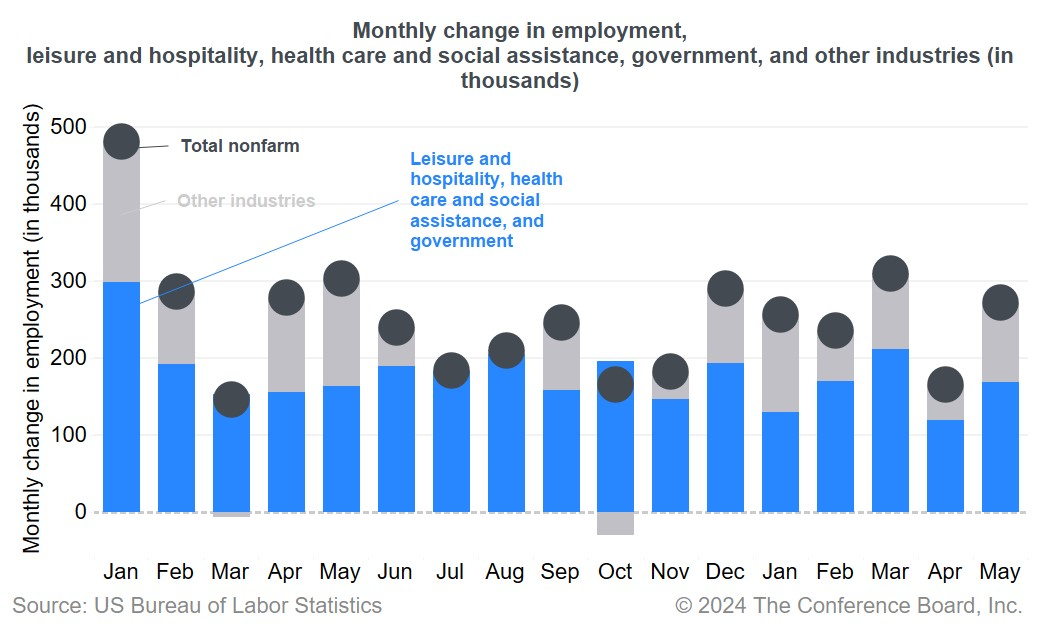

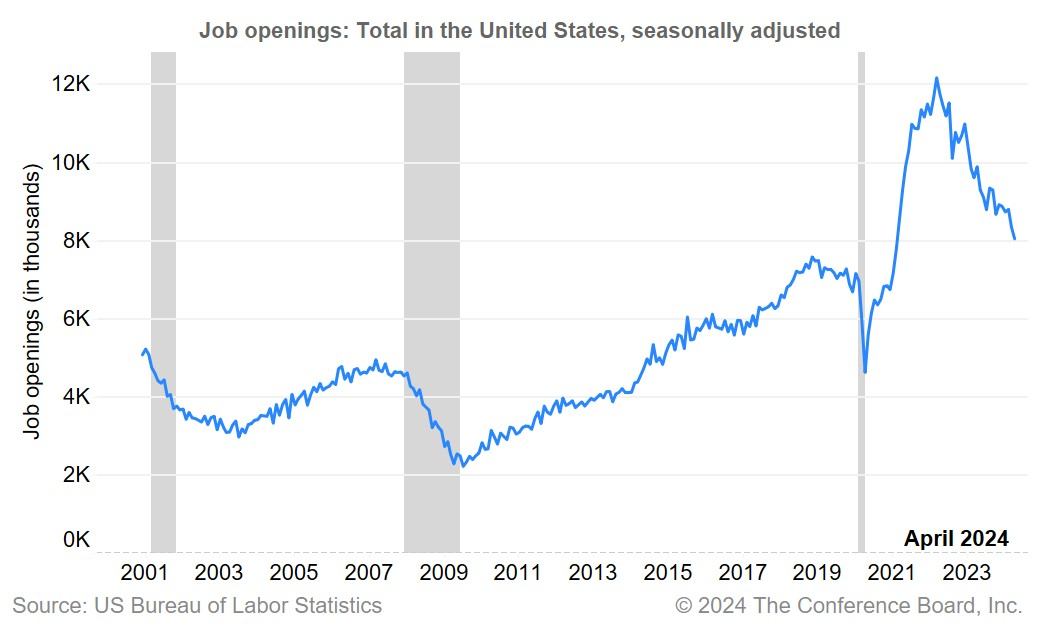

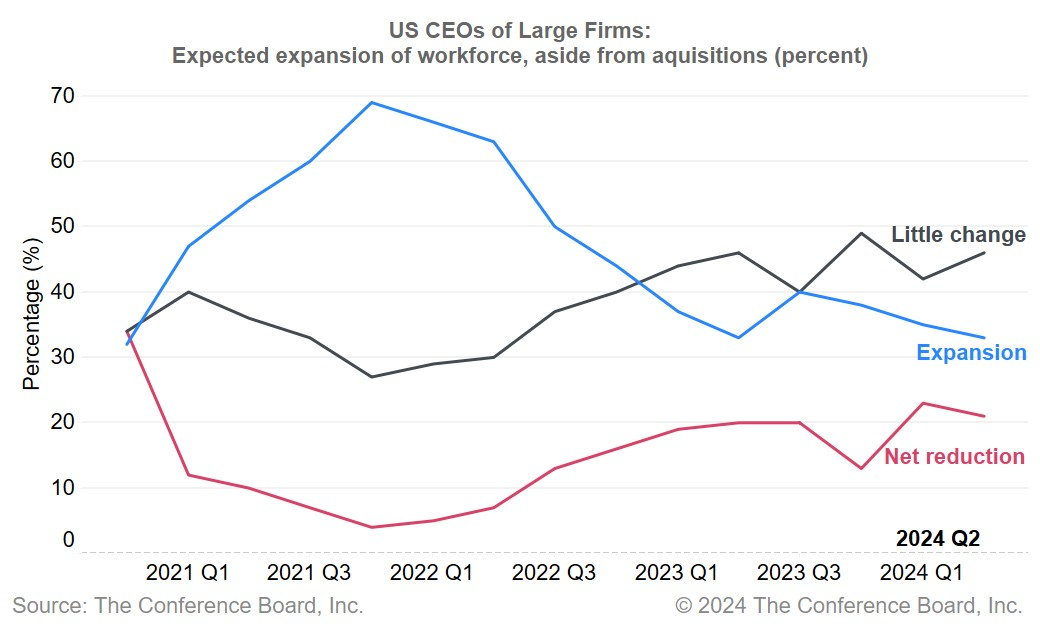

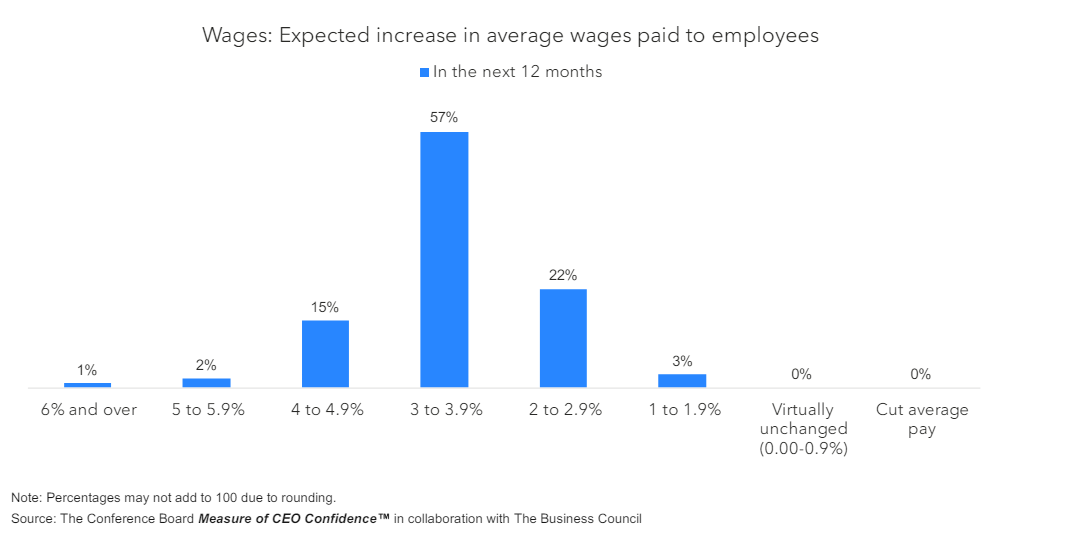

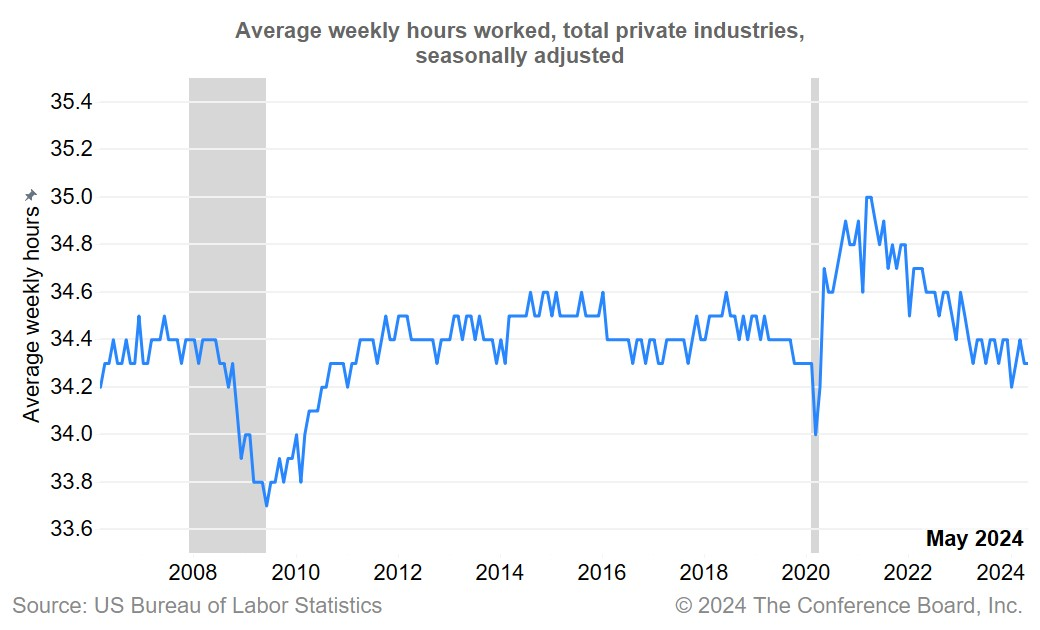

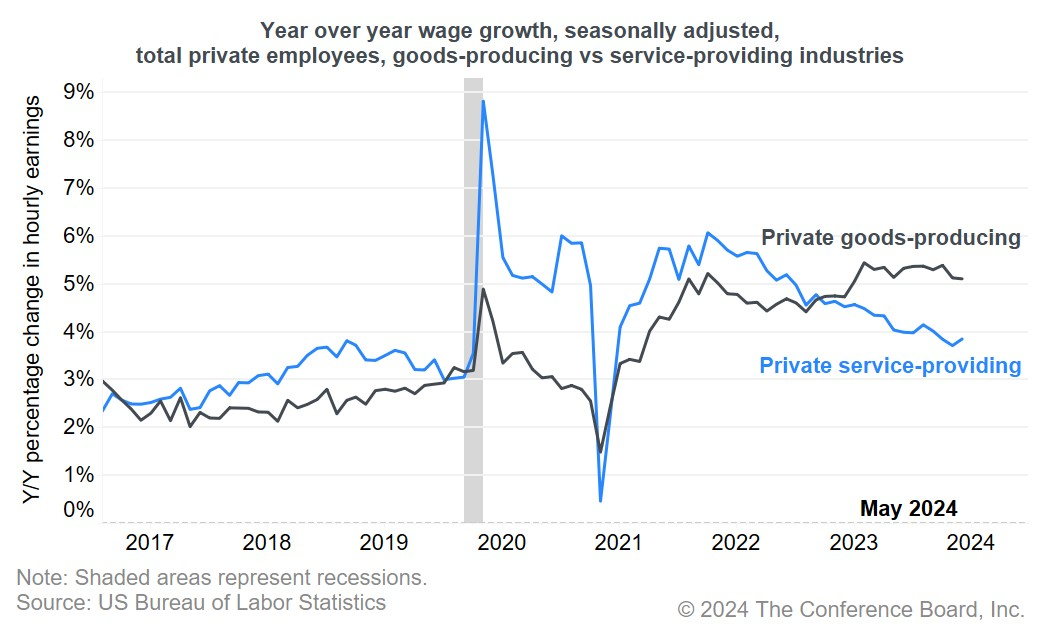

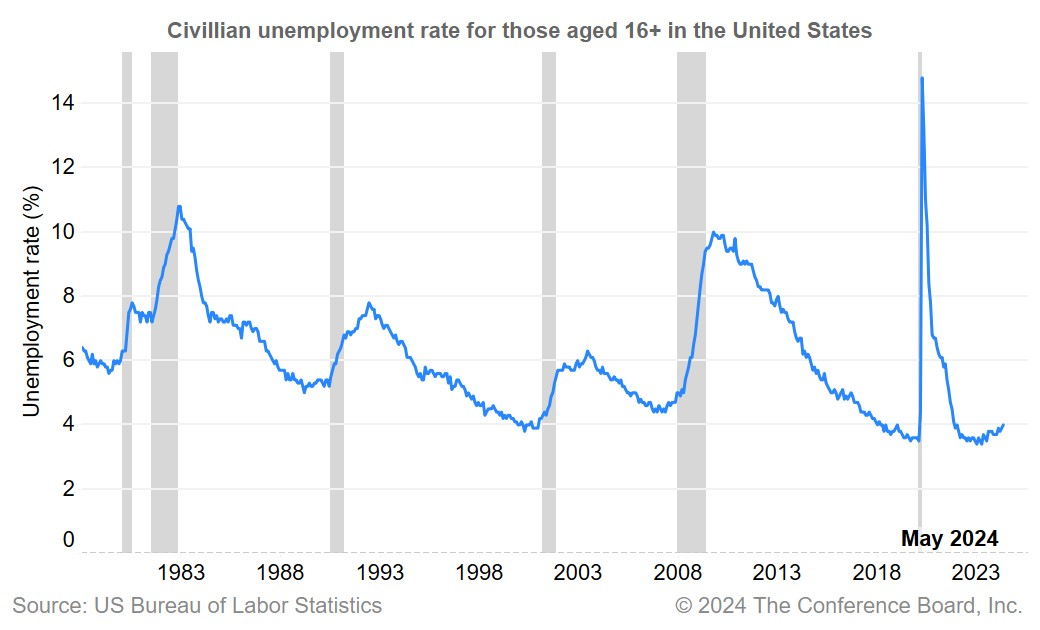

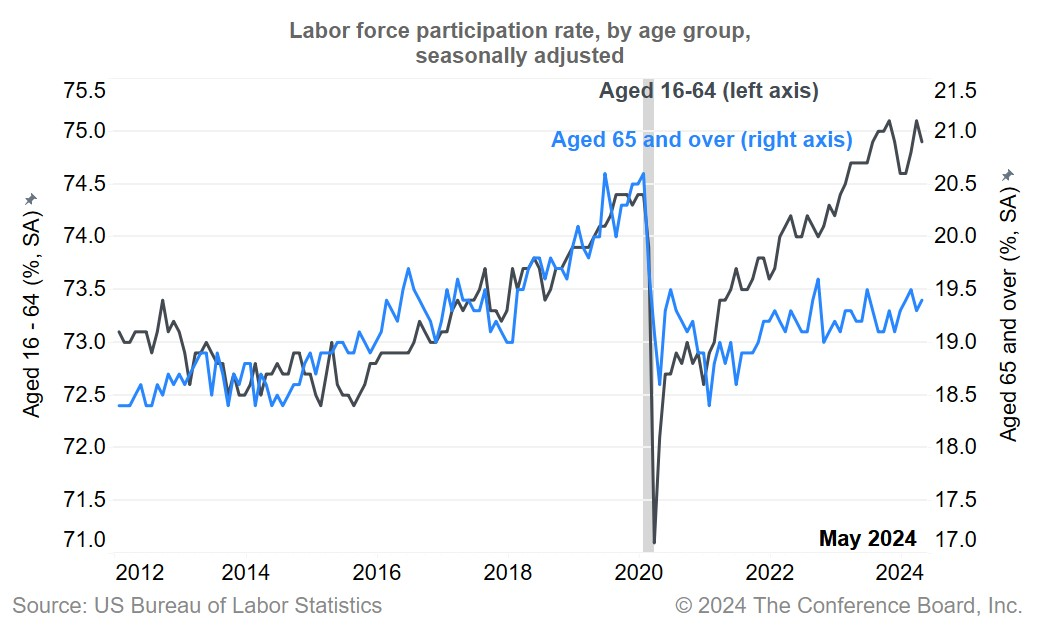

Job gains were outsized in May reflecting additions in most industries, while the unemployment rate ticked up a tenth of a percentage point to 4.0 percent. The slight rise in the jobless rate notwithstanding, the US labor market is quite healthy with most persons desiring to work doing so. Indeed, aggregate hours worked, which can signal labor market stress, have been stable, confirming that the labor market is still in good shape. However, wage growth picked up complicating the Fed’s work to subdue inflation. Trusted Insights for What’s Ahead® Figure 1. Nonfarm Payroll Employment spiked higher in May Jobs Report Suggests Higher-for-Longer Rates Nonfarm payrolls rose by a sizable 272,000 in May following a downwardly revised increase of 165,000 in April. May additions were driven by the usual suspects, but there were small gains across most other industries. While most sectors have made up for the losses in workers during the pandemic, most hires now are either incremental to maintain appropriate levels and/or due to labor shortages, especially among sectors requiring in-person workers. The ongoing retreat in the JOLTs job opening