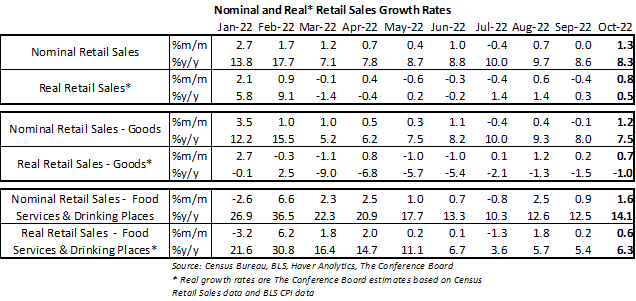

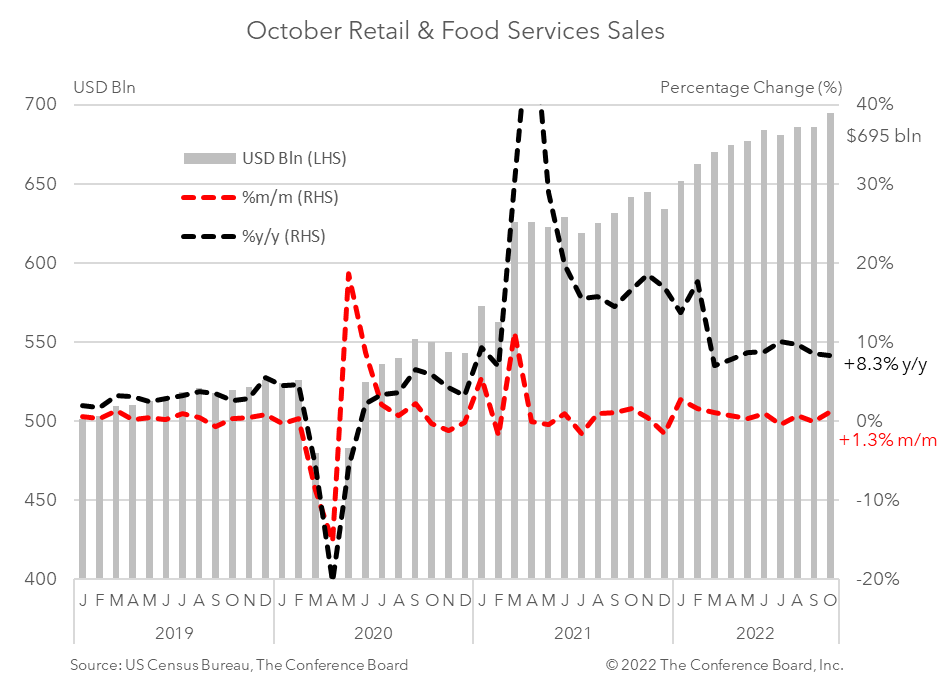

Retail sales were unexpectedly strong in October, rising 1.3 percent month-over-month and 8.3 percent from a year earlier in nominal terms. While gasoline sales led the increase, spending ticked up in many categories—including auto dealers, grocery stores and non-store retailers. Even when adjusted for inflation, sales were the strongest seen since February, rising 0.8 percent from the previous month.* It is unclear whether the spike is associated with early holiday shopping. Looking ahead, we do not expect this strength to continue as inflation and interest rates continue to weigh on consumers. Consumer demand for goods jumped in October—rising by 1.2 percent from the previous month in nominal terms. Spending on motor vehicles and parts rose by 1.3 percent in October from September, while retail sales excluding motor vehicles and parts rose by 1.2 percent. Spending at gasoline stations rose 4.1 percent for the month on higher crude oil prices. Retail sales less motor vehicles, gasoline, and building supplies (known as “Retail Control”) rose 0.7 percent from the previous month. Online sales at non-store retailers rose 1.2 percent in October. When adjusting goods spending for CPI inflation the real growth rate was about 0.7 percent from the previous month.* Meanwhile, spending at food services and drinking places rose by 1.6 percent month-over-month, vs. 0.9 percent in September. However, after adjusting for CPI inflation, the real growth rate rose by about 0.6 percent from the previous month.* * Real growth rates are The Conference Board estimates based on Census Retail Sales data and BLS CPI data

FOMC Reaction: US Economy In a Good Place, But Staying Vigilant

January 28, 2026

Fed January Decision: Pause or Full Stop?

January 27, 2026

November PCE: Are Consumers Spending Beyond Their Means?

January 22, 2026

Retail Sales Highlight Affordability Issues

January 14, 2026

No, Tamer CPI Does Not Mean Inflation Peaked

January 13, 2026

Exiting International Climate Pacts Will Leave The US Isolated

January 08, 2026