’s climate strategy—grew in both number and support, with some even passing in 2021, and boards can expect even more such proposals in 2022. Outside the US, investor alliances are proliferating (e.g., Asia Investor Group on Climate Change, The Institutional Investors Group on Climate Change); they are urging companies to set science-based emissions reduction targets and disclose their strategies for dealing with the impact of climate change, including climate change risks in their financial statements.

In light of this unrelenting attention, this essay suggests five relatively straightforward questions that directors at any company can pose to their management team—and that management should be prepared to answer.

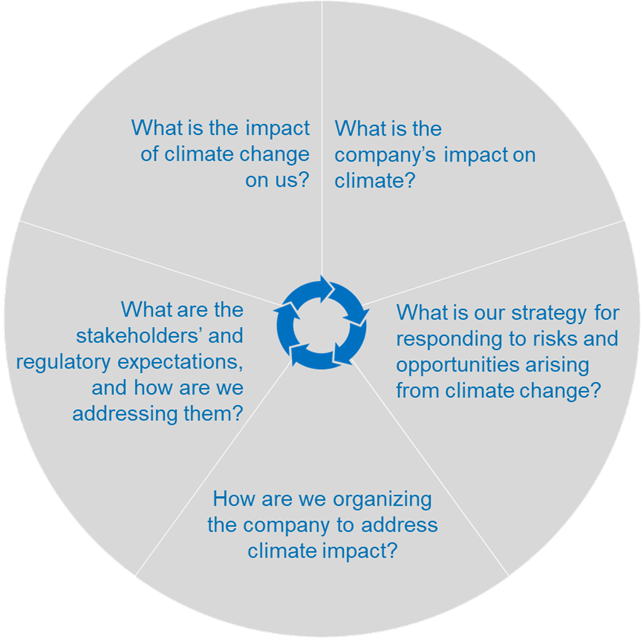

Key Questions Boards Should Ask Their Companies About Climate Change

Source: The Conference Board

1. What is the impact of climate change on us?

A director’s instinct may be first to ask, “What impact does the company have on climate change?” And if the answer from management is “not much,” directors may naturally turn their attention to more pressing matters.

We would therefore suggest that the first question a board should ask is the more universally applicable one: “What impact is climate change likely to have on the company?” The answer from management should cover the potential impact on the company’s own operations, costs, and revenues; upstream suppliers, business partners, and downstream customers; the company’s employees and communities; and the laws and regulations under which the company operates. Moreover, the analysis should look at the interconnections between climate and other issues, such as employee health.[3]

In particular, boards should ask about the impact not just of climate change itself, but of the steps to mitigate it. This impact is likely to include increased costs associated with energy prices; replacement of equipment; and new taxation, disclosure, and regulatory regimes, as well as broader changes in financial markets.

Energy Transition Costs: Risks and Opportunities

The greening of the global economy has material short-term downside risks for the growth of financial markets and businesses, but also potential for long-term benefits once the transition is complete.

The global economy is already beginning to grapple with the transition costs related to shifting consumption and production away from fossil fuels toward renewables. Oil and natural gas prices are rising as energy companies’ divestiture from fossil fuels mining runs headlong into rising demand for limited renewable energy supplies. As the march toward renewables gathers steam, equipment, machinery, and structures that relied on fossil fuels will be rendered obsolete, requiring new investments that come at a cost. For example, businesses will need to transition to modes of transporting goods with zero-carbon emissions or reoutfit facilities with windows that help better regulate the internal atmosphere. Meanwhile, consumers will need to purchase electric vehicles and swap out old boilers used to heat their homes. To hasten the transition, governments are expected to erect regulatory and tax regimes to drive this transition toward renewables. Compliance with these regimes will require major changes to business models for some firms, just as noncompliance will be met with punitive costs. As the world shifts to an environment that thrives on renewables, jobs that relied on the production of fossil fuels and the maintenance of other goods and services that depend on fossil fuels will be invariably lost. These lost jobs mean firms will have to play a role in reskilling affected workers to sustain labor market dynamism and foster consumer-driven contributions to real economic growth.

