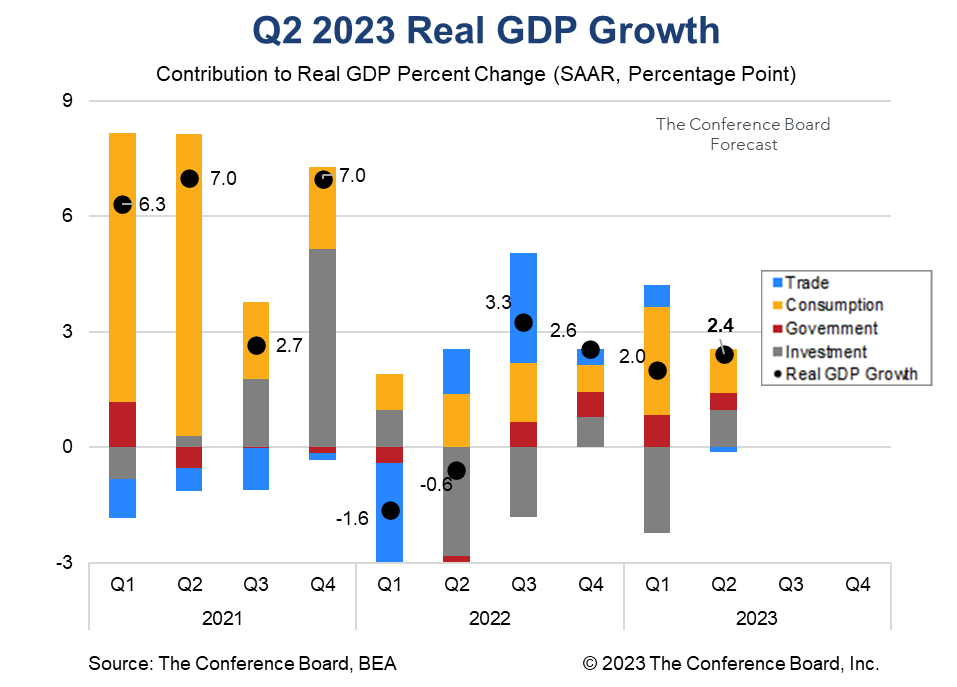

US Real Gross Domestic Product rose by 2.4 percent (annualized) during the second quarter of 2023, well above the consensus forecast of 1.8 percent* and The Conference Board’s forecast. Consumption growth cooled for the quarter, but improvements in business investment growth more than offset this. The prospects for a soft-landing for the US economy are rising, but The Conference Board projects that a short and shallow recession beginning later this year is more likely. GDP data in Q2 2023 showed a number of important trends that we expect to continue to play out over the year. Following a spike in consumption in Q1, due to high demand for durable goods, consumption in Q2 came in more muted. Growth in consumer spending on goods and (importantly) services both cooled for the quarter. As real disposable personal income growth cools, pandemic excess savings are depleted, and mandatory student loan repayment resumes, we expect consumption growth to weaken further and eventually dip into contractionary territory. The GDP data also showed a stronger than expected increase in non-residential investment in Q2. A spike in business investment in equipment (transportation equipment in particular) was a major driver of the strength. However, investment growth in structures and intellectual property products were also positive. Looking ahead, we expect weaker consumer demand and persistently high interest rates to reverse this trend. These and other recent data show that the US economy has been remarkably resilient to the duel stresses of high inflation and high interest rates. As inflation continues to cool it is possible that a soft landing may be achievable, but we continue to believe that a short and shallow recession is the more probable outcome. Considering today’s report, we are pushing our recession forecast out one quarter to Q4 2023. Personal Consumption Expenditures (PCE) expanded by 1.6 percent for the quarter, vs. 4.2 percent in Q1. Demand for goods grew by 0.7 percent (vs. 6.0 percent in Q1), while demand for services grew by 2.1 percent (vs. 3.2 percent in Q1). Additionally, as we already have monthly spending data for April and May, these quarterly data imply that consumer spending deteriorated in June. We’ll learn more about this in tomorrow’s Personal Income & Outlays report. On the investment side, nonresidential fixed investment grew by 7.7 percent, vs. 0.6 percent in Q1, due largely to strong investment in equipment for the quarter (10.8 percent). Residential investment grew by -4.2 percent, vs. -4.0 percent in Q1. This was the nineth consecutive quarter of contraction, but recent housing data suggests that growth may stabilize soon. Private inventories expanded by $9.3 billion**. This increase from $3.5 billion in Q1 resulted in a boost to US GDP growth of 0.1 percentage points. Government spending was a positive contributor to overall economic growth for the quarter, rising 2.6 percent, vs. 5.0 percent in Q1. The slowdown was largely associated with a decline in federal non-defense spending. Net exports contributed -0.1 percentage points to overall GDP. Exports grew by -10.8 percent for the quarter while imports grew by -7.8 percent. Finally, it is important to note that GDP data have undergone large revisions in recent quarters. For example, the advance estimate for Q1 2023 data was 1.1 percent, but was gradually revised up nearly a full percentage point to 2.0 percent. It is very likely that the final data for Q2 2023 will be quite different from these advance estimates. * Consensus data from Bloomberg

Key takeaways from today’s report.

The individual components of GDP were mixed.

January CPI Raises More Questions than Provides Answers

February 13, 2026

Lukewarm Holiday Shopping in 2025 Augurs Slower Spending in Q4

February 10, 2026

FOMC Reaction: US Economy In a Good Place, But Staying Vigilant

January 28, 2026

Fed January Decision: Pause or Full Stop?

January 27, 2026

November PCE: Are Consumers Spending Beyond Their Means?

January 22, 2026

Retail Sales Highlight Affordability Issues

January 14, 2026