aggregate supports this view. Figure 2. Job openings are steadily falling as firms stabilize labor forces Meanwhile, layoffs are few as jobless claims remain near historical lows. Indeed, executives of the largest firms, according to our CEO Confidence Survey for the US, still mainly prefer to hold onto workers even amid signs of slowing in the broader economy. Real GDP growth is slowing as consumer spending growth decelerates with excess savings now depleted, debt rising, and elevated prices and interest rates curbing purchasing power. However, as long as companies hoard workers in the face of Baby Boomer retirements, the unemployment rate probably will only tick up modestly over the course of this year (to 4.2 percent) and to a level that is still near historical lows. Figure 3. Most CEOs of large firms prefer to retain workers The Fed likely will view weaker consumer spending, but a relatively healthy labor market constructively. However, wage growth at 4.1 percent year-over-year remains elevated compared to the period between the Great Financial Crisis and the pandemic and continues to contribute to faster services inflation. CEOs of the largest firms plan to continue to raise wages considerably over the course of the next year. The upward pressure on consumer prices from wage growth likely will continue to make “the last mile” to the Fed’s 2-percent target a slog, suggesting interest rate cuts this year probably will be limited. We continue to anticipate just two 25 basis point cuts from the Fed in 2024, probably at the November and December meetings. Figure 4. CEOs of large firms plan to continue to increase wages over the next year No definitive evidence of end-of-college-school-year quirkiness Markets were anticipating some volatility in education workers and leisure and hospitality in May as college students left for the summer. However, we did not see a drop in private or local government education workers, and state education employment was flat following very small gains in recent months. Leisure and hospitality hiring increased in May 2024 by the most since October 2023. But the behavior did not seem odd compared to May readings in prior years, even before the pandemic. Other industries also add workers Even away from the “usual suspects,” most other sectors added workers. Material gains were evident in the construction (+21,000), nondurable goods manufacturing (+10,000), retail (+12,600), transportation (+10,600), finance (+10,000), and professional and business services excluding temporary help services (+19,000). No help wanted among pandemic darlings Unsurprisingly, payrolls were down or flat among the sectors that are doing poorly as the pandemic-era boom continues to fade. Weakness was reported among the durable goods manufacturing, information (i.e., tech), and temporary help services sectors. Consumers are no longer purchasing as many goods and have largely switched to services purchases. The tech