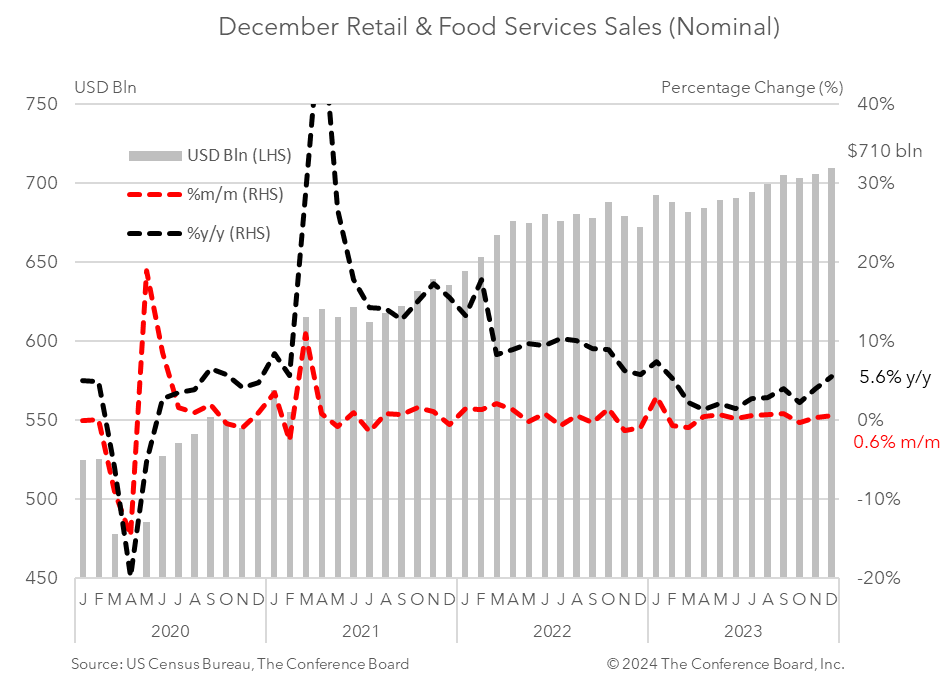

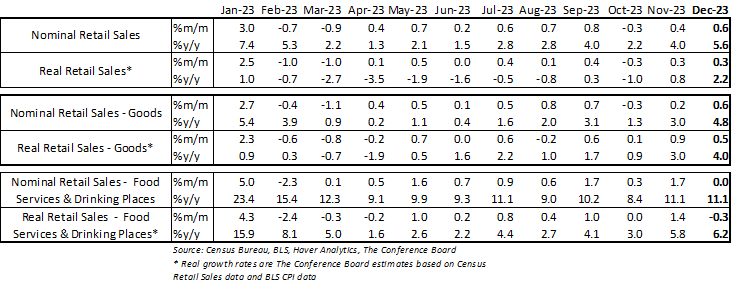

Retail sales were robust in December, closing out a year in which US consumer spending continually surprised to the upside. Retail spending rose by 0.6% m/m in December, vs. 0.4% m/m in November and a decrease of 0.3% m/m in October. After adjusting for inflation using CPI data, real December spending growth was up 0.3% from November.* Real retail sales were up 1.1 percent annualized in Q4 2023 compared to 3.2 percent annualized in Q3 2023. These data show that US consumers did not pull back on spending activity over the holiday period. While not quite as robust as spending over the summer, these data will help secure a healthy expansion in GDP in Q4 2023. Looking into 2024 we expect these data to cool as US consumers contend with high interest rates, elevated prices, rising debt, and falling savings. These headwinds to consumption coupled with a pullback in business investment associated with decades-high interest rates may tip the economy into a recession later this year. Regarding the drivers of retail sales this month: Consumer demand for goods rose 0.6% from the month prior in nominal terms. Spending on motor vehicles and parts rose by 1.1% in December from November, while retail sales excluding motor vehicles rose by 0.5%. Spending at gasoline stations fell 1.3% from the month prior due to further declines in oil prices. Retail sales less motor vehicles, gasoline, and building supplies (known as “Retail Control”) rose by 0.8% from the previous month. Nonstore retail sales rose 1.5% from the month prior and spending at department store rose 3.0%. When adjusting goods spending for CPI inflation, the real growth rate was about 0.5%.* Meanwhile, spending at food services and drinking places rose by 0.0% month-over-month in December. After adjusting for CPI inflation the real growth rate was about -0.3%.* * Real growth rates are The Conference Board estimates based on Census Retail Sales data and BLS CPI data.

Shutdown Aside, Growth Moderates Under Inflationary Pressures

February 20, 2026

January CPI Raises More Questions than Provides Answers

February 13, 2026

Lukewarm Holiday Shopping in 2025 Augurs Slower Spending in Q4

February 10, 2026

FOMC Reaction: US Economy In a Good Place, But Staying Vigilant

January 28, 2026

Fed January Decision: Pause or Full Stop?

January 27, 2026

November PCE: Are Consumers Spending Beyond Their Means?

January 22, 2026