Arguments over the causes of climate change notwithstanding, there is broad-based evidence of rising costs related to not making the energy transition. Natural disasters disproportionately affect lower-income nations lacking resources to recover from such disasters and also the poorest within those nations, who are often domiciled in the regions most vulnerable to natural disasters or in the housing types least able to withstand disasters. Even in wealthier nations, the effects of weather events and flooding linked to climate change inflict significant damage on household balance sheets in the immediate wake of events, disrupt businesses’ supply chain networks, and place a strain on financial institutions tasked with insuring losses. Meanwhile, governments are finding their regional infrastructures to be woefully inadequate to weather environmental disasters, hastening the need to rebuild and replace often already crumbling infrastructure.

Climate change related to the use of fossil fuels also presents physical and transition risks for the financial sector. According to Kevin Stiroh of the US Federal Reserve, the financial risks from climate change include “the impairment of collateral due to severe weather events, mark-to-market losses from the devaluation of companies with stranded assets, stress to contractual cash flows as regional shocks are realized, or the reduced provision of financial services as business strategies adapt.”[4] According to the IMF, climate change affects the financial system through two channels: physical risks (arising from damage to property, infrastructure, and land) and transition risks “that could impact the safety and soundness of individual financial institutions and have broader financial stability implications for the banking system.” Transition risks result from changes in climate policy, technology, and consumer and market sentiment during the adjustment to a lower-carbon economy.[5] Still, these transition costs might be equated to growing pains associated with achieving the greater goal of shifting to a less harmful mode of production and living.

The short-term downsides notwithstanding, there is significant upside to the green transition over the longer run. Foremost, the ultimate transition to renewable energy sources and reduction of activities contributing to climate change should result in reduced environmental impacts that hamper business output and diminish consumer well-being today. Businesses can directly invest in the technology and structures required to produce renewables. There will be opportunities for firms to help construct and monitor regimes designed to help with the transition, including carbon capture and repurposing. Businesses can align themselves with projects to retrofit machinery and buildings, and to build smart and clean cities and other infrastructure (e.g., charging stations and electric grids) to help support a more environmentally friendly world. Importantly, these efforts should create new jobs to both build and sustain the greening. There will also be space for financial firms to help fund the transition. Climate change finance as sustainable investing had a global asset size in the range of US$3 trillion to US$31 trillion prepandemic and is destined to grow.[6]

Everyone has a role to play in the transition and establishment of a greener economy. As climate change and climate policies have material implications for macroeconomic variables, including interest rates, prices, output, and labor markets, look for central banks to incorporate climate risks into monetary policy analysis and execution, including considering whether the entities presenting collateral to or providing assets for purchase by central banks have been stress-tested for climate-related financial risks. Also expect credit intermediaries to incorporate climate-related risk into their financial risk management.[7] At the same time, expect government regulators and international organizations to work toward standardizing rules and data so that firms can adequately disclose and manage climate risks to financial management, and facilitate limited disruptions to economies from policies aimed at mitigating climate change–related risks.[8]

2. What is the company’s impact on climate?

To ensure long-term resilience, of course, boards should also understand the potential impact that their company can have on climate. Ideally, boards should encourage their management to assess and understand the impact that not only their own operations but also those of their full value chain have on climate. CDP, an international nonprofit organization that helps companies disclose their environmental impact, notes that the supply chain operational footprint is on average 5.5 times larger than the company’s own.[9]

Scope 1, 2, and 3 Emissions

Greenhouse gases are categorized into three groups or “scopes” by the Greenhouse Gas Protocol, the most widely used international accounting standard:

- Scope 1 covers direct emissions from owned or controlled sources (e.g., company fleet).

- Scope 2 covers indirect emissions from the generation of purchased electricity, steam, heating, and cooling consumed by the reporting company (e.g., energy use in offices, factories, etc.).