sector, while reporting strong revenues, appears to have rightsized its labor force after a surge in hiring during the pandemic. Temporary help services payrolls continued to decline as many companies are retaining existing workers or turning to automation. Hours signal healthy labor market Average weekly hours held steady at 34.3 hours, remaining in the range that has persisted since late 2022. Moreover, the recent range is on par with 2019 readings, just ahead of the pandemic. Typically, a decline in the average workweek signals slackening in the labor market. However with no evidence of reduced hours, the labor market is still holding up for hourly workers. Figure 5. The workweek remains stable, signaling healthy labor market fundamentals Wage growth remains sticky Average hourly wages rose by 0.4 percent month-over-month in May and picked up to 4.1 percent year-over-year. While wage growth has decelerated significantly since the peak of 5.9 percent year-over-year growth in March 2022, the rate continues to exceed the average of 2.5 percent year-over-year that prevailed between the Great Financial Crisis and the pandemic. It is also higher than the average 3 percent growth rate that prevailed in the years right before the pandemic. Goods wage growth continues to rise aggressively. Services wage growth has moderated but is still notably above prepandemic levels. Figure 6. Wage growth is still elevated for goods and services Unemployment rate ticks up but remains low The unemployment rate edged higher: from 3.9 percent in April to 4.0 percent in May. The rise reflected an increase in Household Survey unemployment (+157,000) and a large drop in employment (-408,000). We anticipated that the unemployment rate might rise in 2024, and likely will peak at 4.2 percent before yearend. Nonetheless, the May reading, as well as our forecast, suggests a jobless rate near historical lows. The Fed would likely not see a 4.2 percent unemployment rate as a signal of cratering in the labor market, but a signal of strength (and inflationary) whereby interest rates need to remain somewhat restrictive. The natural rate of unemployment?the rate of unemployment that is compatible with a steady inflation rate—is estimated to be 4.4 percent, according to the Congressional Budget Office. Additionally, the unemployment rate is likely to remain relatively subdued going forward because of labor shortages. Firms, stung by the difficulty of hiring workers during the pandemic and plagued by rising retirements now, are holding onto workers. Figure 7. The unemployment rate remains near historical lows Labor force participation keeps jobless rate low The labor force participation rate dipped to 62.5 percent as the rate for persons aged 16 to 64 declined. The rate for workers 65 and older rose. While the overall labor force participation rate remained close to post-pandemic highs, it is still well below the 2019 level. It is unlikely to quickly recover