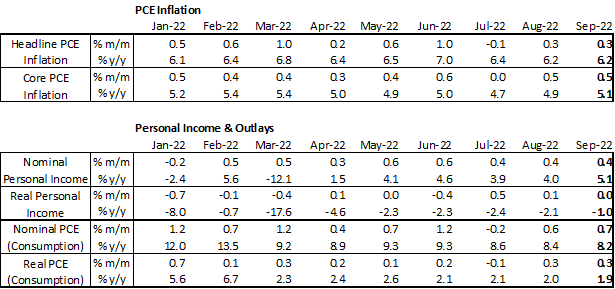

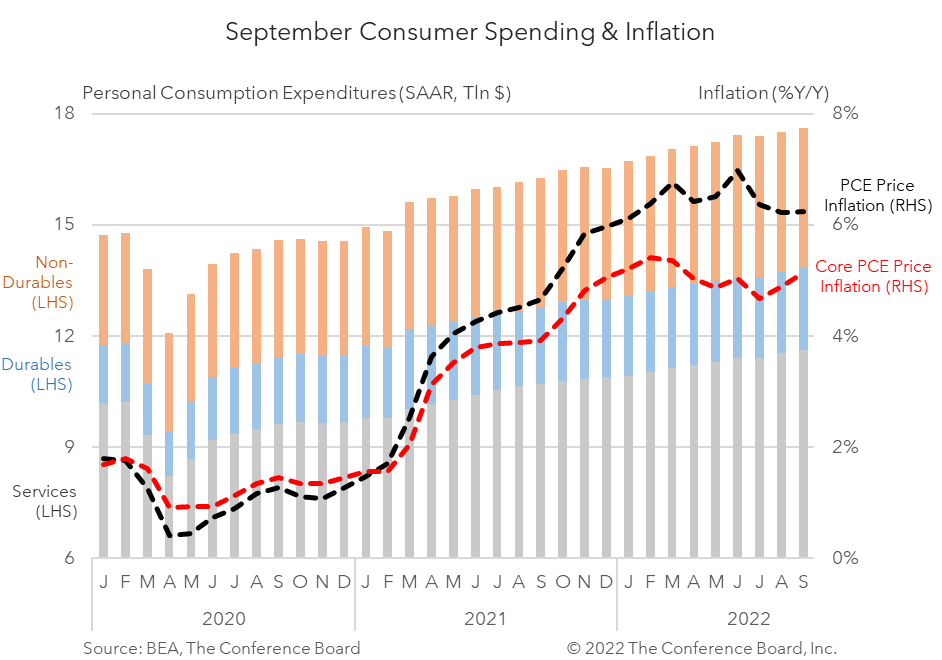

September Personal Income & Outlays data show an economy that continues to grapple with inflation. Month-over-month (m/m) readings for both headline and core PCE inflation were unchanged from August, but year-over-year (y/y) core inflation rose to 5.1 percent (the highest reading since March). These inflation metrics remain far too high. Indeed, according to the BEA the 0.4 percent m/m increase in personal income in September was wiped out when accounting for inflation. Furthermore, increases in consumer spending in September were also partially offset by rising prices. These data will likely encourage the Fed to make another large 75 basis point increase in the Fed Funds rate next week. Looking ahead, the stagflationary characteristics of the US economy are likely to give way to a recession beginning in Q4 and extending into early 2023. Headline PCE price inflation was flat at 6.2 percent y/y in September, but core PCE price inflation rose to 5.1 percent y/y. However, on a month-over-month basis both inflation metrics remained about the same, with core inflation actually falling slightly to 0.45 m/m percent from 0.54 m/m percent in August. These data show neither a meaningful improvement nor a deterioration in the inflation situation, but it remains quite clear that the readings remain far too high. When the FOMC meets next week we’ll likely see another 75 basis point interest rate hike. Overall personal income growth rose 0.4 percent m/m (in nominal terms), vs. 0.4 m/m percent in August. However, the increase was more than offset by rising prices. In inflation-adjusted terms, personal income was flat from August. Indeed, eight of the last twelve months have seen either flat or negative real income growth. Thus, while Americans have recently seen their incomes rise in nominal terms, their purchasing power eroded just as quickly. Personal consumption expenditures rose by 0.7 percent m/m (in nominal terms) in September, vs. 0.6 m/m percent in August. Spending on services rose by 0.8 percent m/m while spending on goods rose 0.3 percent m/m. However, after accounting for inflation, consumer spending rose by just 0.3 percent m/m in September with spending on goods rising 0.4 percent m/m and spending of services rising 0.3 percent m/m. We expect personal consumption expenditures to slow further over the coming months as tighter monetary policy drives interest rates higher. Personal income and consumer spending will face continued challenges in the months ahead. Headline inflation may have peaked in Q2 2022, but persistence of elevated inflation rates in the face of rising interest rates is troubling. These developments are likely to weigh on consumer spending and should prompt the Federal Reserve to continue hiking interest rates in large increments over the coming months. This environment increases the probability and potential severity of a recession.

