Members of The Conference Board get exclusive access to the full range of products and services that deliver Trusted Insights for What's Ahead ® including webcasts, publications, data and analysis, plus discounts to conferences and events.

11 August 2025 | Press Release

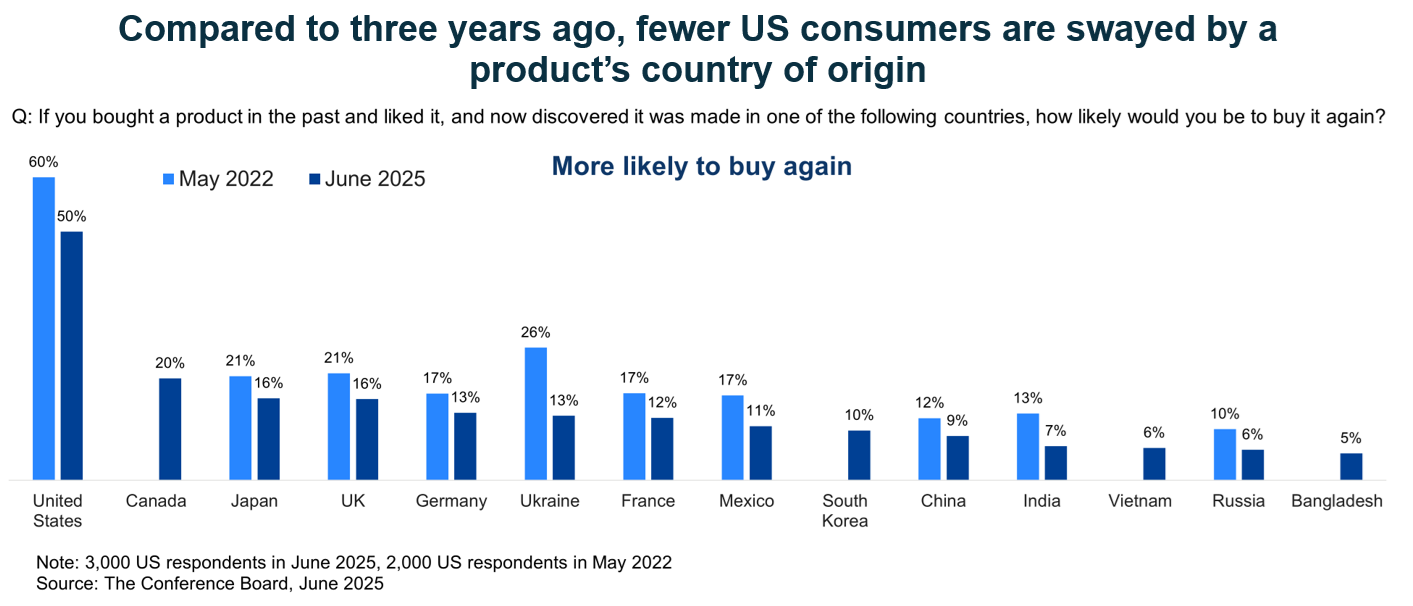

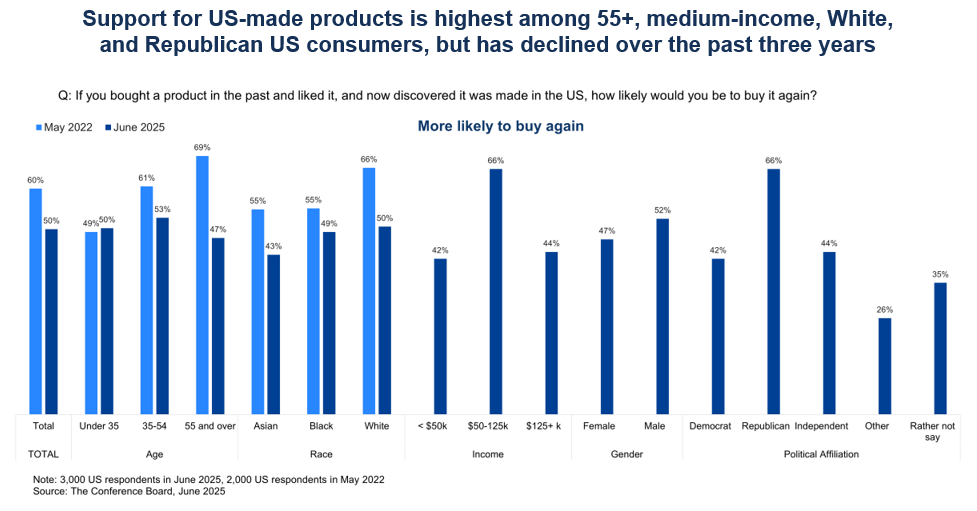

US consumers are now less likely to factor country of origin—even the US—into their product buying decisions than they were just three years ago. Despite aggressive federal efforts to promote domestic production, the power of “Made in USA” to influence buying decisions fell 18% since 2022. That’s according to new data from The Conference Board, based on a survey of 3,000 US adults.

The new report concludes that price sensitivity, inflation, and trade policy may have reshaped the marketing power even of once-prestigious "Made in" labels—which can serve as a quality indicator, brand differentiator, and even a source of national pride.

“Country-of-origin cues still matter—but their influence is slipping,” said Denise Dahlhoff, PhD, Director of Marketing & Communications Research at The Conference Board and author of the report. “As price concerns intensify, many US consumers appear to associate ‘made in’ labels with elevated prices due to generally higher domestic production costs as well as tariffs on foreign-made goods. Increasingly, consumers prioritize value and affordability over emotional affinity for certain countries, including their own.”

Key findings from the report include:

Fewer consumers now say country of origin influences their purchases. The appeal of “Made in USA” has declined as a purchasing incentive.

Consumers show mixed feelings toward foreign-made products, with wide variations based on country of origin and income level.

About The Conference Board

The Conference Board is the member-driven think tank that delivers Trusted Insights for What’s Ahead®. Founded in 1916, we are a non-partisan, not-for-profit entity holding 501 (c)(3) tax-exempt status in the United States. ConferenceBoard.org

Media Contact:

Jonathan Liu

jliu@tcb.org

Why CEOs Want Communicators to Shape Strategy—Not Just Share It

January 31, 2026