- Scope 3 includes all other indirect emissions that occur in a company’s value chain, including emissions from purchased goods, in-use emissions by clients/consumers, and business travel.

| |

Understanding the risks and opportunities can allow the board to help management take early action to mitigate risks, maximize opportunities, and create a strategy to effectively deal with the transition to a low-carbon economy.

|

|

3. What is our strategy for responding to risks and opportunities arising from climate change?

While many companies tend to focus on the physical effects of climate (e.g., more frequent or severe weather events) and transition costs (e.g., increased expenses due to climate tax), climate impact should be explored in terms of both risks and opportunities.

Climate change, for some, will bring opportunities to unlock innovation and increase value to shareholders and other stakeholders.[10] Boards may want to ask management teams how they wish to position the business to tap into the opportunities that come from the changing external environment directly due to climate change and to the steps that governments and the private sector are taking to mitigate climate change. The latter, in particular, may open up new markets and product lines.

Understanding the risks and opportunities can allow the board to help management take early action to mitigate risks, maximize opportunities, and create a strategy to effectively deal with the transition to a low-carbon economy.

But what should a board expect management to include in a “climate strategy”? As a first step, companies need to understand climate-related risks and opportunities. Frameworks such as the Taskforce on Climate-related Financial Disclosure (TCFD) provide a comprehensive categorization of climate-related risks and opportunities and can help a company understand where their business and climate interact. Companies can use this information to develop their strategy to manage these risks, as well as tap into the economic opportunities that a low-climate economy could bring. Subsequently, companies should seek to set science-based targets and work toward implementing an internal carbon price.

Importantly, boards should ask management teams about the process they are using to set goals and the action plan to realize those goals. While many companies have set ambitious climate targets, not all put a lot of substance behind those commitments,[11] possibly because many companies’ climate strategy is not integrated with company strategy and capital expenditure plans. Companies should forgo stand-alone climate strategy and set ambitious short-, medium-, and long-term targets.

| |

The board has a key role in ensuring that its company integrates climate into broader company strategy and fosters a culture that supports strategy execution.

|

|

4. How are we organizing the company to address climate impact?

Directors should ask how management is structured to address climate issues. Boards should be comfortable that management has allocated sufficient resources, established reasonable organizational structures, and implemented appropriate processes for managing climate-related risks and opportunities.

The board should understand how climate factors into the company’s broader business strategy and should be involved in reviewing the firm’s climate, and more broadly, sustainability efforts. While most heads of sustainability meet at least once every other month with the C-suite, they have little or no access to the board: among US companies, 1 in 5 heads of sustainability never meet with the board.[12] As boards increasingly engage in companies’ ESG efforts, directors can benefit from direct access to the sustainability leader, and sustainability leaders can benefit from better understanding the company’s priorities and having greater credibility within the organization.

Directors should also consider how the board itself can be most effective in advancing the company’s efforts in this regard. Most boards outside carbon-intensive industries will probably not need a “climate expert,” but they should be conversant if not fluent in relevant climate-related matters in order to provide proper oversight. Boards should consider what kind of board education programs could help them in their role. The Conference Board has published a lexicon of essential climate terminology that may help boards in that endeavor.

Similarly, boards may not need a specific “climate” or “ESG” committee, or have dedicated reports focused only on climate, but they should ensure that the board’s governance documents and the reports it receives do cover all material sustainability issues.

The board should also consider whether the company’s executive compensation programs support its climate-related initiatives—and if so, how. But boards should proceed with caution here. Currently, 64 companies in the S&P 500 tie CEO compensation to climate-related goals, and they do so as part of the CEO’s individual performance assessment, as business strategy scorecards, and as stand-alone metrics.[13]

| |

Irrespective of how the board chooses to oversee climate change issues, individual and collective director fluency in climate issues is essential.

|

|

5. What are the stakeholders’ and regulatory expectations, and how are we addressing them?

The climate expectations of stakeholders (e.g., regulators, investors, customers, employees, and NGOs) are dynamic and evolving. Each of these groups has its own interests. For example, while regulators might place importance on embedding climate risk considerations into governance or developing an approach to climate risk disclosure, investors may be interested to understand the impact of climate change on current and future corporate financial performance. Irrespective of this divergence, it is safe to assume that stakeholders will put more demand on businesses for climate disclosure and action.