January CPI Raises More Questions than Provides Answers

February 13, 2026

Lukewarm Holiday Shopping in 2025 Augurs Slower Spending in Q4

February 10, 2026

FOMC Reaction: US Economy In a Good Place, But Staying Vigilant

January 28, 2026

Fed January Decision: Pause or Full Stop?

January 27, 2026

November PCE: Are Consumers Spending Beyond Their Means?

January 22, 2026

Retail Sales Highlight Affordability Issues

January 14, 2026

Charts

US Inflation Expectations Remain High As Inflation Surges

LEARN MORE

Charts

A special poll conducted in the March Consumer Confidence Survey focused on the perceived impact of the war in Ukraine on overall inflation in the US.

LEARN MORECharts

March Consumer Confidence Rises Despite Headwinds

LEARN MORECharts

The Conference Board Consumer Confidence Index® declined in November, following an increase in October. The Index now stands at 109.5 (1985=100), down from 111.

LEARN MORECharts

Global consumer confidence advanced to another record high in the third quarter of 2021..

LEARN MORECharts

The Conference Board Consumer Confidence Index® declined again in September, following decreases in both July and August. The Index now stands at 109.3 (1985=100), do…

LEARN MORECharts

The Conference Board Consumer Confidence Index® (CCI) was relatively unchanged in July, following gains in each of the prior five months. The Index now stands at 129.…

LEARN MORECharts

Consumer confidence for Asia-Pacific declined slightly in the second quarter of 2021.

LEARN MORECharts

Global consumer confidence ticked up to another record high in the second quarter of 2021, according to The Conference Board® Global Consumer Confidence Survey, as ec…

LEARN MORECharts

The Conference Board Consumer Confidence Index® (CCI) improved further in June, following gains in each of the previous four months. The Index now stands at 127.3 (19…

LEARN MOREPRESS RELEASE

US Consumer Confidence Fell Sharply in January

January 27, 2026

PRESS RELEASE

Men Lead Spending on “Little Luxuries” amid Growing Economic Caution

November 19, 2025

PRESS RELEASE

Americans Likely to Tighten Their Belts this Holiday Season

November 11, 2025

PRESS RELEASE

New Data Reveal the Demographic Divides Driving US Consumer Confidence

October 23, 2025

PRESS RELEASE

The Conference Board Launches Consumer Confidence Survey® Premium Dataset

October 23, 2025

IN THE NEWS

Dana M. Peterson: Where Consumer Confidence is headed

September 07, 2025

All release times displayed are Eastern Time

Note: Due to the US federal government shutdown, all further releases for The Conference Board Employment Trends Index™ (ETI), The Conference Board-Lightcast Help Wanted OnLine® Index (HWOL Index), The Conference Board Leading Economic Index® of the US (US LEI) and The Conference Board Global Leading Economic Index® (Global LEI) data may be delayed.

Connect and be informed about this topic through webcasts, virtual events and conferences

The End of Student Loan Relief: Another Headwind for Consumer Spending

August 07, 2025 | Quick Take

How Businesses Can Succeed as US Consumers Guard Wealth, Health Amid Uncertainty

May 12, 2025 | Article

Social Standing: Current Attitudes About Social Media

April 02, 2025 | Article

Politics Shapes US Consumer Views About 2025

February 10, 2025 | Report

US Consumers Hope for Lower Prices and Taxes in 2025

December 17, 2024 | Article

Priced Out: The State of US Housing Affordability

February 11, 2026

Economy Watch: Trends in Consumer & CEO Confidence

November 12, 2025

C-Suite Perspectives

The State of the Economy for August 2024

August 27, 2024

C-Suite Perspectives

The State of the Economy for July 2024

July 30, 2024