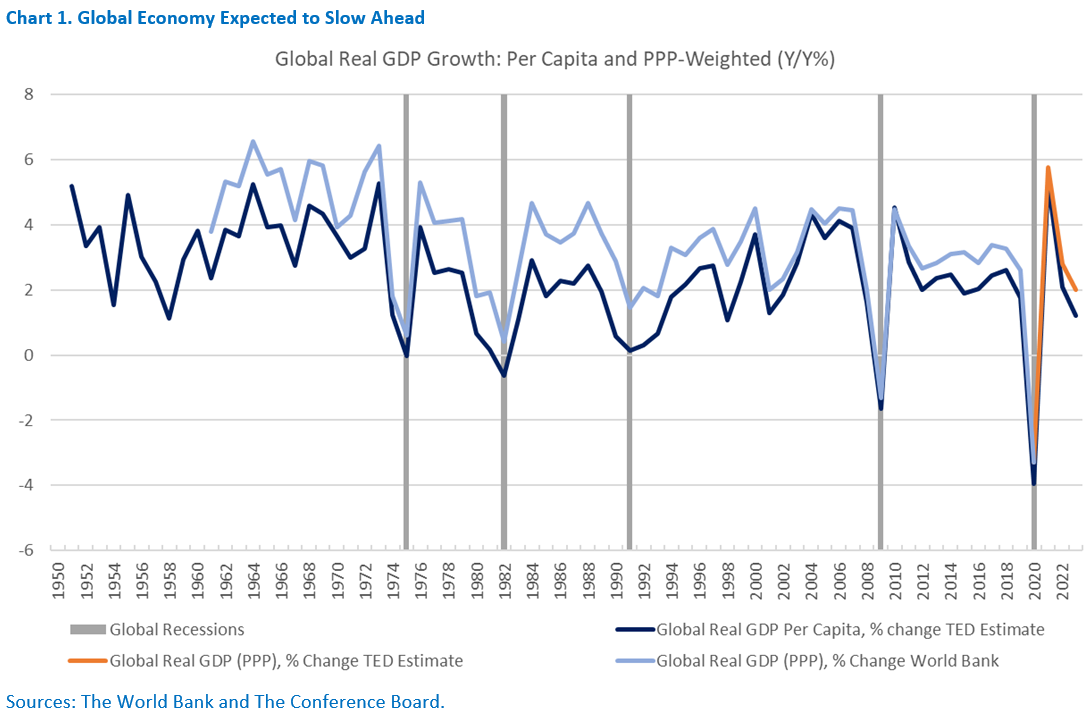

The Conference Board now forecasts global GDP growth of 2.8 percent for 2022 and 2 percent for 2023. This is a downgrade of 0.1ppt and 0.3ppt in 2022 and 2023, respectively. The global growth environment has rapidly deteriorated in recent months most notably with the ongoing war in Ukraine, persistent inflation and tightening global financial conditions. While a global recession is not in our baseline scenario, the global economy is likely to move ever closer to recessionary territory (Chart 1). A global recession is defined as global GDP growth well below 2 percent or negative global per capita income growth. In the postwar period this occurred only five times: in the late 70s, early 80s, early 90s, during the global financial crisis of 2008/09 and during the pandemic recession. The Conference Board forecasts global income to grow by 1.2 percent in 2023, well below the average of the last decade but it will not contract (see The Conference Board Global Economic Outlook). The Conference Board forecasts that US economic growth will slow over the course of this year and that a shallow recession will occur in late 2022 and early 2023. This downgrade to our outlook is associated with persistent inflation and rising hawkishness by the Federal Reserve. The periods immediately before and after the recession are likely to exhibit stagflationary characteristics. Stagflation is a period of very low growth and high inflation (see The Conference Board Economic Forecast for the US Economy).Downgrading the Global Outlook as Recession Probabilities Rise

Further Downgrades to Global Outlook

US Recession Now Likely

Shutdown Aside, Growth Moderates Under Inflationary Pressures

February 20, 2026

January CPI Raises More Questions than Provides Answers

February 13, 2026

Lukewarm Holiday Shopping in 2025 Augurs Slower Spending in Q4

February 10, 2026

FOMC Reaction: US Economy In a Good Place, But Staying Vigilant

January 28, 2026

Fed January Decision: Pause or Full Stop?

January 27, 2026

November PCE: Are Consumers Spending Beyond Their Means?

January 22, 2026