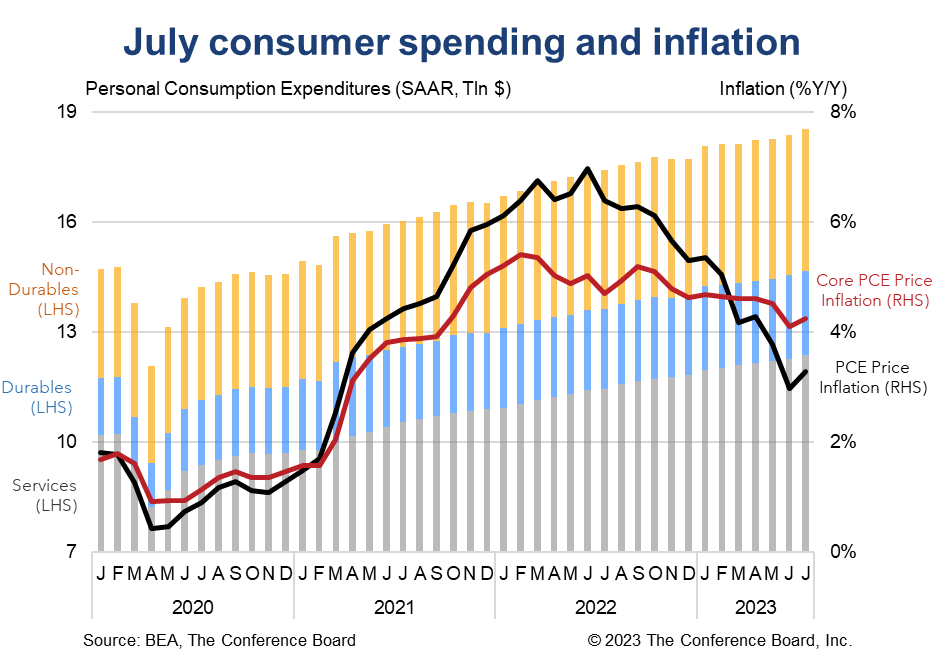

Consumer spending spiked in July despite a small decline in real disposable income. Meanwhile, inflation showed an increase in year-over-year terms due to base effects, but month-over-month price increases were flat at 0.2 percent for both the headline and core PCE deflator. The Fed will likely be content with the inflation readings, but concerned about the strength in consumer spending. While we still don’t expect to see a 25 basis point rate hike in September the odds that we will in November went up given these data. These data will also trigger an upgrade to our Q3 2023 GDP forecast. At first glance inflation appears to have accelerated in July. Both the headline and core PCE deflators rose in year-over-year terms, but this was entirely due to base effects. Indeed, month-over-month growth for both the headline and core deflators came in at just 0.2 percent – the same rates seen in June. Base effects are having a large impact on year-over-year inflation rates at the moment and will likely work to drive these annual rates lower over the coming months. Highlights

Collectively, these data show that consumption is on an unsustainable path. One the one hand, the US consumer is refusing to rein in their spending, but on the other hand their income gains don’t appear to be keeping up. Meanwhile, the personal savings rate continues to drop and Federal Reserve data shows that debt levels are rapidly rising. In the background sits a rapidly diminishing pile of pandemic excess savings. In our view, these trends will increasingly come to a loggerhead and an indebted and cash-strapped consumer will have to pull back. This is consistent with our expectation that a short recession is on the horizon.Inflation

Headline PCE price inflation rose from 3.0 to 3.3 percent year-over-year (y/y) in July and core PCE price inflation (which excludes food and energy) rose from 4.1 to 4.2 percent y/y. On a month-over-month basis (m/m), headline PCE inflation was flat at 0.2 percent and core PCE inflation was also flat at 0.2 percent. Prices for goods fell for a third quarter, but services prices continued to rise.Incomes

Overall personal income rose 0.2 percent m/m (in nominal terms) in July, vs. 0.3 percent m/m in June. However, when factoring in inflation, the real month-over-month growth rate dropped to 0.0 percent m/m, vs. 0.1 percent m/m in June. In year-over-year terms, real personal income rose 1.3 percent in July, vs. 2.2 percent in June. Meanwhile, real disposable personal income (which is personal income less taxes) fell 0.2% from the previous month – the first decline in 13 months. Finally, the savings rate fell from 4.3 percent to 3.5 percent of disposable personal income.Spending

Personal consumption expenditures jumped by 0.8 percent m/m (in nominal terms) in July, vs. 0.6 percent m/m percent in June. Spending on services rose by 0.8 percent m/m while spending on goods rose to 0.7 percent m/m. After accounting for inflation, real consumer spending was up 0.6 percent m/m in July with spending on goods rising to 0.9 percent m/m and spending of services rising 0.4 percent m/m.

myTCB® Members get exclusive access to webcasts, publications, data and analysis, plus discounts to events.

Shutdown Aside, Growth Moderates Under Inflationary Pressures

February 20, 2026

January CPI Raises More Questions than Provides Answers

February 13, 2026

Lukewarm Holiday Shopping in 2025 Augurs Slower Spending in Q4

February 10, 2026

FOMC Reaction: US Economy In a Good Place, But Staying Vigilant

January 28, 2026

Fed January Decision: Pause or Full Stop?

January 27, 2026

November PCE: Are Consumers Spending Beyond Their Means?

January 22, 2026