as the Baby Boomer generation continues to leave the labor market faster than younger generations can join. Lower participation will force companies to look for alternatives, including automation and AI to supplement labor or engage in new tactics to draw more potential workers from the sidelines. Figure 8. Baby Boomer retirements continue to weigh on labor force participation

Highlights

The usual suspects drive payrolls spike Total Nonfarm Payrolls, as reported in the Establishment Survey, spiked in May to an outsized 272,000 after slowing to a downwardly revised 165,000 in April. The surge in hiring in the month was on par with the sizable readings over much of the last six months. Health care and social assistance, once again led the charge, adding 83,500 workers. However, the government (+43,000) and leisure and hospitality (+42,000) sectors, which took a breather in April, roared back with a pick-up in hiring.

myTCB® Members get exclusive access to webcasts, publications, data and analysis, plus discounts to events.

Steady as She Goes Labor Market, Risks Remain

February 11, 2026

Vacancies Plunge, But Low Hire-Low Fire Equilibrium Persists

February 05, 2026

Steady Labor Market Allows Fed Pause

January 09, 2026

Rising Unemployment Augurs More Rate Cuts in 2026

December 16, 2025

Rising Unemployment to Dwarf Solid Payrolls in December FOMC Decision

November 20, 2025

BLS Revises 2024 Hiring, But Not the Labor Market Narrative

September 10, 2025