For example, the US Securities and Exchange Commissions (SEC) is very likely to propose new, specific disclosure requirements related to climate change issues before the end of 2021 or in early 2022. These requirements might include climate disclosure in Form 10-K securities filings, qualitative disclosures such as how company leaders manage climate-related risks and opportunities and how those feed into corporate strategy, and quantitative disclosures covering Scope 1 and Scope 2 emissions.

As part of the Green Deal and the interim Fit for 55 commitment (the EU’s 2030 target of at least 55 percent emissions reduction compared to 1990 levels), the EU will mandate climate reporting in line with the recommendations of the TCFD. More specifically, the proposed Corporate Sustainability Reporting Directive (CSRD), which would amend the existing reporting requirements under the Non-Financial Reporting Directive (NFRD), will seek to ensure that companies provide consistent and comparable sustainability information. Nonfinancial undertakings will also be required to identify and disclose whether their products contribute to climate change as part of the EU Taxonomy Climate Delegated Act.

| |

Boards can assume that momentum to bring down emissions will continue to grow and there will be further calls for corporate climate action.

|

|

Climate—and more broadly, ESG—disclosure regulation seems inevitable. The board should encourage its company to engage with policymakers and regulators to shape future regulations.[14] The board should receive regular updates from management on these developments, such as new disclosure requirements and shareholder resolutions that may come into play and affect the company’s response to climate change. For example, boards may want to closely follow the “say-on-climate” initiative.

Say on Climate (SoC)

Shareholders are calling on companies to hold annual “say-on-climate” (SoC) votes. The specific form of these SoC proposals varies by region and in specific details, but generally includes three requests: 1) provide an annual disclosure of emissions and progress on goals, 2) present the company’s strategic plan for reducing future emissions and managing climate-related risks, and 3) hold a shareholder vote on the company’s climate plan or report at the annual general meeting.

As of June 2021, only 32 companies have submitted (or plan to submit) a SoC proposal for a shareholder vote, but the campaign to encourage SoC votes has gained considerable attention in the UK, continental Europe, and the US.[15] In 2021, shareholders at US companies filed 19 proposals asking firms to hold a SoC vote, up from two in 2020. Even though these proposals are a relatively recent phenomenon, the proposals that went to a vote received average support of 46 percent—and two passed.

Lastly, the board should ask management how it is engaging other stakeholders—beyond investors—on climate-related issues. Shareholder engagement strategies in the form of periodic in-depth meetings between investors, board members, and management are well established. But this may not be the case for other stakeholder groups. While some stakeholders (e.g., business partners, regulators, etc.) might prefer formal communication, others (e.g., customers, community, etc.) might prefer to engage through public channels, including social media. While companies cannot plan for every eventuality, the board should encourage management to look ahead—and implement processes for identifying emerging trends with different stakeholder groups.

| |

Corporate climate action is not all about big investments. Companies can start their climate program by seeking to understand the risks and opportunities of a changing climate, measuring their footprint comprehensively, reducing emissions through efficiency and innovation, and reporting on their progress.

|

|

Climate change issues are complex and evolving; there is no one right course for companies to take. The board, primarily through its oversight and advisory roles, can help ensure that management meaningfully integrates climate change issues into company strategy. Even if companies do not have a significant direct impact on climate, they may have one through their broader value chain; as such, every company should consider how climate change and the costs associated with mitigation can affect the organization. Whether due to growing regulatory pressure[16] or rising consumer concerns about climate,[17] a robust climate strategy and action plan can be a competitive advantage for an organization.

[6] IMF, “Climate Change and Financial Risk.”

[8] IMF, “Climate Change and Financial Risk.”

[15] Anna Hirai, Isabella Champion-Sinclair, and Ali Saribas, “What’s Been Said on Climate,” SquareWell Partners, June 2021.