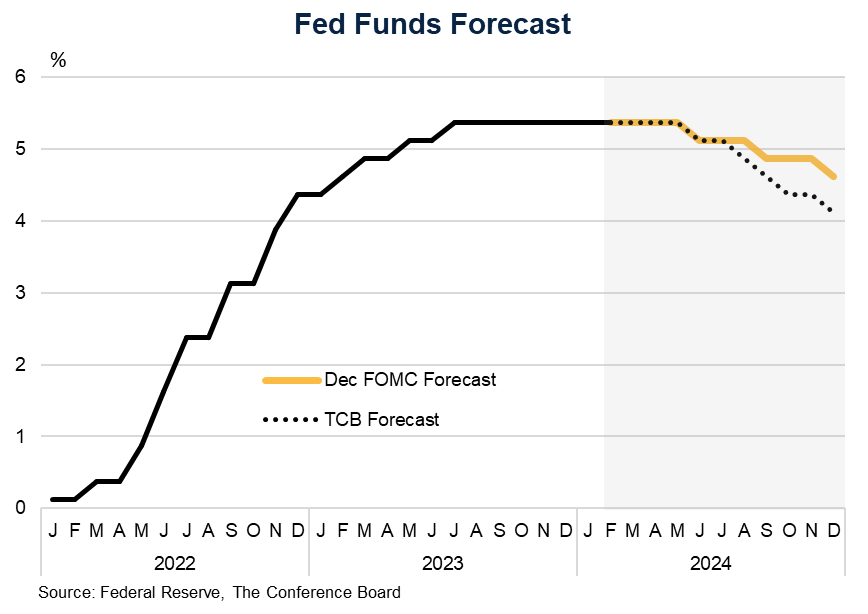

Insights for What’s Ahead On the economy, Chair Powell said that growth was “solid to strong” in 2023 but that he expects it to moderate. Overall, he sounded pleased about developments in the labor market, which he described as softening but strong. Powell said that the 12 month inflation rate remains well above where it needs to be, but that it has slowed substantially over the last six months. He stated that the Fed is confident that inflation is moving toward 2%. Even with this progress the Fed is not ready to begin scaling back tight monetary policy. Chair Powell said that the decision to begin making cuts is highly consequential and the Fed is in “risk management” mode. The Fed is concerned that loosening policy too soon or too quickly could hamper additional progress on inflation or even reverse it. Indeed, the FOMC statement said that the Fed needs “greater confidence that inflation is moving sustainably toward 2 percent” before it begins to make cuts. On timing, no clear guidance was provided about when policy will begin to loosen. The Fed remains data dependent, per Powell. However, he did say that it is unlikely that the FOMC would decide to cut rates at its next meeting in March. Powell also said that the Fed’s balance sheet runoff would continue, but that an “in-depth discussion” of the balance sheet would occur at the next meeting. Today’s actions were unanimously approved by the members of the Federal Open Market Committee.

Highlights

Shutdown Aside, Growth Moderates Under Inflationary Pressures

February 20, 2026

January CPI Raises More Questions than Provides Answers

February 13, 2026

Lukewarm Holiday Shopping in 2025 Augurs Slower Spending in Q4

February 10, 2026

FOMC Reaction: US Economy In a Good Place, But Staying Vigilant

January 28, 2026

Fed January Decision: Pause or Full Stop?

January 27, 2026

November PCE: Are Consumers Spending Beyond Their Means?

January 22, 2026