Retail sales for December showed consumers continued to spend at a robust pace supported by solid growth in labor income amid a strong holiday shopping season.

However, a broadbased increase in retail spending may also reflect some stockpiling behavior ahead of potential trade wars, as consumers may foresee price increases if the proposed policies by the new administration are implemented. We expect consumer spending growth will decelerate later this year, albeit to a still solid pace.

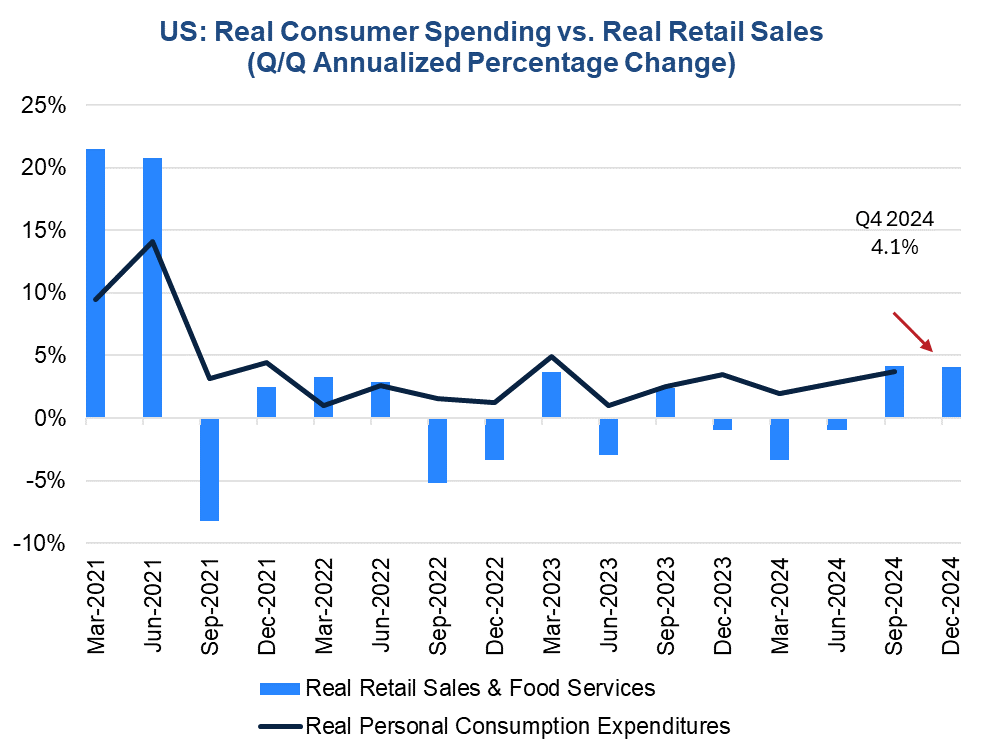

Real retail sales of goods and food and beverage services rose by 4.1 percent annualized in Q4, on par with the robust reading in Q3, boding very well for overall real consumer spending and real GDP growth in the quarter. We estimate annualized real GDP grew at a solid 2.5% in Q4 2024.

Figure 1. Real Retail Sales suggest strong Q3 real consumer spending

Sources: Census Bureau and The Conference Board.

myTCB® Members get exclusive access to webcasts, publications, data and analysis, plus discounts to events.

Shutdown Aside, Growth Moderates Under Inflationary Pressures

February 20, 2026

January CPI Raises More Questions than Provides Answers

February 13, 2026

Lukewarm Holiday Shopping in 2025 Augurs Slower Spending in Q4

February 10, 2026

FOMC Reaction: US Economy In a Good Place, But Staying Vigilant

January 28, 2026

Fed January Decision: Pause or Full Stop?

January 27, 2026

November PCE: Are Consumers Spending Beyond Their Means?

January 22, 2026