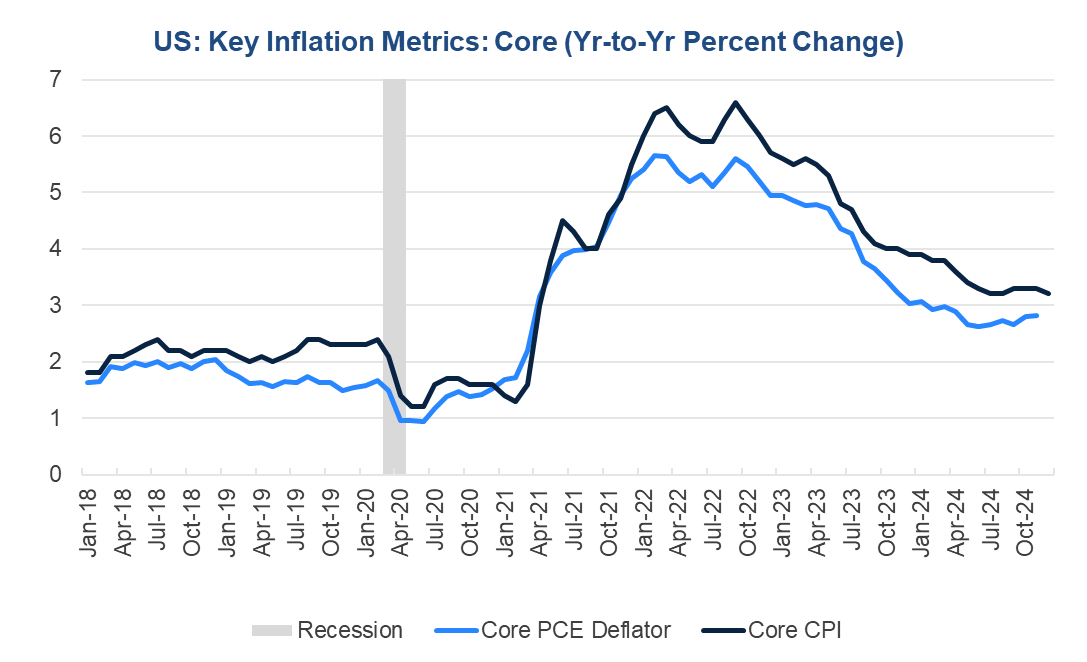

Modest softening in consumer price inflation in December is a positive signal that underlying inflationary forces will likely continue to moderate and allow the Fed to resume rate cuts in H2. While the Consumer Price Index (CPI) is not the measure the Fed uses to guide monetary policy, it is a useful gauge for determining the direction of the Personal Consumption Expenditure (PCE) deflator, which is the Fed’s preferred inflation metric.

Trusted Insights for What’s Ahead®™

Figure 1. Core CPI inflation ticked down

Sources: Bureau of Labor Statistics, Bureau of Economic Analysis, and The Conference Board.

Nevertheless, despite Core Consumer Price Index (Core CPI) inf

myTCB® Members get exclusive access to webcasts, publications, data and analysis, plus discounts to events.

Shutdown Aside, Growth Moderates Under Inflationary Pressures

February 20, 2026

January CPI Raises More Questions than Provides Answers

February 13, 2026

Lukewarm Holiday Shopping in 2025 Augurs Slower Spending in Q4

February 10, 2026

FOMC Reaction: US Economy In a Good Place, But Staying Vigilant

January 28, 2026

Fed January Decision: Pause or Full Stop?

January 27, 2026

November PCE: Are Consumers Spending Beyond Their Means?

January 22, 2026