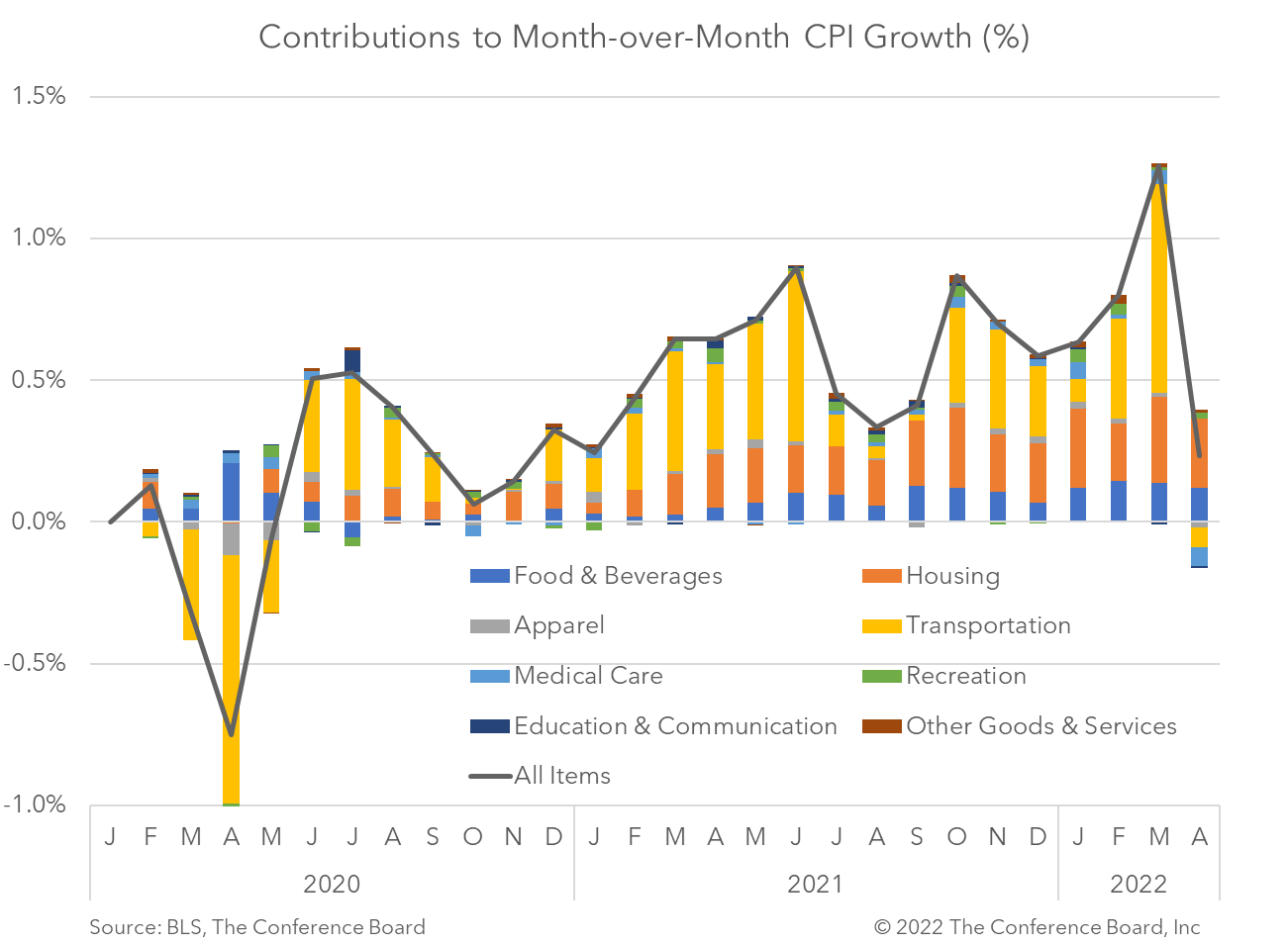

The Consumer Price Index (CPI) rose to 8.3 percent year-over-year in April, vs. an increase of 8.5 percent year-over-year in March. This is the first time this widely-followed gauge of inflation increased at a slower clip in eight months. Core CPI, which excludes volatile food and energy prices, slowed to 6.1 percent year-over-year, vs. 6.4 percent in March. On a month-over-month basis, April CPI rose 0.3 percent, vs. 1.2 percent March. Meanwhile, April Core CPI rose 0.6 percent, vs. 0.3 percent in March. This direction divergence shows that energy prices cooled following a large spike in March, but that inflation in core parts of the economy may be intensifying. Indeed, while the index for gasoline fell 6.1 percent over the month, prices for shelter, airline fares, and new vehicles all rose. Meanwhile, food prices rose 0.9 percent from the previous month. These price trends appear to be consistent with current events around in the world. Russia’s invasion of Ukraine sent oil prices soaring in late-February and March, but energy prices have retreated somewhat over the last month. Meanwhile, shocks to global agricultural prices associated with the conflict (Ukraine and Russia are major global grain producers) appear to be ongoing. Finally, COVID-19 outbreaks in China have resulted in lockdowns in numerous cities there, including Shanghai. The resulting disruption to production and export activity are once again cascading through global value chains. This still evolving story in China is important and may result in additional inflationary pressures in the coming months. At present, our forecast for PCE inflation, which is similar to CPI, rises from a reported 6.3 percent year-over-year in Q1 2022 to a high of 6.6 percent in Q2 2022 and then slows to 4.2 percent in Q4 2022. We project that Core PCE inflation, which is similar to Core CPI, rises from a reported 5.2 percent year-over-year in Q1 2022 to a high of 5.9 percent in Q2 2022 and then slows to 4.4 percent in Q4 2022.

January CPI Raises More Questions than Provides Answers

February 13, 2026

Lukewarm Holiday Shopping in 2025 Augurs Slower Spending in Q4

February 10, 2026

FOMC Reaction: US Economy In a Good Place, But Staying Vigilant

January 28, 2026

Fed January Decision: Pause or Full Stop?

January 27, 2026

November PCE: Are Consumers Spending Beyond Their Means?

January 22, 2026

Retail Sales Highlight Affordability Issues

January 14, 2026