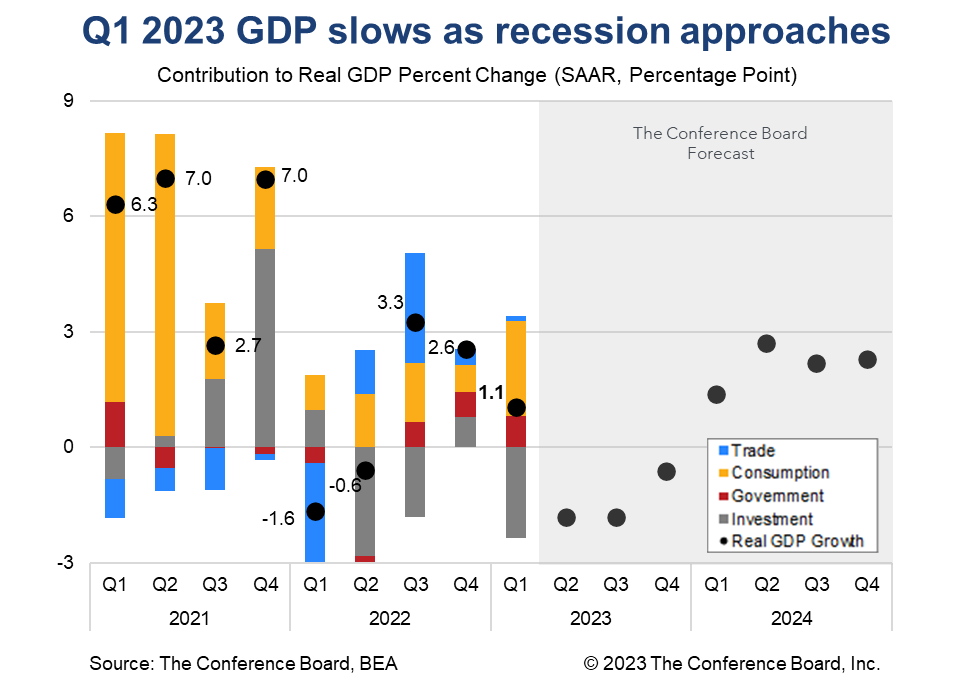

US Real Gross Domestic Product rose by 1.1 percent (annualized) during the first quarter of 2023, below the consensus forecast of 2.0 percent* and The Conference Board’s forecast. Consumption came in strong for the quarter, but weak investment and inventory data limited overall economic growth. We continue to expect the US economy to slip into recession in mid-2023. GDP data in Q1 2023 showed a number of important trends that we expect to continue to play out over the year. Consumer spending was robust for the full quarter, but according to monthly data that strength was isolated to January. February spending growth slipped into negative territory and these quarterly data suggested that March spending was even weaker. We’ll learn more about this in tomorrow’s Personal Income & Outlays report. The GDP data also showed that both residential and non-residential investment continued to struggle under the weight of high interest rates. Investment in Intellectual Property, which is associated with the tech industry, was the weakest it’s been since the COVID-19 lockdowns in early 2020. Inventories also played a large role in today’s data. The change in private inventories fell slightly for the quarter following a surge in late 2022. This resulted in a large drag on topline economic growth. We do not expect companies to restock over the coming quarters due to weakening consumer demand. Personal Consumption Expenditures (PCE) expanded by 3.7 percent for the quarter, vs. 1.0 percent in Q4. Demand for goods grew by 6.5 percent, while demand for services grew by 2.3 percent. Strong spending in January, especially on durable goods, was largely responsible for the uptick in these data. However, more recent data shows softening demand in February and March. On the investment side, nonresidential fixed investment grew by just 0.7 percent, vs. 4.0 percent in Q4, due largely to weak investment in equipment for the quarter (-7.3 percent). Residential investment grew by -4.2 percent, vs. -25.1 percent in Q4. This was the eighth consecutive quarter of negative growth and was associated with rising interest rates and elevated home prices. Private inventories contracted by $1.6 billion** - an unexpectedly large amount. This decrease from $136 billion in Q4 resulted in a drag to US GDP growth of -2.3 percentage points. Government spending was a positive contributor to overall economic growth for the quarter, rising 4.7 percent, vs. 3.8 percent in Q4. The recent strength to this component of GDP are associated with federal non-defense spending and investment – which is being augmented by infrastructure investment. Net exports contributed 0.1 percentage points to overall GDP. Exports grew by 4.8 percent for the quarter while imports grew by 2.9 percent. Today’s data are consistent with our expectation for one or two more 25 basis point hikes from the Fed, but tomorrow’s data on March consumer spending and inflation could change that. Stay tuned. * Survey conducted by Bloomberg. ** chained 2012 US$The individual components of GDP were mixed.

Shutdown Aside, Growth Moderates Under Inflationary Pressures

February 20, 2026

January CPI Raises More Questions than Provides Answers

February 13, 2026

Lukewarm Holiday Shopping in 2025 Augurs Slower Spending in Q4

February 10, 2026

FOMC Reaction: US Economy In a Good Place, But Staying Vigilant

January 28, 2026

Fed January Decision: Pause or Full Stop?

January 27, 2026

November PCE: Are Consumers Spending Beyond Their Means?

January 22, 2026