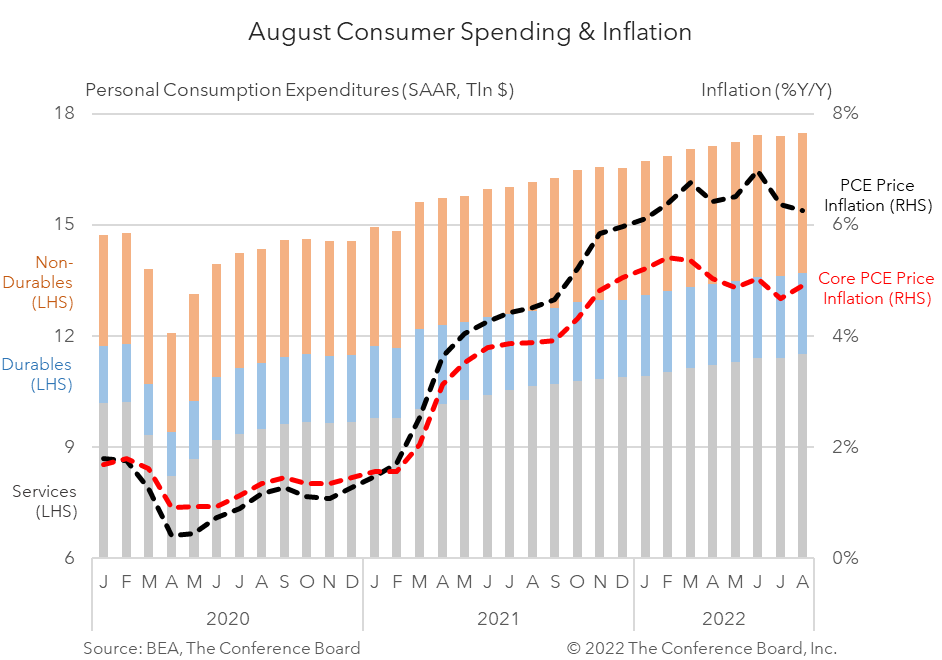

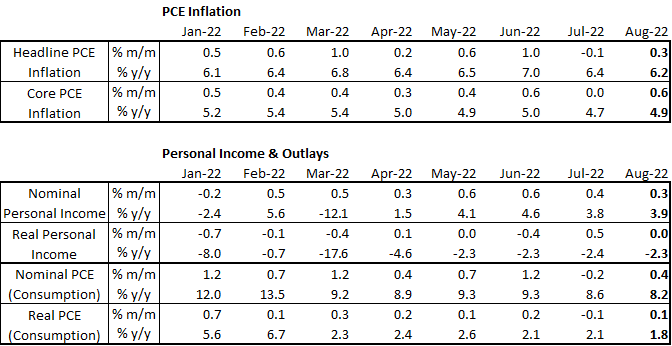

August Personal Income & Outlays data show an economy that continues to grapple with inflation. Core PCE inflation, which excludes volatile energy and food prices, accelerated in August suggesting that inflation is becoming more embedded in the economy. According to the BEA, much of the gains recorded in personal income in recent months have been undercut by rising prices. Furthermore, increases in consumer spending are weaker when the data are adjusted for inflation. These August data will likely encourage the Fed to continue to make large increases to interest rates over the coming months. The stubbornness in core inflation paired with recent Fed guidance suggests that there is mounting downside risk to our forecast of a brief and mild recession. Headline PCE price inflation fell to 6.2 percent year-over-year (y/y) in August but core PCE price inflation rose to 4.9 percent y/y. On a month-over-month basis both inflation metrics worsened, with core inflation rising to 0.6 percent from 0.0 percent in July. While a slowing in the August headline y/y inflation number was expected given trends in energy prices last month, the pick-up seen in the core inflation reading (which strips out energy and food prices) is concerning. This trend suggests that inflation is spreading more broadly throughout the economy and increases the likelihood that the Fed will continue to make large interest rate hikes over the coming months. Overall personal income growth rose 0.3 percent m/m (in nominal terms), vs. 0.4 percent m/m in July. However, the increase was more than offset by rising prices. In inflation-adjusted terms, personal income was flat from July. Indeed, six of the last eight months have experienced either flat or negative real income growth. Thus, while Americans have recently seen their incomes rise in nominal terms, their purchasing power eroded just as quickly. Personal consumption expenditures rose by 0.4 percent m/m (in nominal terms) in August following a -0.2 percent m/m contraction in July. Spending on services rose by 0.9 percent m/m while spending on goods contracted by -0.5 percent m/m. However, after accounting for inflation, consumer spending rose by just 0.1 percent m/m in August with spending on goods falling -0.2 percent m/m and spending of services rising 0.3 percent m/m. We expect personal consumption expenditures to slow further over the coming months as tighter monetary policy drives interest rates higher. Personal income and consumer spending will face continued challenges in the months ahead. Headline inflation may have peaked in Q2 2022, but the pickup in core inflation recorded in these August data suggest that price increases are spreading throughout the economy. These developments are likely to weigh on consumer spending and may prompt the Federal Reserve to continue hiking interest rates in large increments over the coming months. This environment increases the probability and potential severity of a recession later this year. Stubborn core inflation increases risk of a more severe recession

January CPI Raises More Questions than Provides Answers

February 13, 2026

Lukewarm Holiday Shopping in 2025 Augurs Slower Spending in Q4

February 10, 2026

FOMC Reaction: US Economy In a Good Place, But Staying Vigilant

January 28, 2026

Fed January Decision: Pause or Full Stop?

January 27, 2026

November PCE: Are Consumers Spending Beyond Their Means?

January 22, 2026

Retail Sales Highlight Affordability Issues

January 14, 2026