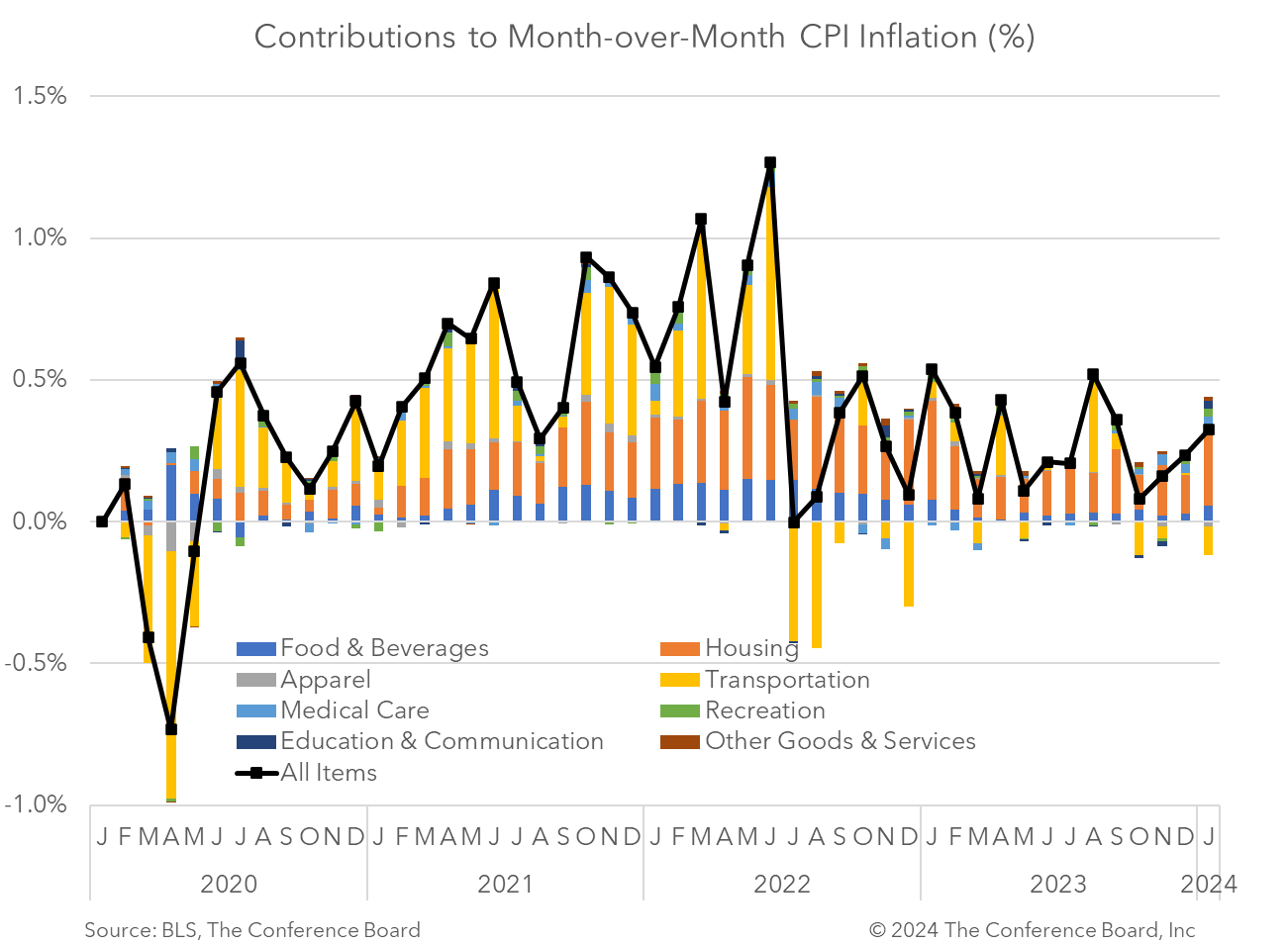

The January Consumer Price Index (CPI) showed that inflation rose by 3.1% from a year earlier, vs. 3.4% in December and 6.4% at the beginning of 2023. Meanwhile, core CPI, which excludes volatile food and energy prices, rose by 3.9% in January from a year earlier, vs. 3.9% y/y in December and 5.6% y/y at the beginning of 2023. While year-on-year price inflation was tame, prices rose more than expected on a month-on-month basis. Headline CPI rose 0.3% m/m (vs. 0.2% in Dec) and core CPI rose 0.4% m/m (vs. 0.3% in Dec). Federal Reserve Chair Powell has noted that the path to the Fed’s 2% inflation target would be ‘lumpy and bumpy’ and we agree. While headline inflation rates have fallen dramatically since earlier in 2023, this reading does show a bump in month-on-month terms. Shelter prices continued to be one of the primary drivers of inflation and picked up again slightly in January. However, in year-on-year terms, shelter prices continued to slow. We expect shelter prices to gradually cool in 2024 and to bring additional relief to CPI. Today’s data provide a preview of the PCE deflator – the Fed’s preferred measure for guiding policy – later this month. Given what the CPI signals for the PCE deflator and Fed Chair Powell’s previous statements, the Federal Reserve will likely hold rates steady at the conclusion of the March FOMC meeting. However, as inflation rates continue to slow over the next several quarters we expect the Fed to begin cutting rates starting in June. Provided that inflation settles around 2 percent before the end of the year, which is our forecast, we should see steady rate cuts of 25 basis point at subsequent FOMC meetings that push the Fed Funds rate to nearly 4% by year end. Further interest rate reductions are expected in early 2025. Core CPI rose by 0.4% m/m and 3.9% y/y, vs. November’s 0.3% m/m and 3.9% y/y. According to the BLS, the core CPI was overwhelmingly driven by shelter, but motor vehicle insurance, recreation, personal care, and medical care prices also played a role.

DATA DETAILS

Headline CPI rose by 0.3% month-on-month and 3.1% y/y, vs. December’s 0.2% m/m and 3.4% y/y. Month-on-month shelter prices continued to rise in January, contributing more than two-thirds of the all items increases, according to the Bureau of Labor Statistics (BLS). However, in year-on-year terms shelter price increases continued to moderate. While food prices continued to rise for the month, energy prices slid due to a large decline in gasoline prices.

myTCB® Members get exclusive access to webcasts, publications, data and analysis, plus discounts to events.

Shutdown Aside, Growth Moderates Under Inflationary Pressures

February 20, 2026

January CPI Raises More Questions than Provides Answers

February 13, 2026

Lukewarm Holiday Shopping in 2025 Augurs Slower Spending in Q4

February 10, 2026

FOMC Reaction: US Economy In a Good Place, But Staying Vigilant

January 28, 2026

Fed January Decision: Pause or Full Stop?

January 27, 2026

November PCE: Are Consumers Spending Beyond Their Means?

January 22, 2026